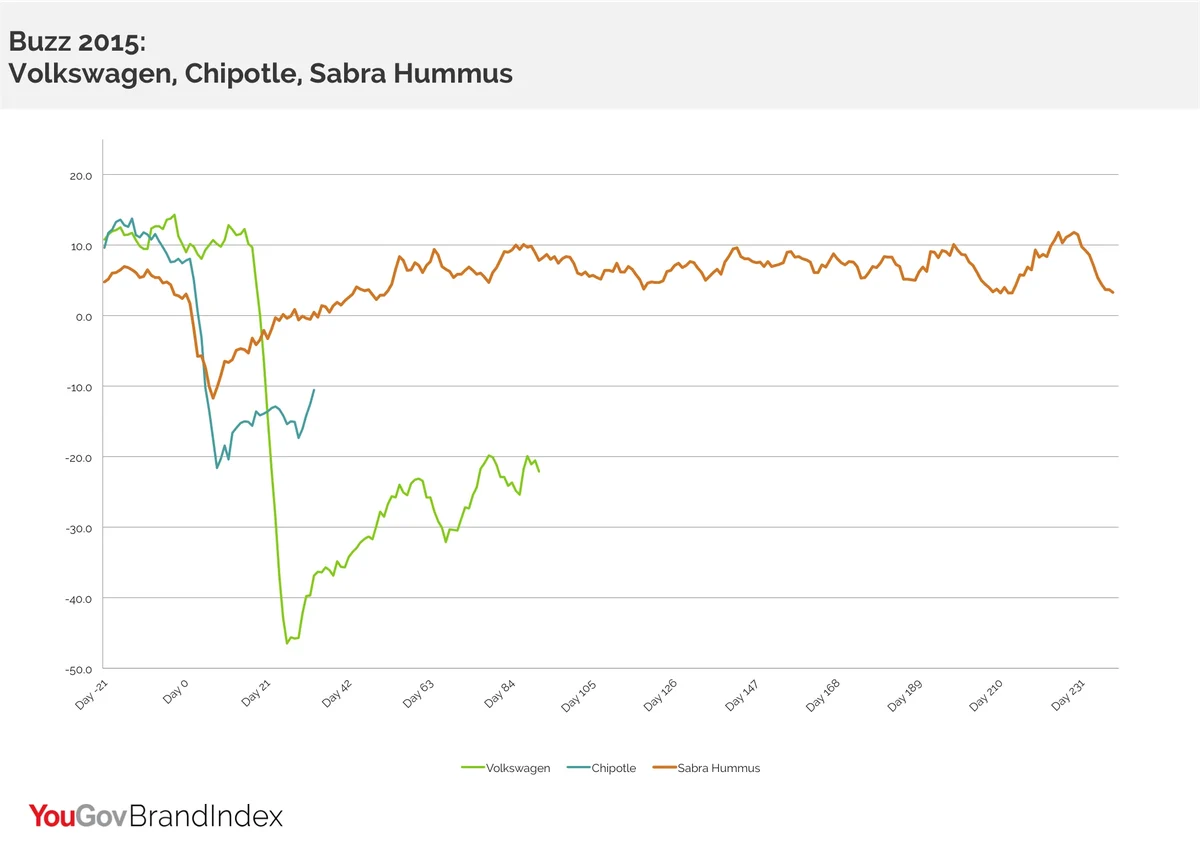

Sabra took 54 days to fully recover from its “possible” hummus listeria outbreak in the spring, while the NFL has yet to make it back after nearly 15 months, according to YouGov BrandIndex, the only daily brand consumer perception research service.

Sabra recalled 30,000 cases of hummus this past April, although according to the FDA, no illnesses had been reported and only a handful of products had been affected.

Several other prominent brands who have experienced crises have yet to get back their consumer perception footing:

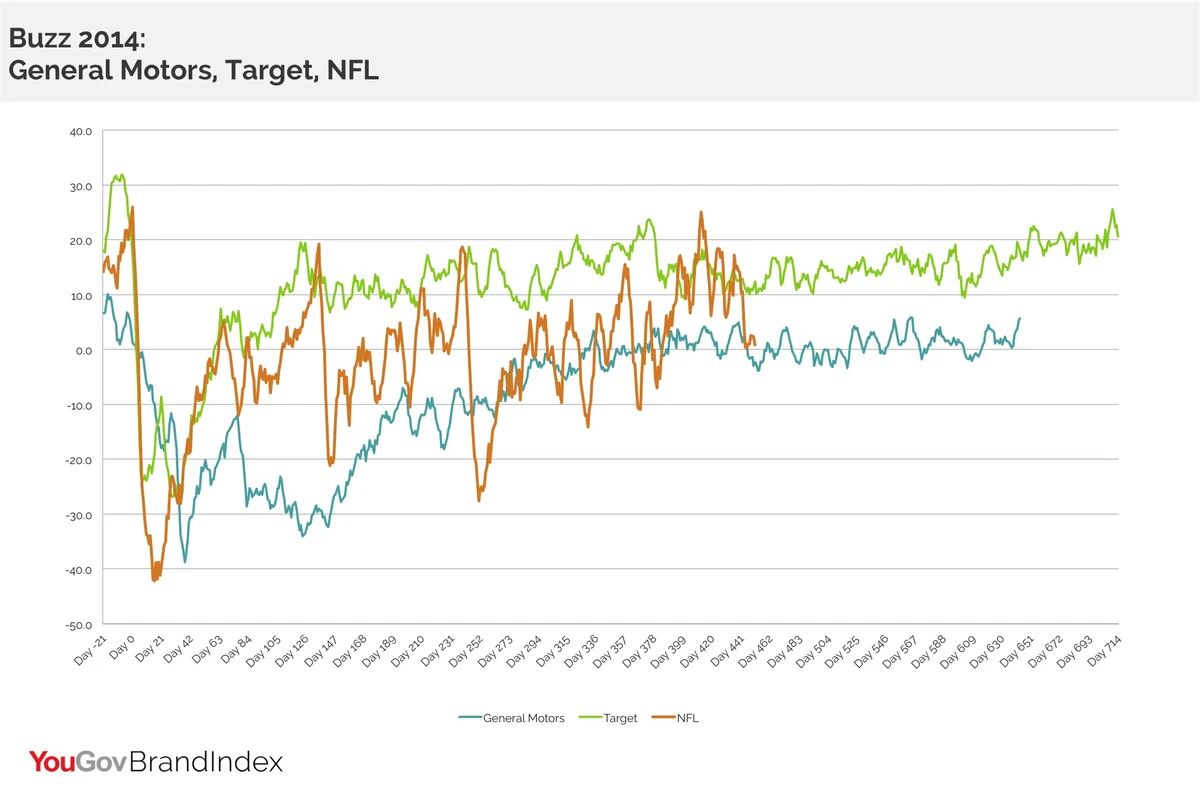

- In the wake of its domestic abuse-related incidents and “Deflategate,” the NFL experienced the steepest consumer perception drop of all the recent major crises. The league has touched the rebound mark a few times after the original incident – at the 135, 238 and 412 day marks -- but with each successive issue the NFL encountered, scores dropped significantly and still remain below pre-crisis levels.

- Target’s post-data breach plunge was equal to what Volkswagen has experienced so far this fall. Target took 373 days to briefly reach the same consumer perception level pre-crisis but has not returned since then. Possible reasons for not sustaining their climb: the breach's anniversary, Staples having its own widely publicized breach, and a Federal judge dismissing Target's motion to consolidate all the lawsuits it faced. Currently it has been more than 714 days since the breach was first reported at Christmas 2013.

- General Motors, in the wake of covered-up ignition switch issues which resulted in deaths, and subsequent large recalls, has yet to come back in consumer perception after 645 days.

How do 2015 crises compare to these holdovers from 2014, and which ones were more hype than real damage? YouGov BrandIndex’s data reveals some surprises:

- Volkswagen’s recently passed the 90-day mark, and as mentioned above, has equaled the same drop as Target. Both crises equaled the second biggest consumer perception drop in two years.

- Chipotle’s E.coli crisis has been ongoing for more than a month, and while their perception numbers have continued to slide, the drop has not been as severe as General Motors.

- Bud Light’s April "sexually suggestive" bottle label backfire landed them on many “brand fail” lists for 2015. While its consumer perception sunk by a significant but relatively modest amount over two weeks, the bottles were removed, and the brand’s perception levels rose to nearly what they were pre-incident by the following week.

- Urban Outfitters is typical of many brief social media crises: a brand does something controversial – in this case, selling a “bloodied” Kent State sweatshirt or outfits that looked like LGBT Holocaust prisoner garb. There’s a lot of fuss for a couple of days, and then it goes away, without bringing any real significant swing in perception.

YouGov BrandIndex interviews 4,300 people each weekday from a representative US population sample, more than 1.5 million interviews per year. Respondents are drawn from an online panel of more than 2MM individuals.