Americans continue to grow concerned about the possibility of a recession within the next year. Some may be looking to change their investment strategies.

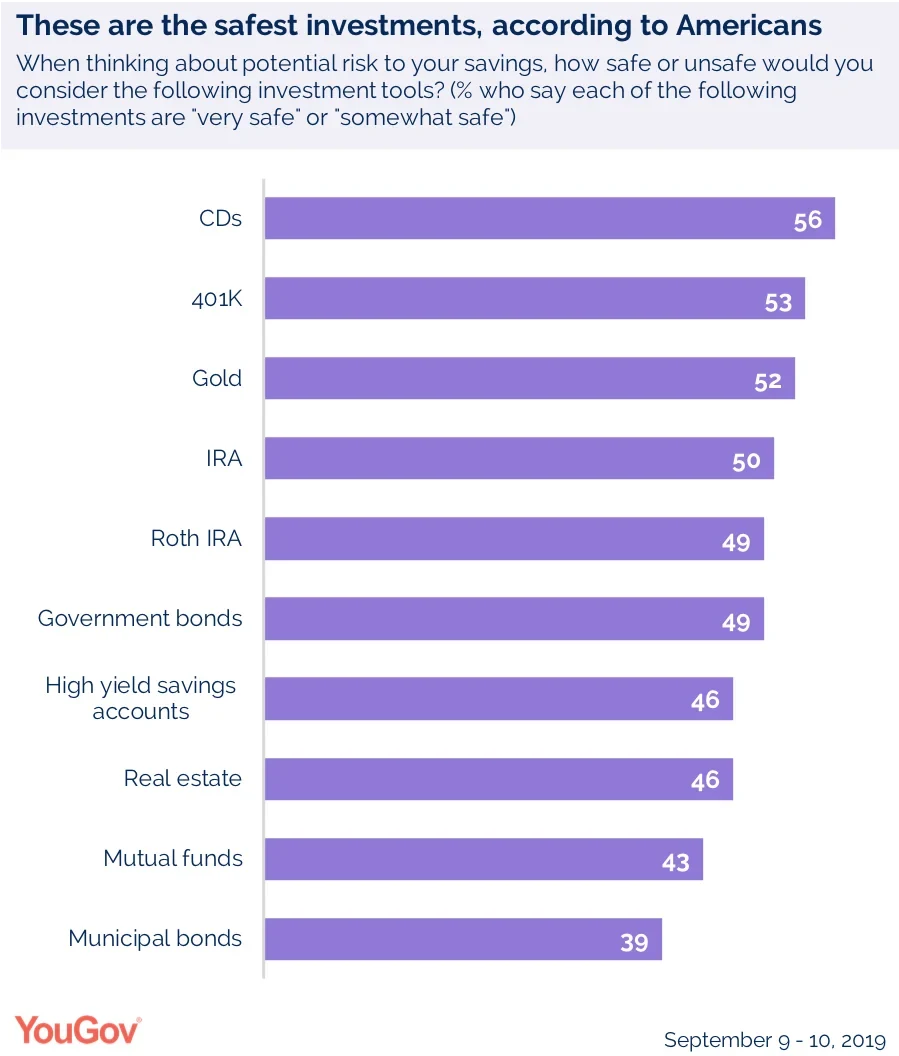

New data from YouGov finds a majority of Americans say they consider investments in CDs (56%), 401Ks (53%), and gold (52%) to be safe investments. Around half say that investing in an IRA, a Roth IRA, and government bonds is a “very safe” or “somewhat safe” choice.

At least four in 10 believe that high-yield savings accounts, real estate, mutual funds and municipal bonds are also safe ways to invest money.

Related: This dataset was mentioned by The Motley Fool in the article A Recession Is Coming, but Real Estate Should Be Fine (Especially If You Follow These Tips)

In contrast, four in 10 (40%) Americans say cryptocurrencies are unsafe investments, and 34% say the same about high-growth stocks.

Recent data from YouGov finds that one in four US adults (25%) believe a major recession will occur within the next year. Americans may be moving their investments to areas they believe are best equipped to weather a recession.

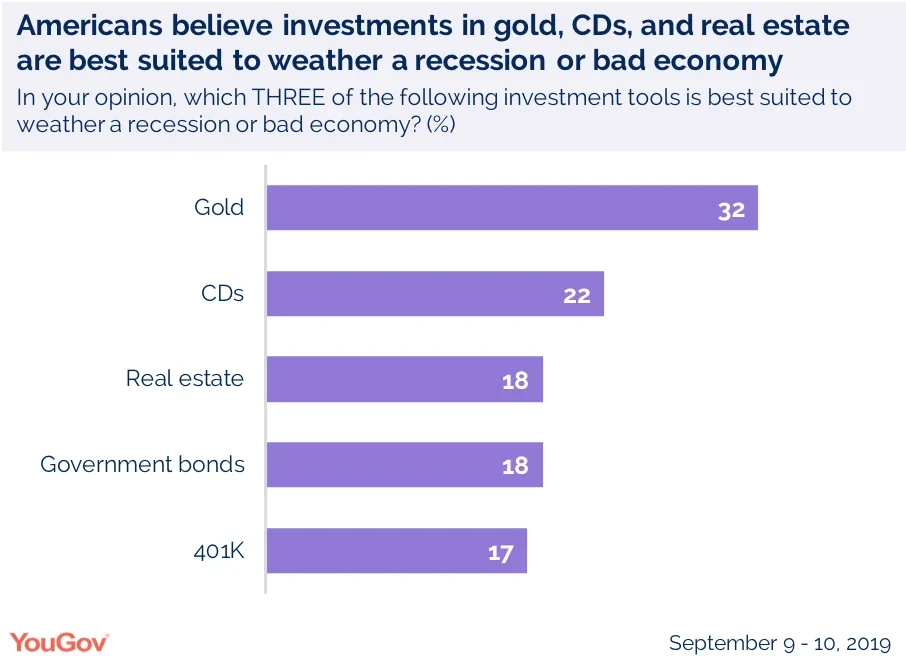

Among US adults, about one-third (32%) believe that gold is one of the investment tools best suited to weather a bad economy. Around one in five say the same of CDs (22%), real estate (18%) and government bonds (18%).

But YouGov’s data also suggests that many Americans may be postponing their investment plans until after 2020.

Nearly half (46%) say they don’t plan to make any investments within the next year. More than one in 10 (12%) say they “don’t know” what they’ll be investing in within the next 12 months, though a similar number (11%) plan to make investments into their 401K.

Related: 81% of Americans are familiar with at least one type of cryptocurrency

Methodology: Total unweighted sample size was 1,239 US adults. The figures have been weighted and are representative of all US adults (ages 18+). Interviews were conducted online between September 9 - 10, 2019.

See the full survey results here.

Image: Getty