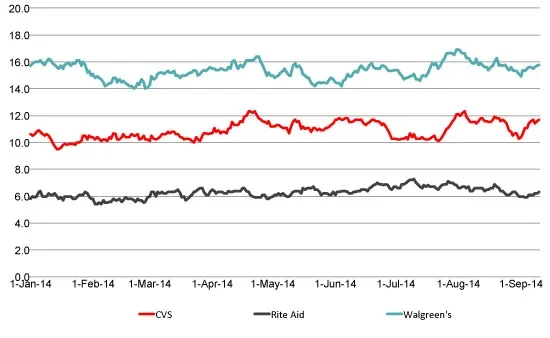

A week after announcing it will stop selling tobacco one month earlier than targeted, recently re-branded CVS Health has reached consumer perception levels of category leader Walgreen’s for the second time this year and invigorated its potential sales.

Back in February when CVS went public with its intention to stop selling tobacco products, the announcement appeared to give a bump to the drugstore chain’s perception, leading to a 10-day run where it equaled Walgreen’s scores. CVS is on a similar trajectory this time, but it remains to be seen how long the boost will last.

Since February’s initial announcement, CVS has also seen an improvement in its purchase consideration, YouGov BrandIndex’s key predictor of potential sales. There is currently a 13% likelihood that US adults would consider shopping at CVS next time they need a drugstore, up from 9% at the beginning of the year. CVS is just two percentage points behind category leader Walgreen’s, presently at 15%.

Rite Aid lags behind the other two at 7% while its consumer perception metrics are a distant third.

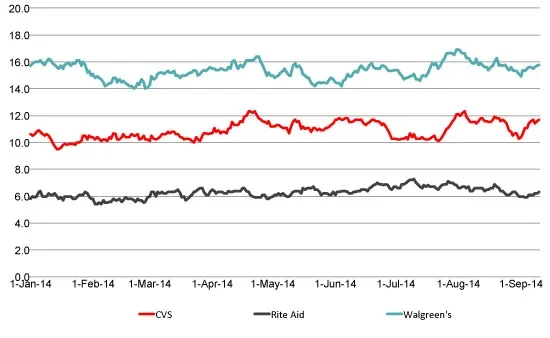

In addition to Purchase Consideration, YouGov BrandIndex measured CVS, Rite Aid and Walgreen’s with its Buzz score, which asks respondents "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?”

The Purchase Consideration score range is from zero to 100%. For both metrics, all respondents were adults 18 and over.

Buzz: CVS, Rite Aid, Walgreen's

Purchase Consideration: CVS, RIte Aid, Walgreen's