A growing number of businesses are shunning cash in favor of digital-only transactions, like credit cards, debit cards and electronic transfer, even though most Americans (55%) still prefer cash, according to YouGov Plan and Track data.

Companies like Dos Toros Taqueria, Dig Inn, Sweetgreen, and Amazon Go stores do not accept cash at their locations. Neither does Atlanta's Mercedes-Benz Stadium.

The reason behind the shift toward electronic-only payments include convenience, security, and speed. By not handling cash, employees are able to focus completely on service.

Some have also inferred a class arguement: Tony Zazula, the owner of the now defunct eatery, Commerce, told Eater that: "If you don't have a credit card, you can use a debit card. If you don't have a debit card, you probably don't have a checking account. And if you don't have a checking account, you probably shouldn't be eating at Commerce to begin with."

Zazula and other business owners that have moved away from cash might be making a mistake. That's because a portion of the so-called Unbanked or Underbanked population bucks the classist label. A segment of this group actually has quite a bit of disposable income, according to YouGov Plan and Track data.

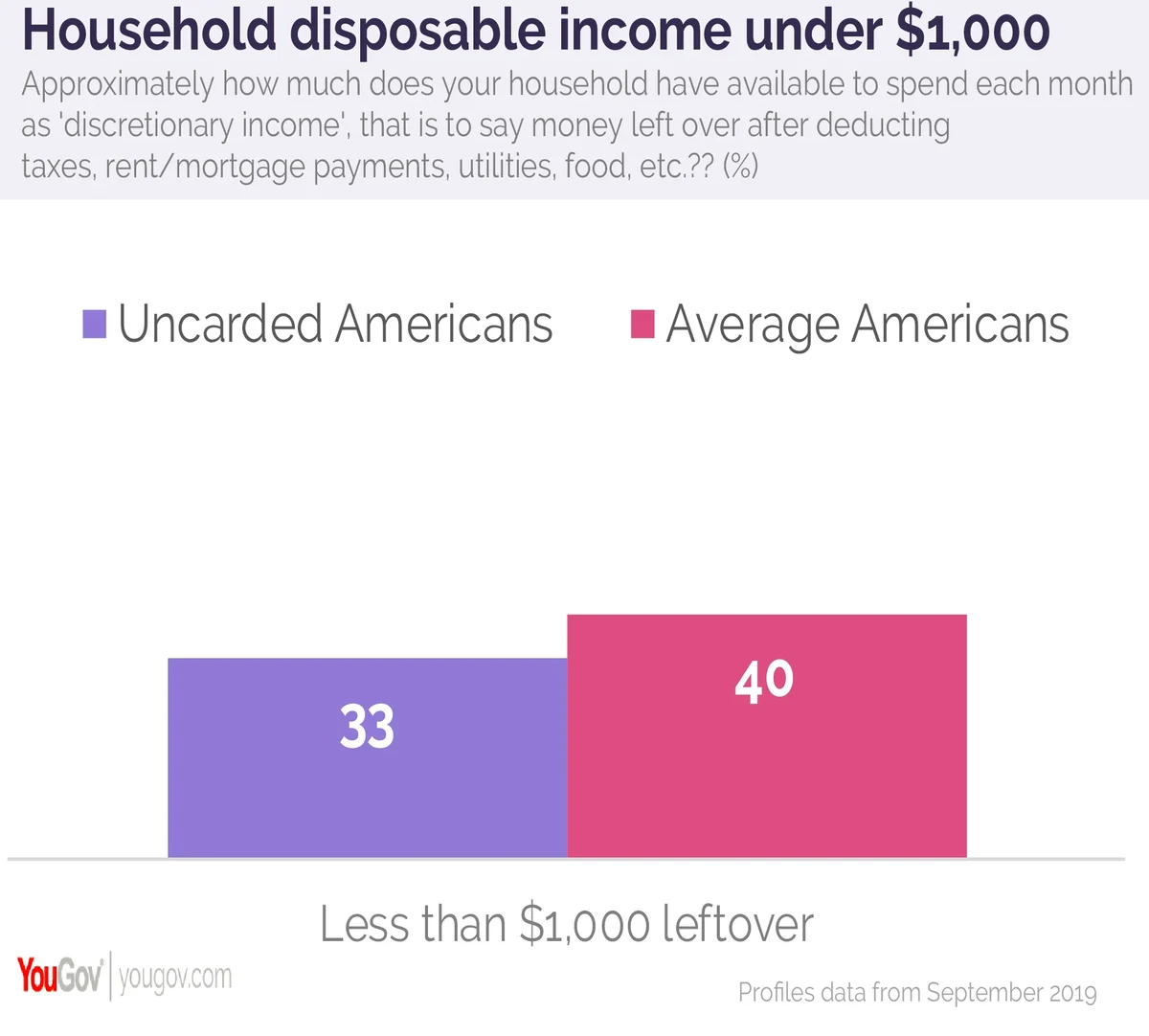

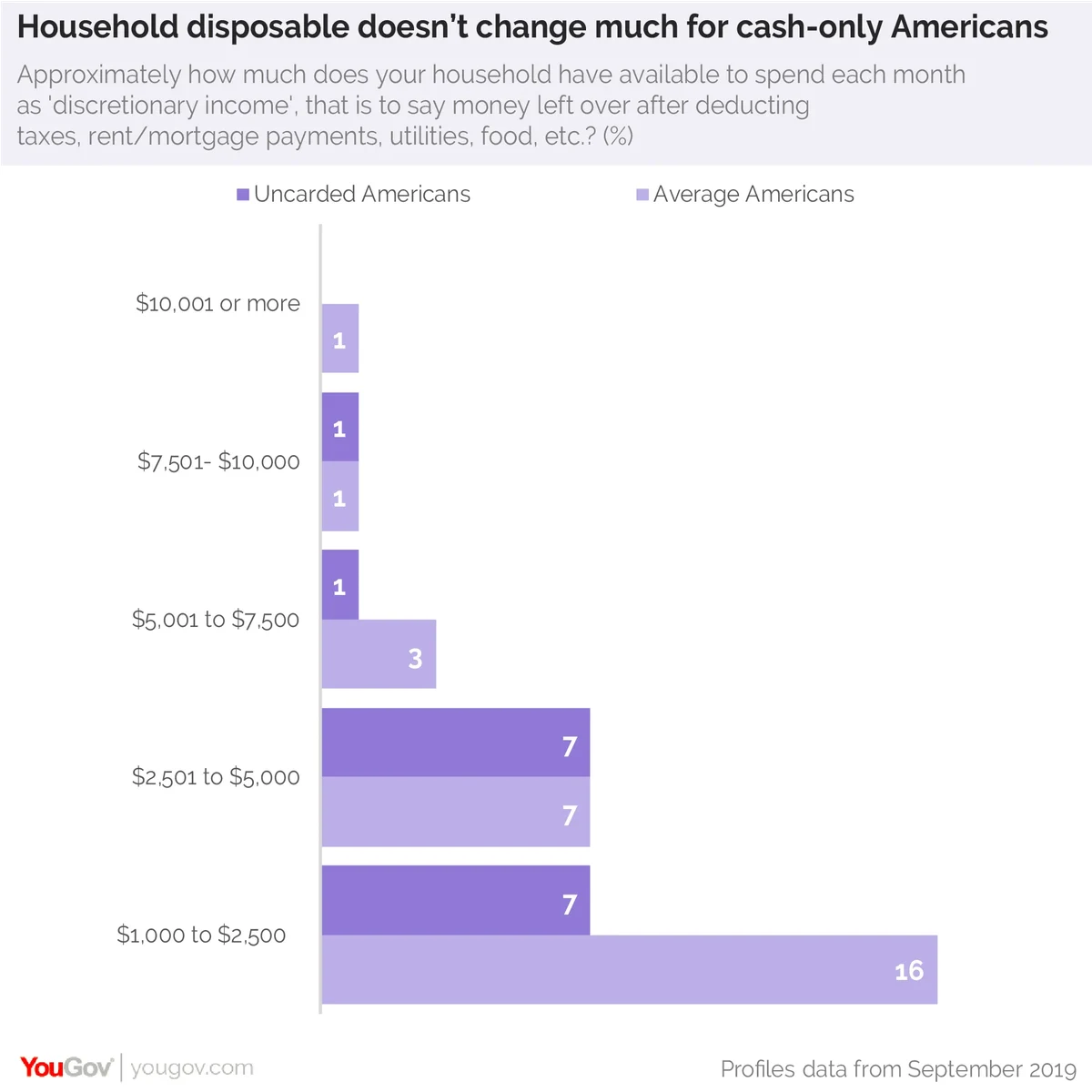

In fact, when compared with the average American on spending cash that's left over after all the bills are paid, cash only shoppers -- those that told YouGov they have no means of paying other than cash -- are more likely to have more than $1,000 remaining for disposable reasons.

But there's more to it than just edging out the average American when it comes to having some spare cash left over each month. This group of cash ony shoppers also lines up well against Americans that have a good amount of money for disposable reasons.

That's right: there's no difference between average American households and the households of cash only shoppers when it comes to having between $2,500 and $5,000 left for disposable reasons. After all the bills are paid, about 7 percent of cash-only shoppers enjoy a healthy amount of left over capital.

Another issue at hand for these businesses that only accept cash is that state and municipal governments are starting to regulate the practice. In 2019, New Jersey Governor Phil Murphy signed a law prohibiting the practice in New Jersey and Philadephia Mayor Jim Kenney did the same in his city. The New York City Council is also considering a ban in 2019.

Some of the businesses that chose cash only, in other words, might not have a choice but to start accepting greenbacks once again. But according to YouGov's Plan and Track data, there's upside to that move in the form of disposable income from the cash only shoppers.