Americans oppose French economist Thomas Piketty's proposal for dramatically higher income taxes on the wealthy

French economist Thomas Piketty recently released a book, Capital in the 21st Century, examining inequality in modern economies, arguing that inequality is primarily caused by the wealthy receiving returns on their wealth that exceed the rate of broader economic growth. The book has been hailed by economists for its cutting-edge research methods and praised for its insightful analysis of the modern economy, but his proposals on how to roll back the tide of inequality have not been welcomed with similar acclaim. Piketty's core solution to the problem of inequality is a highly progressive income tax – 80% on incomes over $500,000 – and a global wealth tax, in excess of 5% annually on particularly large fortunes.

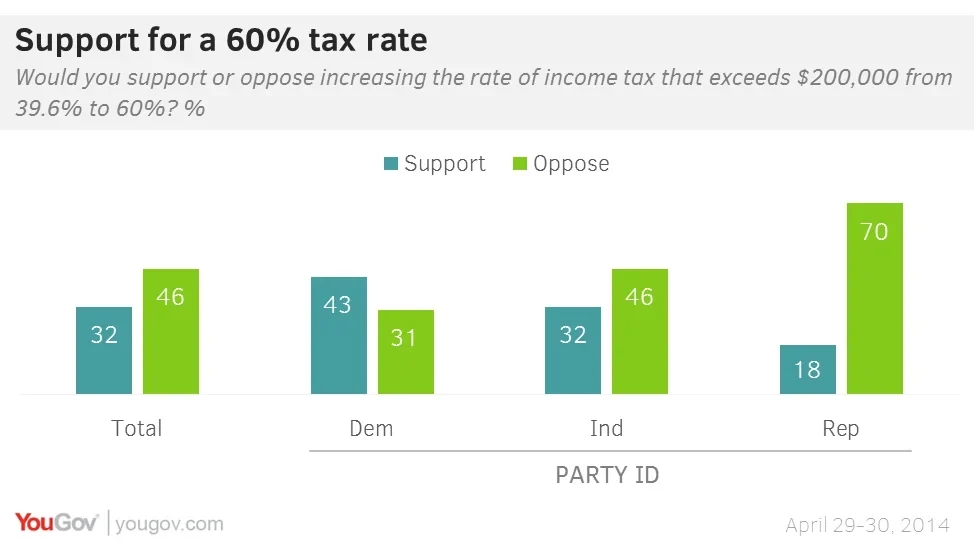

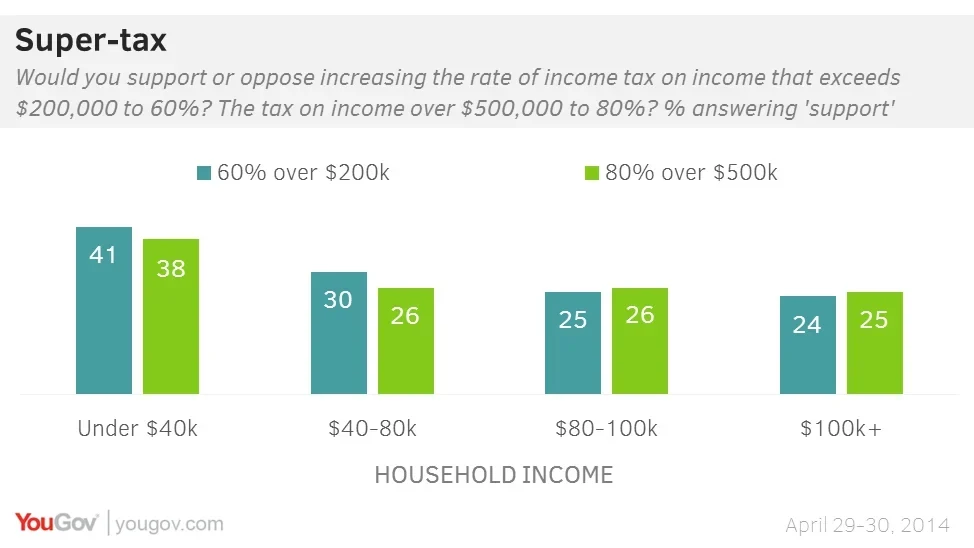

The latest research from YouGov shows that Americans tend to oppose Piketty's tax proposals, even though Americans are concerned with inequality and say that they are willing to sacrifice wealth for greater equality. Support for a 60% tax rate on incomes over $200,000 a year is supported by 32% of the public, but opposed by 46%, while for the 80% tax on incomes over $500,000 support is even lower, with 29% backing an the 80% tax and 50% opposing it.

Democrats are the only political group supportive of these higher rates, with 43% backing the 60% rate. Even Democrats are effectively evenly divided on the 80% rate, however, with 40% supporting it and 39% opposing it.

Support for these higher tax rates is most pronounced among the poorest households in the country. Among households earning over $40,000 a year, support hovers around 25-30%. Households that earn less than $40,000 a year, however, are much more supportive of higher taxes, with 41% in favor of the 60% rate (and 32% against), while attitudes on the 80% rate are evenly split with 38% in favor and 38% against.

When it comes to taxing wealth, support never goes above 37%. 33% of Americans support a tax of up to 0.5% annually on fortunes of less than $1.5 million, while 37% support taxes of up to 2% on estates worth up to $14 million and tax rates of over 5% on even larger holdings.

Support for Piketty's proposals is higher in Britain. When the British public were asked if they supported the 60% rate, 45% support it and 35% oppose it, compared to a 32%-46% split here. 38% of the British public support the 80% tax, though 44% oppose it – compared to 29%-50% here.

Full poll results can be found here.

Image: Getty