This year, the Federal Trade Commission (FTC) has stepped up its enforcement of antitrust laws, bringing major lawsuits against companies including Amazon, Google, and Meta. Recent YouGov polling finds that most Americans support antitrust laws and believe that penalties for violating them should be increased. The vast majority hold negative views of monopolies, and while most believe there is at least some competition within U.S. industries, more than one-third believe it is not enough. Americans are far more likely to believe stricter antitrust enforcement would help the U.S. economy rather than hurt it — and the same holds for views on the effects of stricter enforcement on consumers, workers, and small businesses. Large companies, on the other hand, are more likely to be thought to be hurt by such laws rather than helped.

When asked broadly, most Americans (67%) say it is a bad thing for a single company to dominate a market; just 6% say it is good, 16% say neutral, and 11% aren't sure.

Small companies are generally viewed by Americans as superior to big companies when it comes to their ethics, their treatment of employees, the quality of their products, and their impact on the environment. When it comes to consumer prices, however, Americans say by a margin of two to one big companies charge less than small companies.

While most Americans (65%) say there is at least some competition between companies within U.S. industries, just 23% say there is a "a lot" of competition. How much competition they think there is depends on the industry.

Some of the 10 industries asked about are viewed as highly competitive, particularly the restaurant industry (56% say it has a lot of competition) and the retail industry (47%). Others, such as the pharmaceutical industry (26%) and oil and gas industry (25%) are less likely to be seen as very competitive. Despite recent antitrust cases involving tech companies, many Americans say the tech industry is highly competitive (38%), though somewhat fewer say the same about the social media industry specifically (27%).

Most Americans (69%) strongly or somewhat support antitrust laws, which were defined in the survey as "government regulations of business aimed at preventing monopolies and ensuring fair competition among companies." Just 9% strongly or somewhat oppose antitrust laws. While the highest share of Democrats (83%) are supportive of antitrust laws, majorities of Republicans (62%) and Independents (60%) are also in favor.

While one in three Americans aren't sure whether antitrust laws are too strict or not strict enough, people who do have an opinion are more likely to say current laws are too lenient. A total of 36% of Americans say the laws aren't strict enough, while 24% say they're about right and 6% say they're too strict.

There is more consensus on the effects of stricter antitrust enforcement, with nearly half of Americans believing that more enforcement would help each of the following: consumers, small businesses, workers, and the U.S. economy as a whole. Far fewer say more enforcement would hurt each of these. More Americans say that stricter enforcement would hurt rather than help large companies.

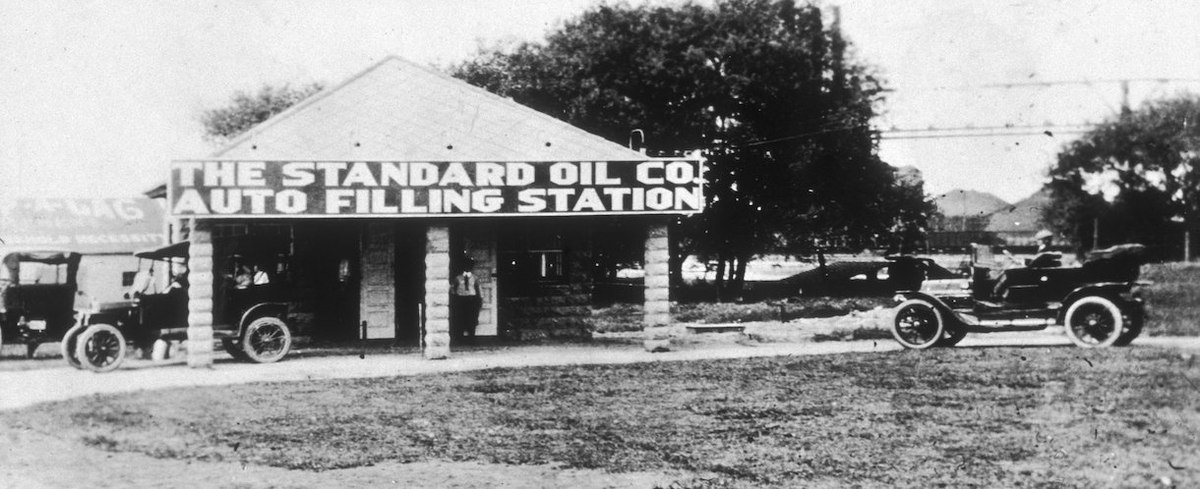

The standards and interpretations of antitrust law have shifted at various points in U.S. history. When the first federal antitrust law was passed in 1890, regulators were primarily focused on how company behaviors would affect the amount of competition within industries. During the late 20th century, emphasis shifted to effects on consumer welfare, and in particular to short-term effects on consumer prices. More recently, however, Federal Trade Commission chair Lina Khan has argued against the consumer welfare standard and suggested a return to earlier approaches focused more broadly on competition, as well as on other factors, such as innovation, the labor market, and long-term prices.

To understand what standards Americans think the government should use in deciding which antitrust cases to take on, the poll asked whether eight factors should be major considerations, minor considerations, or not considered. Of these, Americans are most likely to say that long-term consumer prices (48%) and the quality of goods and services (42%) should be major considerations in antitrust enforcement decisions. Slightly fewer say enforcement should largely be focused on the effects on small businesses (39%), the labor market (38%), the amount of competition (38%), or the variety of consumer choices (36%). Americans are least likely to say major consideration should be given to the effects on short-term consumer prices (31%) or innovation (28%). For each, nearly two-thirds say it should be a major consideration or somewhat of a consideration, and no more than 12% say it should not be a consideration at all.

The survey also asked Americans the extent to which they agree or disagree with six statements about markets and competition. Around two-thirds strongly or somewhat agree that "capitalism needs competition to work" (70%) and a similar share think that "no company should be too big to fail" (67%). Nearly half (46%) think that "the government should break up big tech." Smaller shares agree with the ideas that "regulation harms economic growth" (39%) or that "free markets will naturally correct monopolistic tendencies" (37%); for both of these statements, roughly as many disagree as agree.

— Carl Bialik contributed to this article

See the results for this YouGov poll

Methodology: This poll was conducted online on October 26 - 30, 2023 among 1,000 U.S. adult citizens. Respondents were selected from YouGov’s opt-in panel using sample matching. A random sample (stratified by gender, age, race, education, geographic region, and voter registration) was selected from the 2019 American Community Survey. The sample was weighted according to gender, age, race, education, 2020 election turnout and presidential vote, baseline party identification, and current voter registration status. Demographic weighting targets come from the 2019 American Community Survey. Baseline party identification is the respondent’s most recent answer given prior to November 1, 2022, and is weighted to the estimated distribution at that time (33% Democratic, 31% Republican). The margin of error for the overall sample is approximately 4%.

Image: Getty (Hulton Archive)