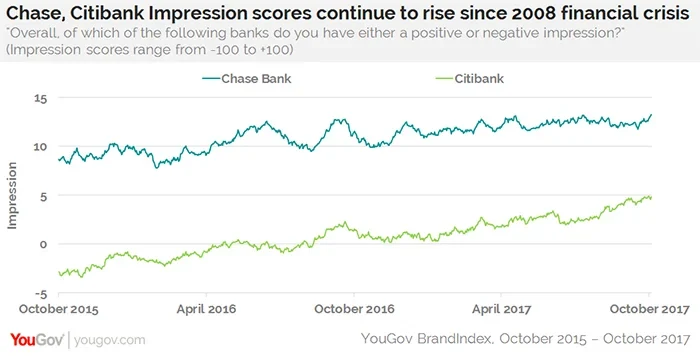

New data shows that more US consumers have a positive view of the two financial institutions than at any point following the 2008 financial crisis

A bad reputation can be hard to recover from, and after the 2008 financial crisis began to gain momentum, the banking industry as a whole took a PR punch right on the jaw.

But now, as parent companies of both Chase Bank and Citibank prepare to release their respective Q3 2017 results next week, each bank is showing signs of returning to health.

New numbers from YouGov BrandIndex, for example, reveal that both brands are currently seeing their highest Impression scores among the general public since the financial crisis. Throughout the past two years, Chase has climbed from 9 to 13, while Citibank has emerged from negative territory, moving from -3 to 5.

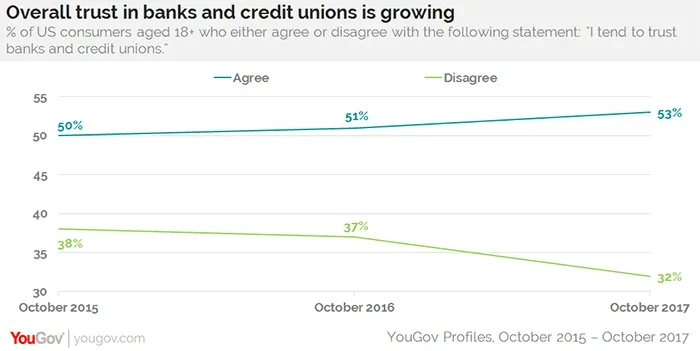

Additional data from YouGov Profiles suggests that, beyond just Chase and Citibank, the American public's trust in banks is growing in general.

Figures from October 2015, for instance, show a 12-point gap between people who say they tend to trust banks and credit unions and those who don't (50% vs. 38%). At present, however, this divide has increased to 21 points, where 53% indicate trust in banks and credit unions, while 32% report the opposite.