As shareholder Engaged Capital LLC sends their 9-page letter demanding Abercrombie + Fitch’s longtime CEO Mike Jeffries step down, BrandIndex research paints a clear picture of the retailer’s problems on two key fronts: brand health and purchase consideration, the latter being an indicator of future sales.

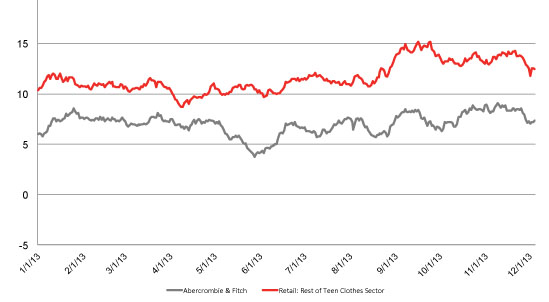

The long-term gap between Abercrombie and the rest of the teen apparel sector in brand health measurements has grown over the last several months. CEO Jeffries’ 2006 controversial remarks about refusing to make clothes for large women, republished by Business Insider last May, seem to have had a sustained negative impact on the brand’s health. Abercrombie’s brand health took a serious hit in May, and its recovery has been slow, with the brand’s Index scores still well below levels from earlier this year. The brand health gap between Abercrombie and its rivals has more than doubled since the remarks went viral.

It may be worth noting that Abercrombie’s first bump in the road happened back in March, around the time of an edgy online campaign for fake “spray-on skinny, skinny jeans,” when its brand health scores made a significant decline.

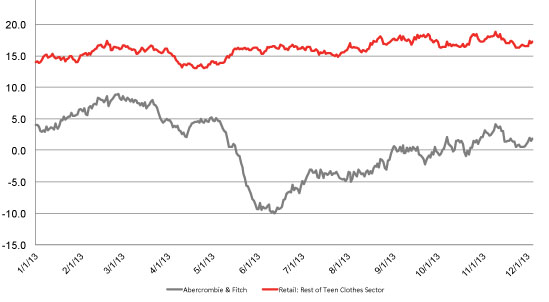

Consumer purchase consideration levels for Abercrombie – an indicator of future sales – have also lagged considerably behind its rivals this year. The purchase consideration gap between Abercrombie and the teen apparel sector widened in early May and hasn’t shown any improvement. More troubling, the teen apparel sector saw a healthy increase in purchase consideration beginning with the back-to-school season, while Abercrombie barely increased.

Abercrombie + Fitch and the teen apparel sector were measured using two YouGov BrandIndex scores: Index, the company’s centerpiece brand health measurement incorporating component scores of Quality, Value, Reputation, Satisfaction, General Impression and Willingness to Recommend; and Purchase Consideration.

YouGov BrandIndex’s Index scores range from 100 to -100 and are compiled by subtracting negative feedback from positive. A zero score means equal positive and negative feedback.

Purchase Consideration is measured as a range from 0 to 100%.

Index: Abercrombie + Fitch, Teen Clothing Sector (minus A+F)

Purchase Consideration: Abercrombie + Fitch, Teen Clothing Sector (minus A+F)