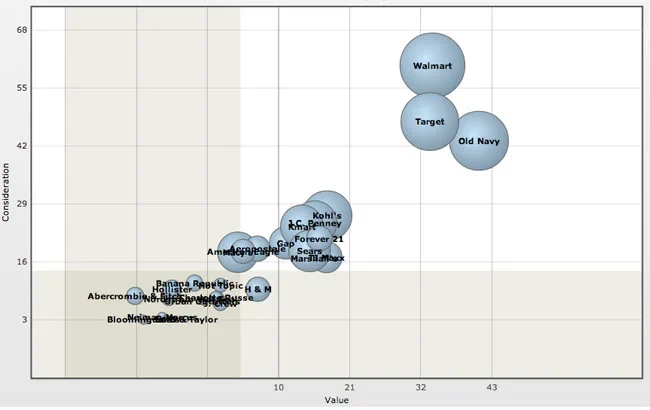

Kmart, Forever 21 and Target have made the biggest strides in purchase consideration among parents over the past 30 days. Kmart is also the leading Value improver during the time period.

While these gains have undoubtedly strengthened the three brands, which are already in the top 10 of purchase consideration scores, Kmart and Forever 21 are in an increasingly tightening pack of back to school retailers where no chains have broken out to catch up with the top tier of Walmart, Target, and Old Navy.

Over the past 30 days, most retailers find themselves in “back to school perception gridlock,” dozens of them scoring in a tight range, while Walmart, Target and Old Navy continue to enjoy the best combined value perception and purchase consideration among parents. All three also continue to score well ahead of the pack on ad awareness over the past month as well, making if challenging for other retailers to make up ground.

On the other hand, Kohl’s has had the greatest ad awareness gains, yet it has been losing the most ground in both purchase consideration and value perception over the past month. Macy’s, which just reported its quarterly earnings missed analyst expectations, is also one of the biggest decliners on purchase consideration and value.

Purchase Consideration

In this important metric which ties in with potential sales, “fast fashion” retailer Forever 21 made the biggest jump over the past 30 days. 22% of parents would consider buying from Forever 21 the next time they are department store shopping, an increase of 5 percentage points from one month ago. That puts Forever 21 close to more broad-based retailers such as Kmart, Gap, J.C. Penney and Kohl’s.

Luxury retailers such as Saks, Nordstrom, Neiman Marcus and Bloomingdales continue to make up the lowest purchase consideration score among retailers. Among teen-directed retailers, Urban Outfitters and Wet Seal are below the pack.

Like Kohl’s, H&M experienced a 5 percentage point drop in purchase consideration over the past 30 days.

Value

Value score is measured on a scale from -100 to 100, with zero being neutral.

Kmart and Sears took the biggest gains in value perception over the past 30 days with parents, adding 5 points each to reach 12 and 14 scores respectively. Sears now has the 9th highest value perception in the group, while Kmart has the 11th highest.

Charlotte Russe lost nine points and Bloomingdale’s eight points, each, the largest margins over the past 30 days, followed by Kohl’s (-6) and Nordstrom (-5).

Old Navy leads the value pack with a score of 42, with Target in second place (33), and Walmart in third (32). The gap between Walmart and the next retailer, Forever 21, is 14 points.

Methodology

Periodically until shortly after Labor Day, YouGov BrandIndex will measure 28 of the most popular back to school retail chains as perceived by adults with children under the age of 18. Each retailer will be charted by combining two of YouGov BrandIndex’s most relevant scores: Purchase Consideration ("When you are in the market next to purchase office supplies, from which of the following brands would you consider purchasing?”) and Value (“Does it give good value for what you pay?").

The size of each bubble in the chart relates to their Ad Awareness score, which asks respondents: "Which of the following brands have you seen an advertisement for in the past two weeks?"

Back To School Retailers: Value / Purchase Consideration