Only 28% of people without a mortgage say it’s likely that they will get one in the future

Though the housing market and mortgage rates will always fluctuate, Americans are feeling confident when it comes to being a homeowner. Many are confident that they will be able to pay off their mortgage in full, and younger Americans without mortgages tend to say it’s likely that they will eventually have a mortgage, according to new data from YouGov Omnibus.

One-third (34%) of Americans currently have a mortgage, while 21% say they used to. Of those who currently have a mortgage, half (52%) of them have refinanced at least once and a quarter (26%) say it’s likely they’ll refinance at some point.

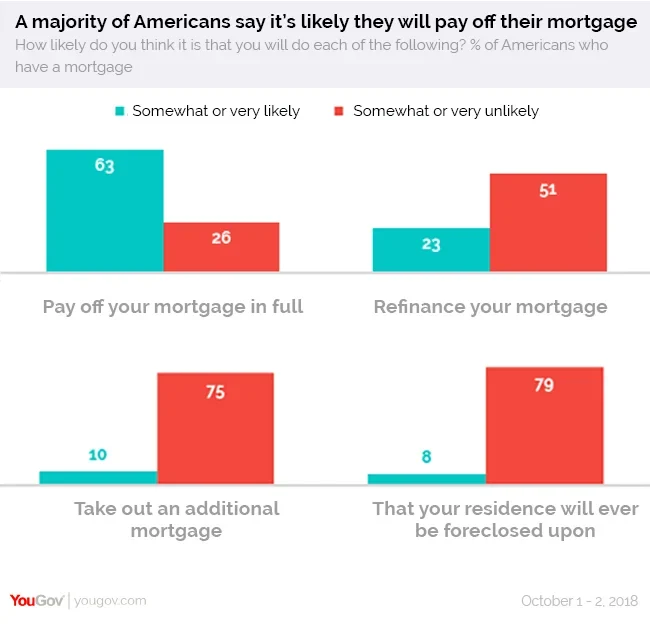

Most are optimistic about their future, with nearly two-thirds (63%) saying it’s likely that they’ll pay off their mortgage in full. A vast majority (79%) also say it’s unlikely their residence will ever be foreclosed upon. Only 10% say it’s likely they will ever take out an additional mortgage on their home.

But those who don’t have a mortgage tend to say it’s unlikely they will ever have one. Close to half (45%) of US adults without a mortgage say they’re somewhat (9%) or very (36%) unlikely to ever get one. Only 28% of people without a mortgage say it’s likely that they will get one in the future, while 14% say it is neither likely nor unlikely. However, the numbers are slightly different between age groups: 18-34-year olds are considerably more likely (44%) to say that it’s likely they will have a mortgage in the future. Only about one-third (32%) of 35-54-year-olds and 10% of 55-and-older Americans without a mortgage felt the same.

But those who don’t have a mortgage tend to say it’s unlikely they will ever have one. Close to half (45%) of US adults without a mortgage say they’re somewhat (9%) or very (36%) unlikely to ever get one. Only 28% of people without a mortgage say it’s likely that they will get one in the future, while 14% say it is neither likely nor unlikely. However, the numbers are slightly different between age groups: 18-34-year olds are considerably more likely (44%) to say that it’s likely they will have a mortgage in the future. Only about one-third (32%) of 35-54-year-olds and 10% of 55-and-older Americans without a mortgage felt the same.

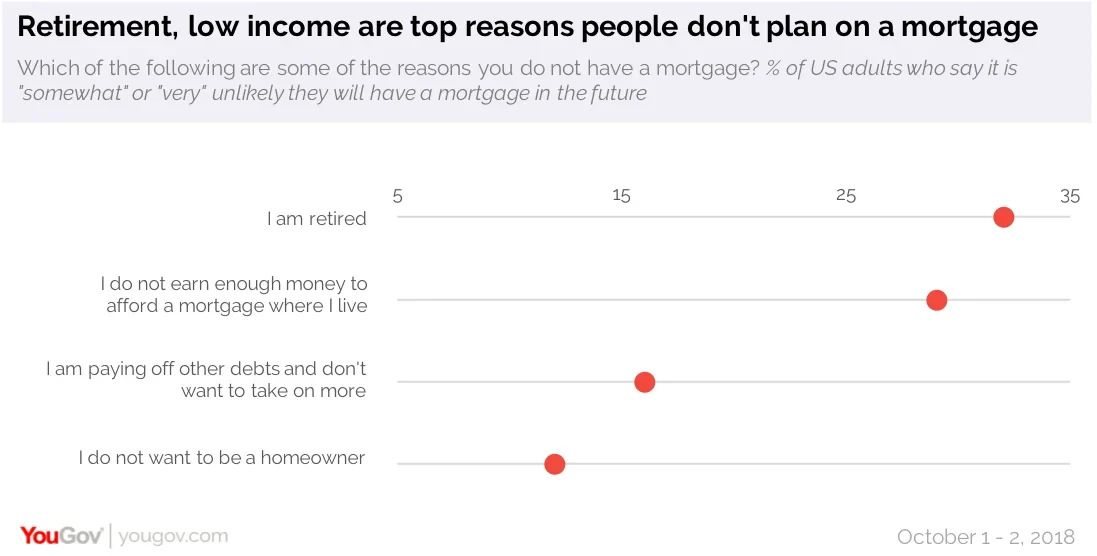

Of course, people may have certain reasons for not planning on a new mortgage. The most common (32%) reason people gave for why they don’t think they will have a mortgage in the future is “I am retired.” Other common responses were “I do not earn enough money to afford a mortgage where I live” (29%) and “I am paying off other debts and don’t want to take on more” (16%).

Some people may just not like the idea of owning a home. When asked whether they would prefer to rent or buy their primary residence, 16% of people said they would prefer to rent it. Millennials (23%) and black Americans (26%) were the groups most likely to say they would prefer renting their home, rather than owning it.

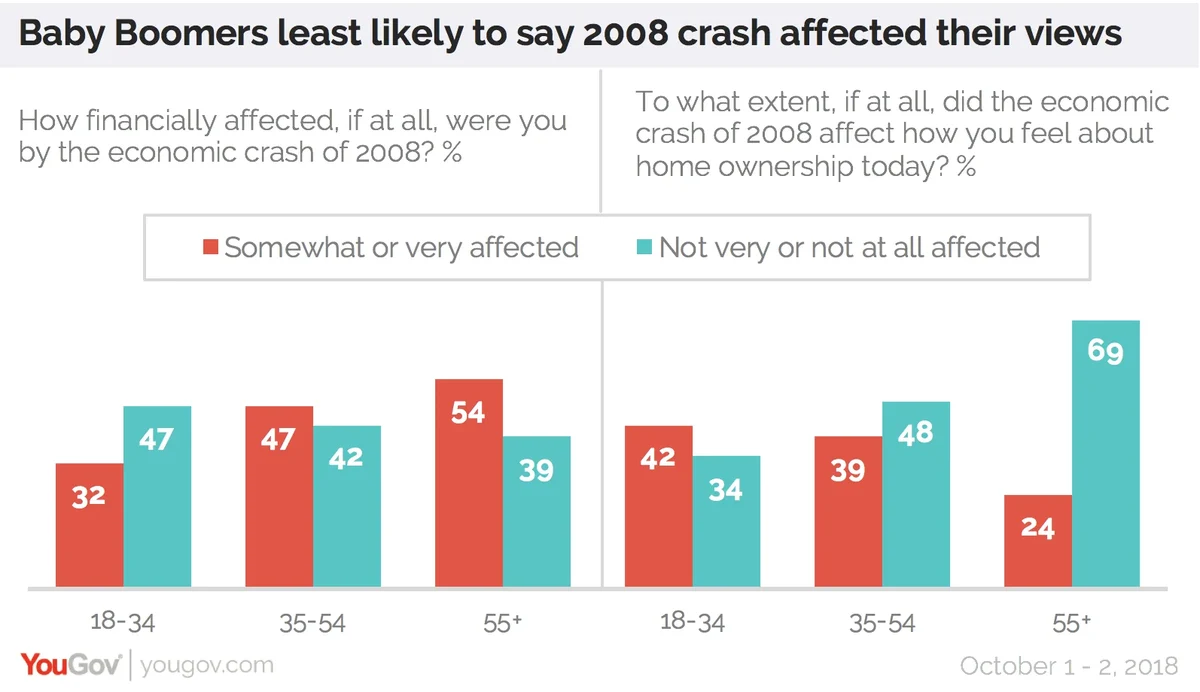

Preferences about renting or owning a home can be influenced by countless factors, but one event that affected many Americans’ thoughts on home ownership was the economic crash of 2008. Close to half (45%) of Americans say that they were somewhat (27%) or very (18%) financially affected by the crash. Now, ten years later, more than one-third (35%) say that the economic crash influenced how they feel about home ownership today.

Interestingly, older Americans who were affected by the 2008 crash were actually less likely to say it affected their views on home ownership in 2018. Over half (54%) of Americans 55 and older said they were affected by the crash, but 69% in this group say it didn’t really affect their views on home ownership, with 58% saying it didn’t affect how they feel “at all”. On the flip side, only 32% of people 18-34 say they were affected by the crash, but 42% of this group says it affected their views on home ownership.