This has been interpreted as a dig at Mitt Romney, whose personal wealth and comparatively low tax rate have been front-and-center in the campaign these past weeks. Romney finally released his tax returns on Thursday, revealing a 2010 income of $27 million and a federal tax rate of 13.9%.

What effect, if any, does this information have on the way voters judge Romney? A January 21-24 YouGov national poll, conducted before Romney released the actual figures, reveals a potential liability for Romney: a majority of Americans believe that he is not paying his fair share in taxes. No other candidate elicits views that are so unfavorable. Moreover, if you already believe or suspect that Romney isn’t paying his fair share, being reminded either of his wealth or his tax rate makes him seem less sympathetic and caring.

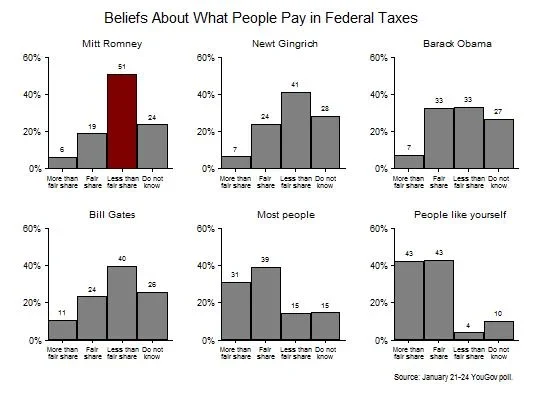

The survey asked whether the following people “pay more than their fair share, their fair share, or less than their fair share of federal taxes”: Barack Obama, Mitt Romney, Newt Gingrich, Rick Santorum, Bill Gates, “most people,” and “people like yourself.”

Of all of these, Romney fared the worst: 51% said that he was not paying his fair share. By contrast, 41% said that of Gingrich and only 33% said that of Obama. Romney fared even worse than the much wealthier Bill Gates: only 40% believed the Microsoft mogul wasn’t paying his fair share. This perception of Romney contrasts starkly with how people perceive their own tax burden and those of most others: relatively few believe that they or other Americans are not paying their fair share.

After respondents had answered these questions, we conducted a simple experiment. Respondents were randomly assigned to see one of the following:

• Information about how the average American’s income compares to Romney’s: “The Census Bureau has estimated that the average American household earned about $50,000 in 2010. In August, Mitt Romney disclosed that in 2010 he and his wife had earned somewhere between $7 million and $40 million.”

• Information about how federal tax rates for different income levels compare to Romney’s: “In this country, a person making under $20,000 each year pays about 2% of their income in federal taxes. A person making $60,000 pays about 13% of their income in federal taxes. A person making $250,000 pays about 20% of their income in federal taxes. Last week, Mitt Romney suggested that he paid about 15% of his income in federal taxes.”

• Information about average income and tax rates, with no mention of Romney: ““The Census Bureau has estimated that the average American household earned about $50,000 in 2010. In this country, a person making under $20,000 each year pays about 2% of their income in federal taxes. A person making $60,000 pays about 13% of their income in federal taxes. A person making $250,000 pays about 20% of their income in federal taxes.”

Although our experiment was based on estimates of his 2010 income and tax rate, these estimates were fairly close to what we now know. His 2010 income of $27 million falls near the middle of the $7 million-$40 million range, and his actual tax rate of 13.9% is close to his estimate of 15%.

After respondents saw one of these three sets of information, they evaluated Mitt Romney on 8 dimensions, several of which we have discussed before: takes positions and sticks by them; is personally wealthy; cares about me; cares about the poor, the middle class, and the wealthy; is honest; and is trustworthy.

Three main findings emerge from this experiment.

First, respondents who saw information about either Romney’s wealth or tax rate were less likely to believe he “cares about people like me”—provided they already believed he wasn’t paying his fair share of taxes. Among this group, the percentage who thought Romney cares about people like me was an already-low 22% among those who saw no information about Romney. This declined to 17% among those who saw information about his tax rate and to 14% among those who saw information about his income.

Second, being told Romney’s income increased the percentage who said that “cares about the wealthy” describes Romney “very well”: from 49% in the group that saw no information to 60% in the group that saw the estimate of Romney’s 2010 income (being told Romney’s tax rate did not have this effect).

And there was a final consequence. We previously found that believing Romney cares about the wealthy is correlated with believing he doesn’t care about “people like me.” In this experiment, this correlation is significantly larger when told either about Romney’s income or tax rate than when told neither piece of information.

We need to be cautious in interpreting these findings. The information about Romney’s income or tax rate did not affect how respondents evaluated Romney on other dimensions, such as his willingness to stick by his positions, his honesty, or his trustworthiness. It didn’t make respondents more likely to describe him as personally wealthy (most already do so anyway). And it didn’t change whether they believed he cares about the poor or middle class. When the information does move opinions, the shifts aren’t large. Many respondents may already have heard about Romney’s income or tax rate or simply don’t consider those facts germane. The Obama team may find that a campaign that implicitly or explicitly characterizes Romney as a plutocrat isn’t a slam dunk.

Nevertheless, for Romney, there is cause for concern. Just over half of Americans doubt that he pays his fair share in taxes. After hearing about his actual income and tax rate, these people are less likely to think he “cares about people like me”—an attribute on which Romney is disadvantaged relative to Obama and which is a perennial predictor of how people vote. Information about his wealth also leads a larger fraction of Americans to believe he cares about the wealthy, and this belief in turn also reinforces the sense that he does not care about “people like me.” The more Romney’s wealth and taxes are discussed, the more he may seem like someone who cannot relate to ordinary voters. This may explain why, during a time in which his wealth and taxes were in the news, negative views of Romney jumped 20 points among whites with incomes below $50,000.

Romney can’t even take comfort in the distinction that Obama raised in his SOTU address. Americans may not begrudge financial success in theory, but Romney’s wealth leads them to see him as more sympathetic to the wealthy, which could cost him if they then see Romney as less like themselves. Even if Romney were paying a larger share of his income in taxes—what Obama would call his “fair share”—the simple fact of his wealth may be an obstacle.