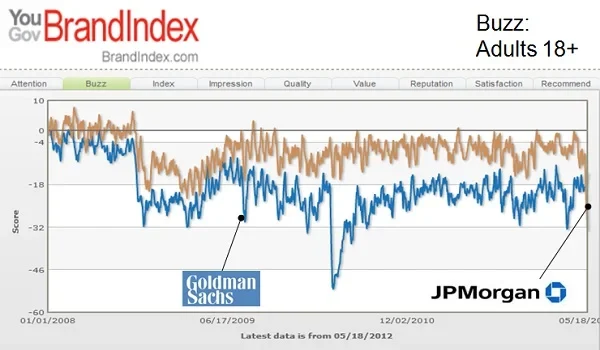

Goldman Sachs may have to relinquish its title as Wall Street’s poster boy for bad behavior.

After its recent admission of multibillion dollar trading losses JP Morgan’s consumer perception has dropped very sharply to the same levels as Goldman Sachs in the US when the NY Times published a stinging op-ed by a former employee just two months ago.

Not only is Goldman Sachs’ consumer perception currently significantly better than JP Morgan’s, it’s the latter firm’s low water mark since YouGov BrandIndex began tracking them at the beginning of 2008.

For Goldman Sachs, their recent public relations campaign appears to be helping: since early April, CEO Lloyd Blankfein gave rare back-to-back TV interviews on CNBC and Bloomberg Television, followed by a speech supporting gay rights. The NY Times noted that Goldman Sachs was more talkative with reporters than usual. During this period since early April, the company’s consumer perception has bounced back to pre-crisis levels, although still with far more negative feedback than positive.

JP Morgan and Goldman Sachs were being measured with YouGov BrandIndex’s buzz score, which asks respondents: "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?" All respondents are adults 18+.

YouGov BrandIndex measurement scores range from 100 to -100 and are compiled by subtracting negative feedback from positive. A zero score means equal positive and negative feedback.

Like Goldman Sachs, JP Morgan’s perception levels have been in negative numbers since September 2008, but not as deep. JP Morgan’s buzz scores have generally been in negative single digits, while Goldman Sachs has been in double digits.

On May 11th, JP Morgan’s buzz score was -8. One week later – last Friday, it had plummeted down to -33. Goldman Sachs’ buzz score as of last Friday was -16.

When Goldman Sachs was in the depth of its New York Times op-ed incident, its buzz score reached -32, very much where JP Morgan is now.

JP Morgan’s previous low buzz score was -22 in February 2009, when Congress berated the company publically for its use of bailout money, as well as when they laid off 12,000 workers when they folded Washington Mutual. Goldman Sachs’ low point was April 2010 with a -52 buzz score, coinciding with its SEC lawsuit.