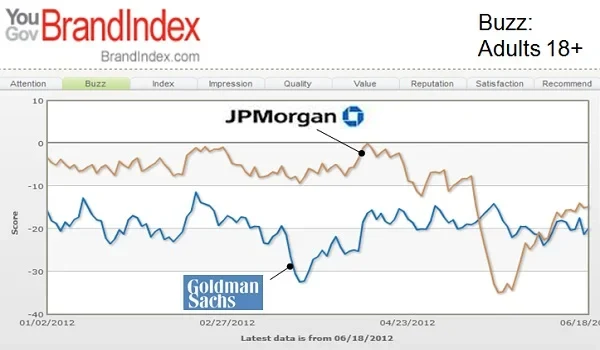

The race for investment bank viewed most negatively by the public between JP Morgan and Goldman Sachs just got a little tighter in the US after CEO Jamie Dimon testified twice on Capitol Hill.

JP Morgan’s recent multibillion dollar blunder sunk their consumer perception to deep depths for the first time below Goldman Sachs from May 21 through 24. JP Morgan rebounded back after June 5th, but is still nowhere close to the levels they were when the large hedge bets were unveiled.

Now that CEO Jamie Dimon has testified twice to explain what happened, the progress of JP Morgan’s consumer perception appears to be stalling. Those levels had begun inching their way back closer to where Goldman Sachs has recently improved to. The Lloyd Blankfein-led institution has upgraded its still mostly negative perception since late March and seems to have escaped any negative halo effect from JP Morgan’s troubles.

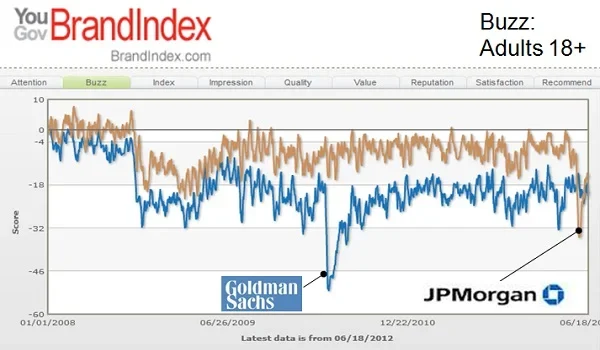

To put JP Morgan’s consumer perception in the big picture, while the bank has consistently had less negative consumer perception issues than Goldman Sachs for the past four years, the “London Whale” trading mess has pushed the bank’s buzz scores down to levels not seen since the aftermath of the 2008 financial meltdown.

JP Morgan and Goldman Sachs were measured with YouGov BrandIndex’s buzz score, which asks respondents: "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?" Respondents are representative of U.S. adults 18+.

YouGov BrandIndex measurement scores range from 100 to -100 and are compiled by subtracting negative feedback from positive. A zero score means equal positive and negative feedback.

Like Goldman Sachs, JP Morgan’s perception levels have been in negative numbers since September 2008, but not as deep. JP Morgan’s buzz scores have generally been in negative single digits, while Goldman Sachs has been in double digits.

On May 11th, JP Morgan’s buzz score was -8. One week after the trading losses became public, it had plummeted down to -33 while Goldman Sachs’ buzz score was -16. JP Morgan bottomed out on May 21 with a -35 score while Goldman Sachs was -14 on the same day.

By June 1st, JP Morgan rebounded and broke even with Goldman Sachs at the -21 score mark, then continued improving to -14 two weeks later. That’s when Dimon gave his first Congressional testimony, after which the score sagged to its current -17. Goldman Sachs current buzz score is close at -19.

JP Morgan’s previous low buzz score was -22 in February 2009, when Congress berated the company publically for its use of bailout money, as well as for laying off 12,000 workers when they folded Washington Mutual. Goldman Sachs’ low point was April 2010 with a -52 buzz score, coinciding with its SEC lawsuit.