Just as T-Mobile announces today that it gained 1.1 million customers over its second quarter, its largest jump in four years, it is poised to capitalize on its one-two punch of no contract and its new Jump smartphone replacement plan. The brand gained the most in smartphone owner perception this year, currently on par with Verizon Wireless, and is the carrier most smartphone users will likely switch to in the next six months.

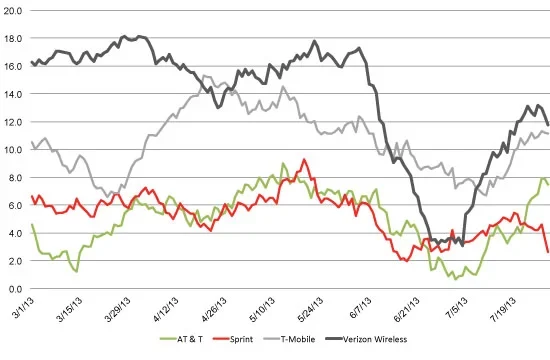

In the first quarter of 2013, Verizon Wireless’ smartphone owner perception was well ahead of its rivals. At the end of March, T-Mobile launched an impressive triple: no more contracts under its new Simple Choice Plan, a high-speed LTE service, and iPhone 5 sales beginning in April. That news sent T-Mobile’s perception on a one-month ascent bringing it up to Verizon Wireless levels.

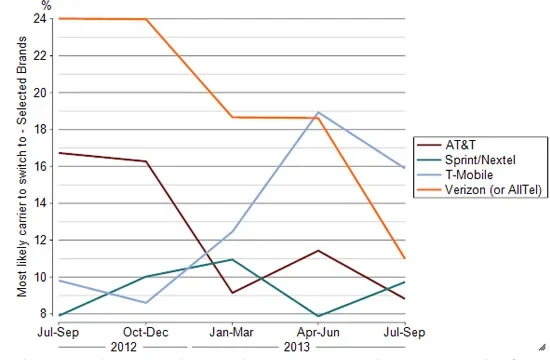

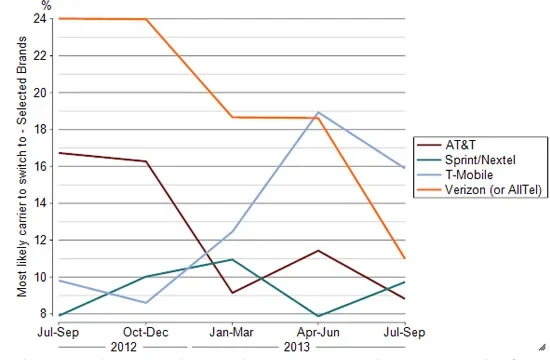

As T-Mobile’s Buzz scores increased so has the likelihood that consumers will switch to the carrier. T-Mobile has become the carrier most smartphone users in the market over the next six months will likely switch to, improving from 11% in Q1 to 20% in Q2, according to BrandIndex CategoryView, which examines spending, ownership, and purchase intent. Verizon’s numbers downshifted from 24% at the start of the year to less than 12% in the most recent quarter.

In early July, Bloomberg News reported T-Mobile added contract customers for the first time in three years.

T-Mobile got its second perception bounce this year, beginning July 10th, when it introduced its new Jump trade-in plan and six new TV ads featuring former SNL star Bill Hader. The company’s perception reached near 2013 highs, just inching past a revived Verizon Wireless, which had struggled for several weeks with the impact of former NSA contractor Edward Snowden’s revelations regarding the company’s cooperation with the NSA’s mass surveillance program.

As the NSA media frenzy cooled, Verizon Wireless rebounded with its own phone trade-in plan, Edge. AT&T also enjoyed a July lift, announcing their plan, the Next.

In BrandIndex CategoryView’s preliminary look at Q3, numbers for smartphone users looking to switch carriers have remained elevated for T-Mobile.

AT&T, Sprint, T-Mobile, and Verizon Wireless were measured with YouGov BrandIndex’s Buzz score, which asks respondents: "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?" All results are for adults 18+ who own smartphones.

BrandIndex CategoryView, interviews hundreds of people every day and asks questions such as product ownership, average spending, purchase intent and more to provide investors and marketers the data and insights they need to predict changes in revenue, profitability, and market share. For this wireless carrier research, all respondents use the smart phone as their primary phone and expect to change carriers in six months or fewer.

Buzz: T-Mobile, Verizon Wireless, AT&T, Sprint

Most likely carrier to switch to: Smartphone users in market next 6 months or fewer