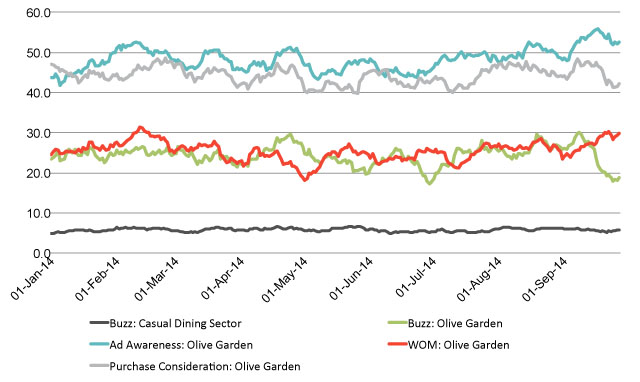

Although Olive Garden’s “$100 unlimited pasta for seven weeks” campaign did drive its ad awareness and word of mouth scores among casual diners, discontent over the limited amount of passes seems to have brought the embattled chain to its lowest consumer perception levels in more than two months.

But what may be most troubling of all to the battling owners and shareholders is Olive Garden losing the recent gains it made with casual diners over the summer in YouGov BrandIndex’s key potential revenue metric, purchase consideration.

Since mid-July, Olive Garden worked its way up from a 40% of casual diners saying they would consider the chain the next time they were dining out to 48% just prior to the past promotion was announced on September 8th. Two and half weeks later, all the gains have been erased as purchase consideration has slipped back down to 40%.

The Pasta Passes may have helped raise Olive Garden’s awareness in the short run, but the challenges they have seen with the execution of the campaign seem to have brought on some ill will with potential customers.

The timing is not ideal either: Olive Garden is fighting slumping sales and earnings, and is in the crossfire between its owner, Darden Restaurants, and activist shareholders Starboard Value Partners, who are campaigning for major changes at the chain.

Despite these difficulties, many of Olive Garden’s consumer metrics remains well above the average of major casual dining chains, showing there is still considerable strength in the brand.

In addition to its Purchase Consideration metric, YouGov BrandIndex measured Olive Garden with four other measurements: Buzz ("If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?"), Ad Awareness (“Which of the following brands have you seen an advertisement for in the past two weeks?"), and Word of Mouth ("Which of the following brands have you talked about with friends and family in the past two weeks, whether in person, online or through social media?"). All respondents are adults 18 and over who have eaten at a casual dining restaurant at least once in the last three months.

Buzz, WOM, Purchase Consideration, Ad Awareness: Casual Diners