On the heels of National Splurge Day, YouGov Profiles reveals the habits and attitudes of shoppers who tend to splurge

You may not have known it, but last Saturday was National Splurge Day — a day devoted to treating yourself to something nice. According to Time, the faux holiday was invented just over two decades ago by a Chicago-based "eventologist" who had grown bored of America's more traditional days of rest. Now, people have a designated day to cruise the mall for shoes, watches, and any number of other gifts to themselves without guilt. How fun.

Using new data from YouGov Profiles, we can sketch an accurate portrait of those likely to shop on National Splurge Day. Defining a splurger as someone who both tends to make impulsive purchases and spend a bit extra on stuff they don't necessarily need, we know this group is 53% female and 47% male. And they skew young: Nearly half are millennials, about a quarter are Gen Xers, and the rest are 50 years old and older. 28% of splurgers say they shop online at least once per week, compared to just 19% of the general public. It's important to highlight the temptations, then, that come from 24/7 accessibility to the internet and the possession of a credit card.

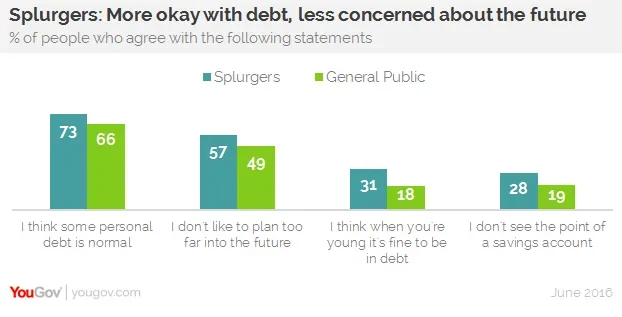

Unsurprisingly, splurgers seem more invested in the moment than the future. 73% think carrying some personal debt is normal, and 31% think it's fine to be in debt while young — both those numbers being much higher than the average person's take on fiscal responsibility. Over a quarter of splurgers don't see the point of a savings account.

Splurgers also appear to gravitate toward ad-heavy environments. 31% feel as though they have too many subscriptions to services such as Netflix and Spotify; 33% say they enjoy ads on TV; and 46% notice ads on the radio more than anywhere else. For the general public, those numbers come in at 20%, 21%, and 37%, respectively.

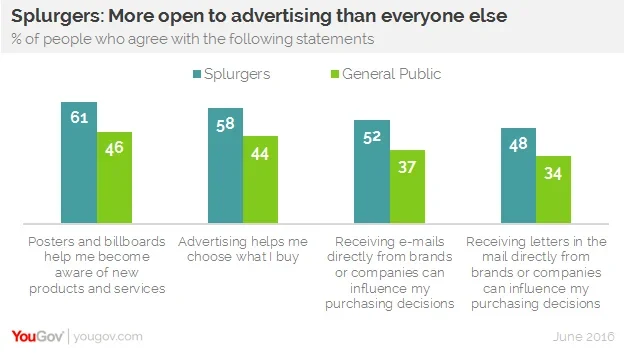

Perhaps a splurger's most interesting characteristic, in that it influences her or his relationship to shopping, is that a splurger has an atypical openness to advertising and marketing. As demonstrated in the chart below, impulsive buyers might not be as naturally impulsive as they think; rather, a constant awareness and engagement with everything from billboards to e-mails might help spur their impulsive tendencies.

According to Bloomberg, credit card dependence tends to begin in one's twenties, and the vast majority of people carry credit card debt from one month to the next. If there's one shopping tip that National Splurge Day might be able to impart, then, it's that purchasing habits aren't born; they're learned, and likely shaped by the advertisements that surround them.