Young Americans have the most negative attitudes towards borrowing money, while half of people in their 30s and early 40s have more debt than they can afford.

The Federal Reserve recently published findings that show Americans are now taking on more debt than had even been doing in 2008, with much of this being driven by rapid growth in student debt and mortgage debt. The ongoing accumulation of debt has led some commentators to speculate that 'millenials' (roughly speaking people born in the mid-80s or later) are defering adulthood, and the expenses that come with it. This 'deferrment' may have lasting consequences on the economy and the broader way that Americans live.

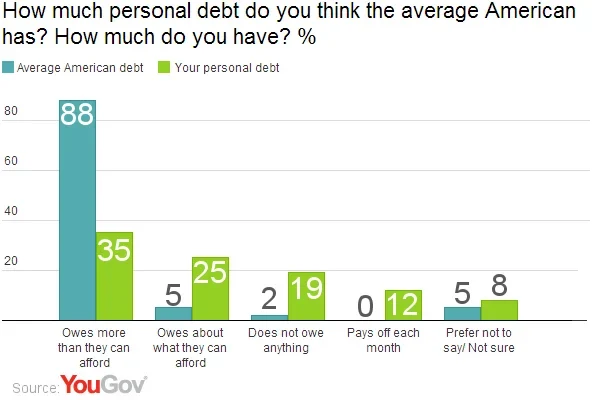

According to the latest YouGov research, Americans overestimate how large the problem of debt is for the average person. 88% say that the average American owes more than what they can actually afford, but asked the same question about their personal finances, only 35% of Americans say they owe more than they can afford. 67% of people also said that they do have some form of personal debt.

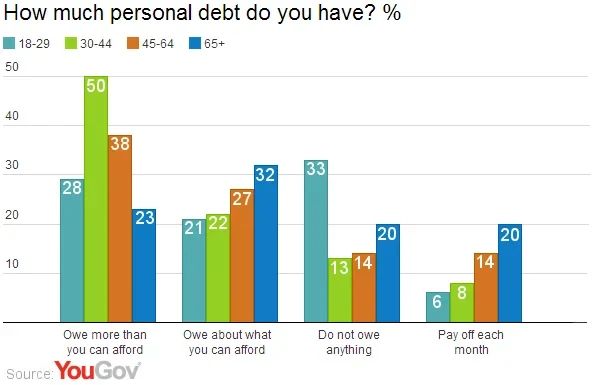

Of those who in debt, 50% of people aged 30-44 have more debt than they can afford, with that age group having the biggest issues with debt. Younger Americans aged 18-29 owe the least out of any age group. Democrats were also roughly 10% more likely than Republicans to owe more than they can afford.

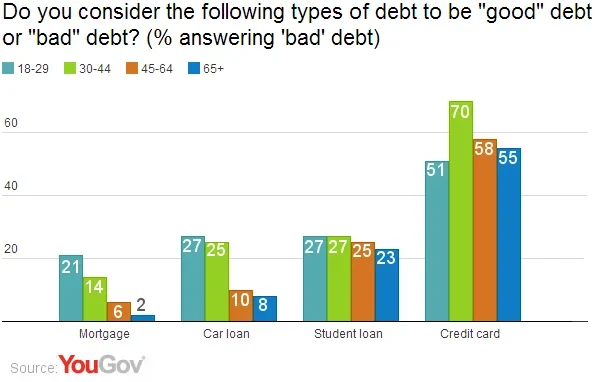

The young are the most likely to call certain types of debt "bad". One notable exception to this is, however, credit card debt, though even among under-30s most say that credit card debt is 'bad'. Overall, a majority of all Americans consider credit card debt to be 'bad'.

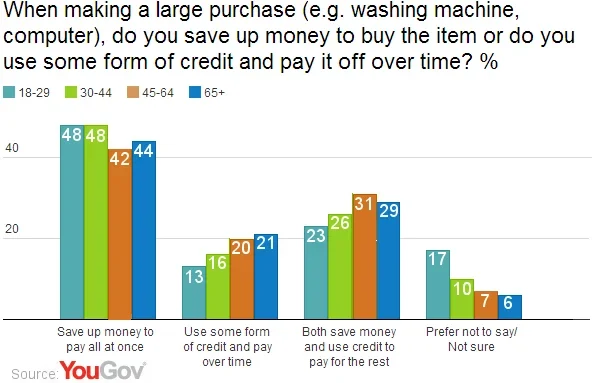

Asked about their saving and borrowing habits, young Americans are the least likely to buy on credit for big purchases. Though almost half of both 18-29 year olds and 30-44 year olds pay up front for large purchases, this younger group is less likely to use credit. Only 13% of younger Americans would pay with credit alone, while 23% would consider saving a little and borrowing a little to make the purchases.

Young people - many of whom have lived much of their adult lives in the shadow of the financial crisis - have seemed to develop an aversion to debt, with young people being significantly less in debt than they were before the crisis. However student debt is the one category where debts are now higher for young people, and growing levels of student debt seem set to make life more difficult for young Americans who went to college.

Full poll results can be found here.

Image: Google.