Most Americans who aren't retired expect they'll have to work past 65 to make ends meet

In roughly twenty years time the Social Security fund is set to run out of money. The fund had built up huge surpluses over the past decades before turning to a deficit. Despite the looming crunch, few politicians have paid much attention to Social Security, indeed the Republican frontrunner Donald Trump has firmly said that he aims to leave Social Security as untouched as possible, much to the consternation of the Republican Congressional leadership.

YouGov's latest research shows that 55% of Americans who are not yet retired say that they are expecting to have to work past the age of 65 in order to make ends meet, while only 30% say that they are not expecting to. Unsurprisingly, people in households with annual incomes under $50,000 are much more likely to say yes (63%) than people in households with incomes over $100,000 (37%).

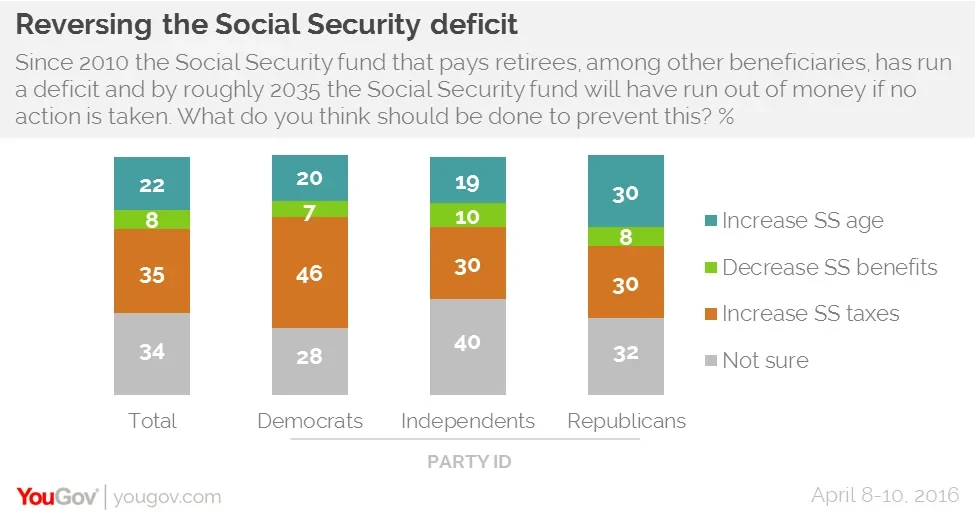

Even these expectations may be optimistic if Social Security runs out of money. Asked what should be done about the deficit, the most popular answer is to raise Social Security taxes, but only 35% support this. 22% want the Social Security age to continue increasing, while only 8% say that Social Security benefits should be cut. Nearly half of Democrats (46%) want taxes to increase, while Republicans are split 30% to 30% between increasing the Social Security age and higher taxes.

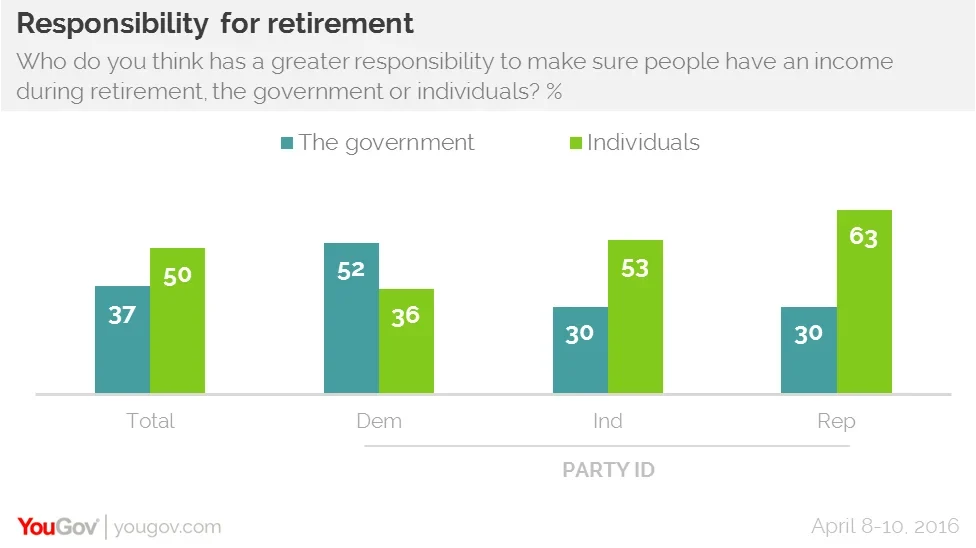

Half of Americans (50%) say that it is primarily the responsibility of individuals to make sure that they have enough money for retirement, but 37% say that it is primarily the government's responsibility. Democrats are an outlier on this issue, with 52% saying that it is primarily the government's duty, compared to 30% of independents and Republicans.