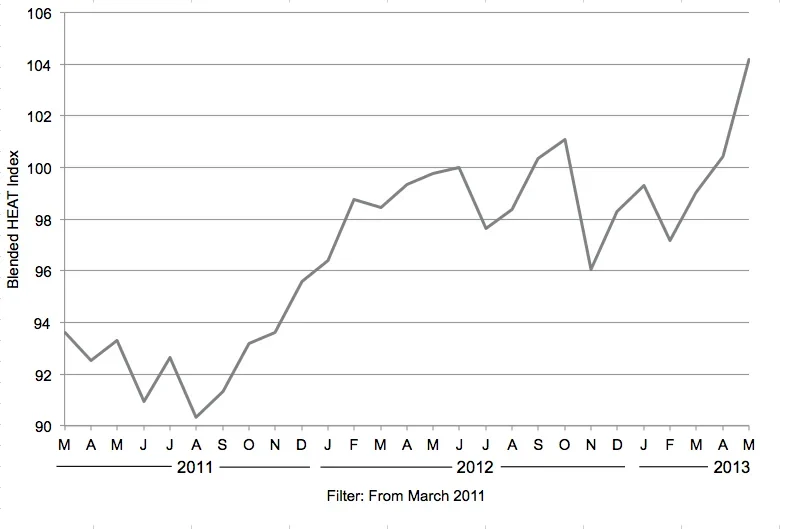

The May US Household Economic Activity Tracker (HEAT) figures from YouGov are at an all-year high, amid an upswing in the housing market in many parts of the country.

The HEAT index is up from 100 in April to 104 in May with perceived house price increases and improved perception of job security driving up the Index scores. An Index score above 100 is positive while an index score below 100 indicates negative sentiment.

Housing prospects reach high

The perception of property price increases is optimistic, despite a gloomy outlook earlier in the year. 15% of homeowners thought their property had increased in value over the past month – the biggest improvement in perception in the past 12 months. 28% of homeowners expect the value of their home to increase in the next year and 20% expect a lower value in the next 12 months.

20% of homeowners believed their home had decreased in value in the period April to May, though this is still an improvement on last month when 22% believed their home dropped in value from March to April. The improvement in sentiment took place amid a tentative upswing in the housing market in many parts of the US.

Job security

Job security for May also hit a 12-month high, as 11% of employed Americans believed their job was more secure than one month ago. 13% thought their job was less secure – an improvement from April, when 16% of Americans believed their job became less secure compared with the previous month.

The future outlook was less positive. 12% of employed respondents believed they might lose their job in the next 12 months, marginally down from 16% in April and 15% in March. Higher earners were less worried about layoffs; 8% of those earning more than $100,000 thought it likely that they would lose their job in the next year.

17% of working Americans thought business activity in their place of work had gone down and 11% believed it would decrease in the next 12 months. This compares with the 20% of employed people who believed business activity had improved in the month to May, and 27% who felt activity would pick up in the next year. This marked an improvement from the multi-year low of February 2013, when 24% believed business activity had decreased and 17% perceived an increase on the previous month.

Cash to spend

Despite improvements in the perception of property values, Americans still view their purchasing power as tentative. The Cash Available for Spending Index remains in the negative, with slight improvement from April – 6% believed they had more cash than last month, compared with 7% in April and 28% thought they had less cash, compared with 30% in April.

The YouGov Household Economic Activity Tracker is a monthly review of the key indicators of consumer confidence. It provides statistical results from the month reviewed to indicate consumer confidence for the month.

YouGov Household Economic Activity Tracker Index (General Population)