But only 33% of Americans support the plan

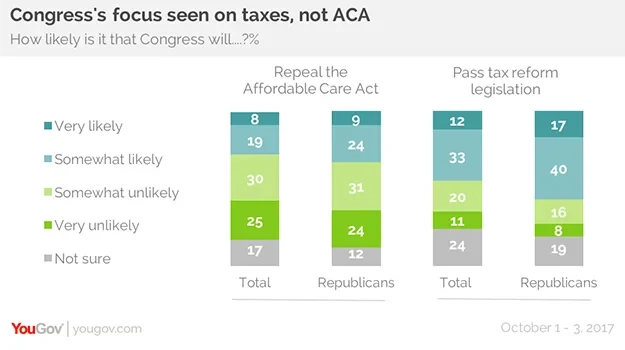

As GOP hopes for repealing the Affordable Care Act anytime soon fade, Republicans now look ahead to Congressional passage of comprehensive tax reform. A plurality of the public overall in the latest Economist/YouGov Poll also expects that Congress will pass tax reform legislation, though there is not clear public support for what Americans today think will happen if the Trump plan becomes law.

Right now, Republicans in Congress face negative evaluations even from those in their own party. Four in ten Republicans say the GOP-controlled Congress has accomplished less than Congresses usually do at this point in time. This week, they are as likely to have an unfavorable opinion as a favorable one about their own party’s legislators in general. Republican opinion of House Speaker Paul Ryan is closely divided; opinion of Senate Majority Leader Mitch McConnell is clearly negative.

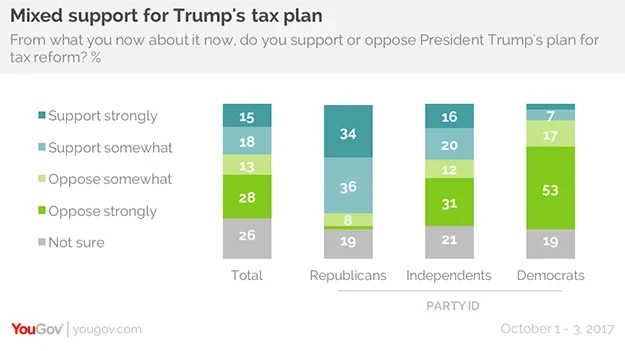

While the tax bill offers hope for legislative accomplishments, the substance of the plan, as described by the President, is not necessarily popular. More oppose the tax plan than support it based on what they know now, though Republicans favor it by seven to one.

When asked if they approve or disapprove of the way the President is handling taxes, 36% approve, while 47% do not.

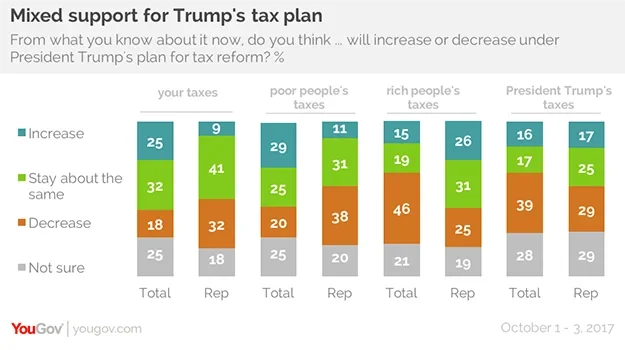

Americans are not at all sure they will benefit from the tax proposal. Fewer than one in five say the amount they pay in taxes will decrease if it becomes law, and the public is much more likely to think the rich will benefit. In fact, Americans are also likely to think the President himself personally will benefit from his own tax reform proposals.

Republicans are more positive about the plan’s impact. However, more than one in four Republicans think the President’s taxes will decrease under his plan, only a few points lower than believe the amount they pay in taxes will decline.

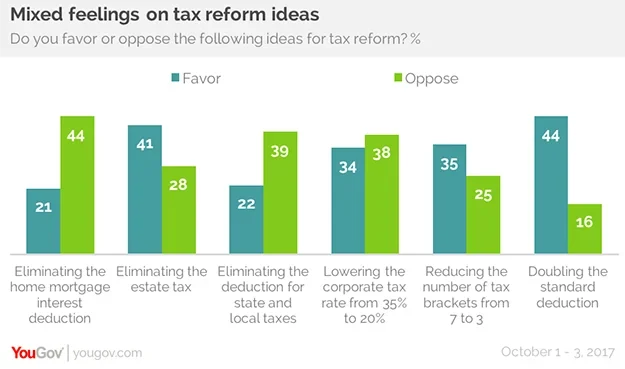

There are some reforms that Americans would like to see – a few of which were mentioned by the President when he outlined his plan. One is the elimination of the estate tax; the other is the reduction in the total number of tax brackets from seven to three.

Americans also favor doubling the standard deduction. However, there is less support for lowering the top corporate tax rate from 35% to 20%.

But relatively few support eliminating two commonly-taken tax deductions – the deduction for state and local taxes and the home mortgage deductions.

There are partisan differences on these changes. Republicans are closely divided on eliminating the deduction for state and local taxes (which tend to be more common in blue states). They overwhelmingly support lowering the corporate tax rate. On the other hand, Democrats oppose getting rid of the estate tax and reducing the number of income tax brackets.