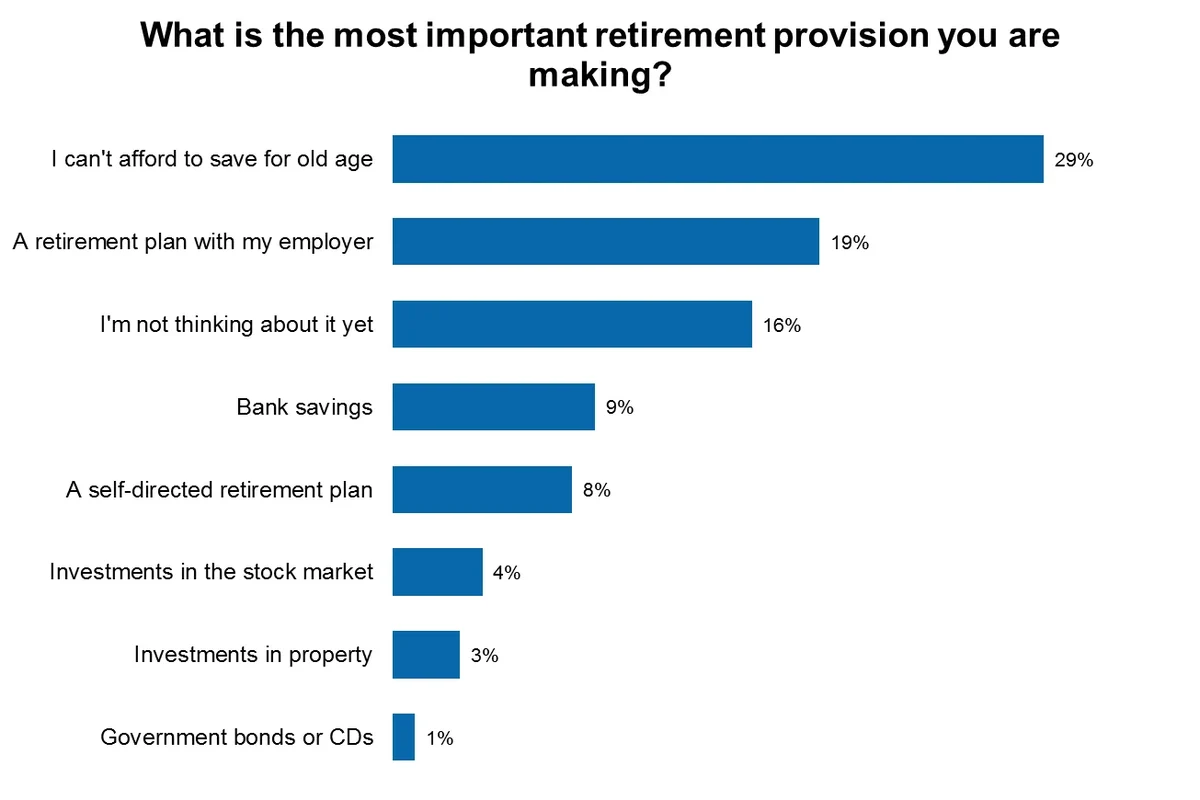

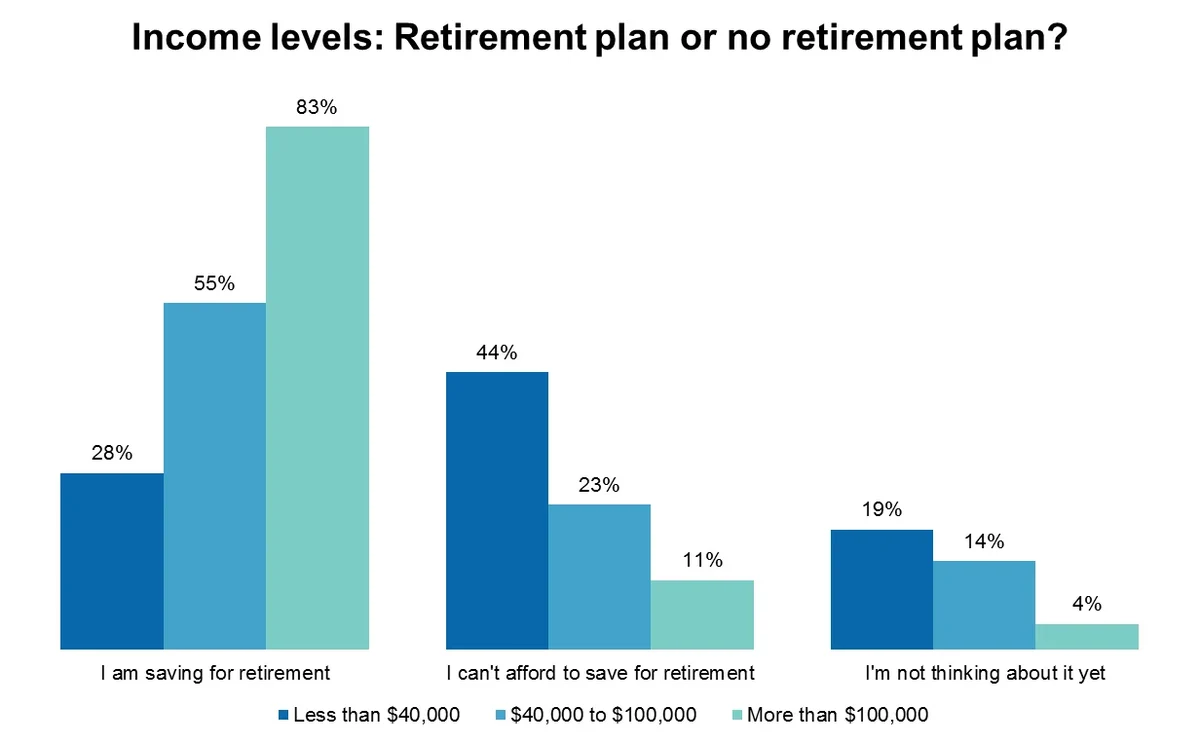

If you think you’re not saving enough for the future, you’re not alone. 29% of Americans say they are ditching retirement plans because they cannot afford to save for old age. A further 29% expect someone other than themselves or their partner to support them when they can no longer work. The findings from a nationally-representative YouGov survey into retirement planning show that income is a major barrier to people’s plans for old age.

- 44% of those earning less than $40,000 say they cannot afford to save for old age

- 16% of us are not thinking about retirement provisions yet

- Half of respondents plan on supporting themselves in old age

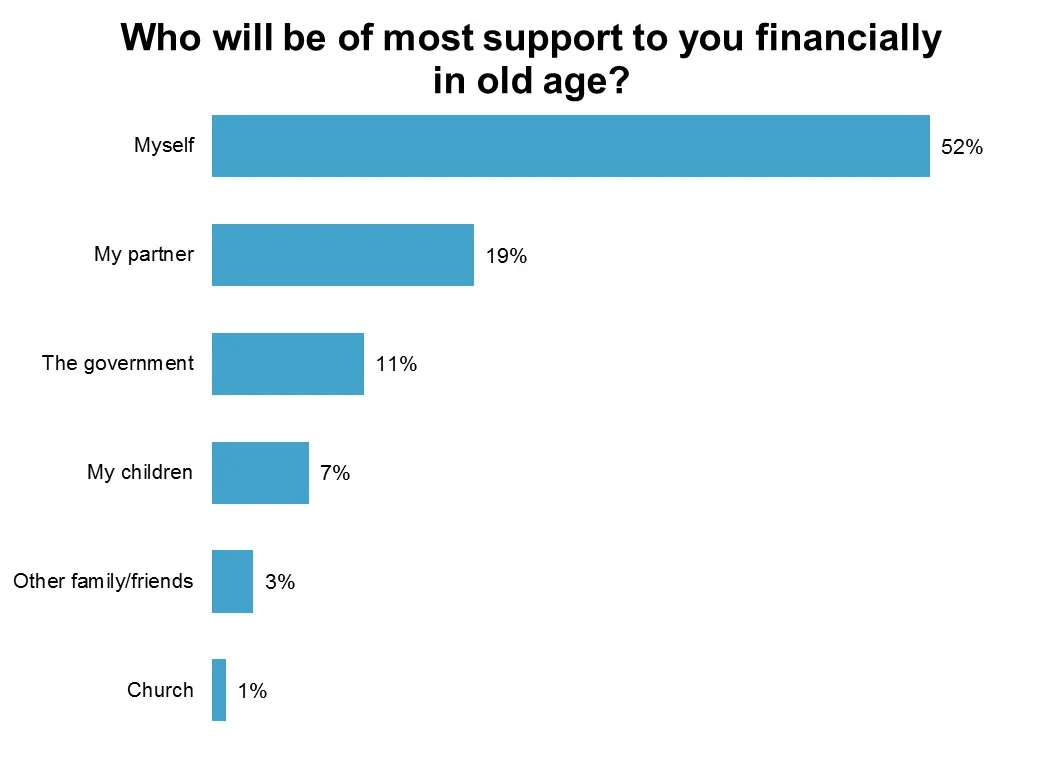

- 11% will rely on the government for income when they retire and 7% on their children

- 30% predict they will be over 65 when they retire – 10% say they will never retire

Retirement provisions can slip by the wayside when pressing living expenses are at hand. Increases in food and gas costs, combined with lower incomes as a result of the economy, means saving has become difficult. But the result is that people may increasingly need to rely on personal savings or someone else to make ends meet.

Which plan? Employer directed policies are most popular

The majority of working people have retirement on their mind. Planning for old age is a complex business, and forms of saving differ among the 46% of people who said they are planning for old age. The most popular types of saving are: holding a plan with an employer (19%), saving in the bank (9%), a self-directed plan (8%), investing in the stock market (4%), investing in property (3%) and holding government bonds or CDs (1%).

Low earners are more likely to shirk saving for old age in favor of other expenses. 44% of people earning less than $40,000 a year say they cannot afford a retirement plan, and this group has the highest proportion of people who are not thinking about retirement yet (19%). Even 11% of high earners said they do not have the necessary cash to put into any retirement provisions. Men are less likely to be thinking about old age than women – 19% of male respondents and 13% of female respondents said they are not thinking about retirement yet.

There’s no ‘right’ proportion of paycheck for retirement

Figures vary when it comes to how much money people pay into their retirement pot. Out of workers who are paying money into a retirement plan, 7% contribute 1-3% of their income, 7% contribute 4-5%, 7% contribute 6-8% and 8% pay in more than 8% of their salary.

Even though higher earners have a larger income, they are more likely to contribute more of their paycheck than low earners. The proportion of people contributing more than 6% of their income is 53% of those earning more than $100,000, 26% of those earning $40,000 to $100,000 and just 15% of those earning less than $40,000.

Sources of support: Individuals, partners, children, government and church

Most people plan on supporting themselves in old age. 52% of respondents say they will rely on their own resources during retirement. But a significant proportion are relying someone else as their primary means of financial support in old age. 19% said their partner or spouse would provide most money, and 7% expect their children to provide for them financially. 11% say they will rely on the government as the primary source of support and 1% say their church will step up when they get old.