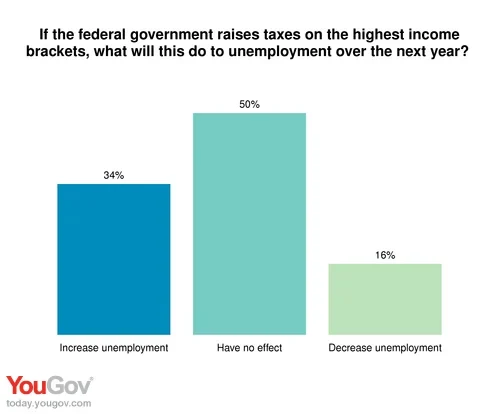

(Week of 12/8/2012) The solutions offered for avoiding the fiscal cliff include increasing taxes on the wealthiest Americans. But would this have a negative impact on the economy — still the country’s most important problem? The latest Economist/YouGov Poll suggests that most Americans don’t see much positive impact.

Half think raising taxes on the wealthiest Americans would have no impact on jobs, and one 16% think it would decrease unemployment. But a third worries higher taxes on high income earners would have a negative impact and increase unemployment. That group is dominated by Republicans, whose party leaders have been making the case against increased taxes for the wealthiest. 70% of Republicans think raising taxes on that group would increase unemployment.

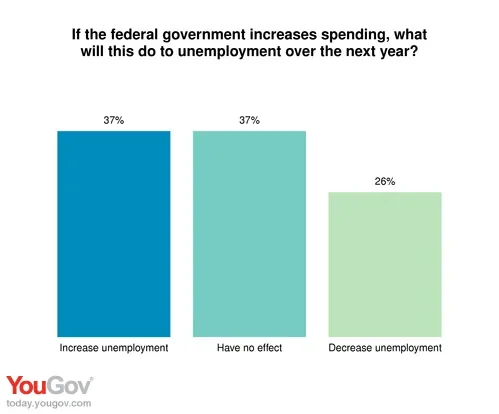

Another solution that has been offered to reduce unemployment—increasing government spending—is not likely to be part of the fiscal cliff negotiations. Opinions about that solution are modestly more hopeful. One in four say increased government spending would decrease unemployment.

But over one in three believe that spending increases would have a negative impact. And again, that group is heavily Republican. 64% of Republicans say increasing

government spending would increase unemployment.

Economist/YouGov poll archives can be found here

Photo source: Press Association