It’s only mid-November and major retailers have their work cut out for them this holiday season: Amazon already has a wide lead over all of them in both consumer value perception and purchase consideration with adults 18 and over.

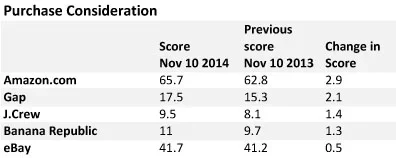

66% of consumers say they would consider the online megastore the next time they are in the market to buy, a full 11 percentage points over the next chain, Walmart and 13 percentage points over Best Buy. Amazon has also made the biggest gains in purchase consideration since the same date one year ago, an increase of three percentage points.

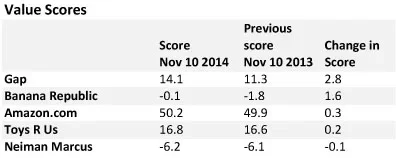

Amazon has an even bigger lead in value perception, which is measured on a range from -100 to 100, with zero being neutral: Amazon’s Value score is 50, a full 18 points ahead of both Best Buy and Target, and 22 points ahead of Walmart. Amazon is even with last year’s value score at this time.

Next to Amazon, Gap and Banana Republic have made the biggest incremental gains in both value perception and purchase consideration, comparing the 4-week period ending November 10th, with the same period one year ago.

55% of all adults 18 and over are aware of seeing a recent advertisement for Walmart, the largest percentage in the retail category. They are followed by Target (45%) and Best Buy.

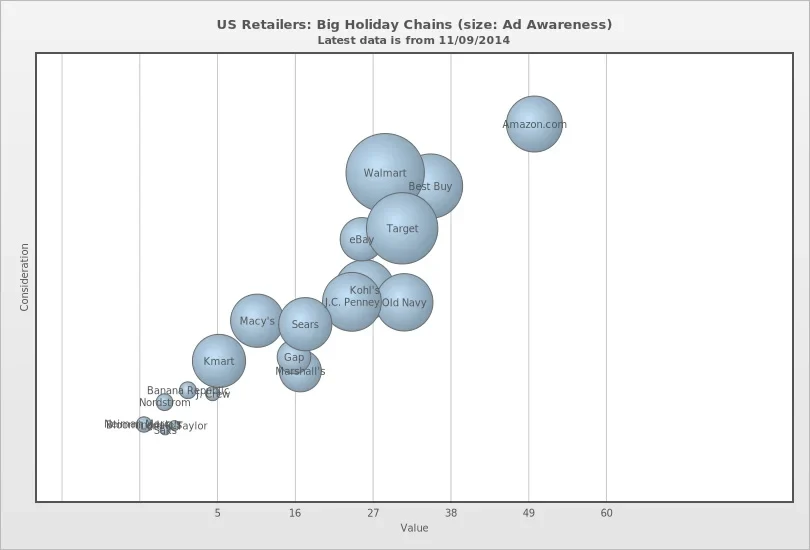

Value v Purchase Consideration: Holiday Shopping Retailers

At this point in time, major retailers have fallen into distinct groupings:

The Leader: Amazon, stands alone ahead of the whole pack.

The Strong Contenders: Walmart, Best Buy, Target and eBay, which have both high value perception and purchase consideration scores. Walmart also has the highest percentage of adults 18 and over who are aware of seeing recent advertisements (55%), followed by Target (45%) and best Buy (37%). eBay has ad awareness of 17%.

The Value Contenders: These are the retailers that have notched solid value scores but fall short of the others on purchase consideration. These include Old Navy, Kohl’s and J.C. Penney, all with advertising awareness around 29% to 32%.

The Struggling Giants: Retailers that fall just below the middle of the pack with their value and purchase consideration scores. These include Sears, Gap, Marshalls, Macy’s and Kmart. This group has advertising awareness around 26%.

The Laggards: Retailers which fall behind the rest of the group in value and purchase consideration. These retailers tend to have a smaller national footprint than the leaders in the space, and therefore have less ability to invest in large national television campaigns. That is reflected in the Ad Awareness scores among this group, which tend to be in the single digits.

Twenty major holiday retailers were charted by combining two of BrandIndex’s most relevant scores: Purchase Consideration ("When you are in the market next to purchase office supplies, from which of the following brands would you consider purchasing?”) and Value (“Does it give good value for what you pay?"). The size of each bubble in the chart relates to their Ad Awareness score, which asks respondents: "Which of the following brands have you seen an advertisement for in the past two weeks?"