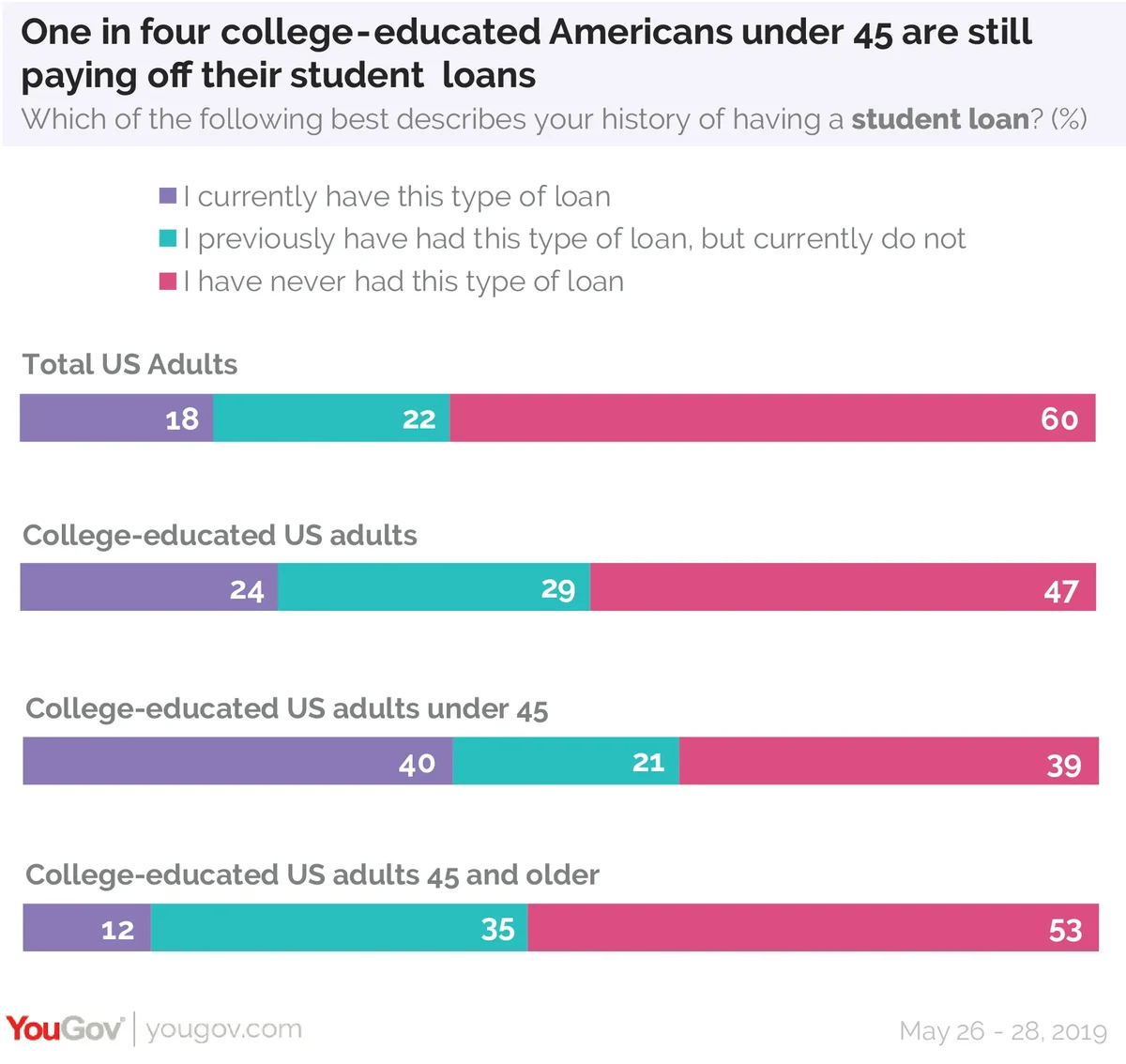

June is the month for graduations, and also the month where graduates have to deal with the debts they incurred in college. There is a lot of it. The total student loan debt has skyrocketed well above $1 trillion. Half of adults with any college education in the latest Economist/YouGov Poll have had student loans; one in four are still paying them off. The student loan situation is especially difficult for those under the age of 45: four in ten of them are still paying off their student loans.

Most of those 45 and older with at least some college took out no loans or have paid them off. Among the college-educated now 65 or older, 70% left school with no student debt; but 5% are still paying off their loans.

One reason the age gap is so large on this question is that as college tuition has risen, it has become harder to pay off debt. The age difference is stark when people are asked about the size of their debt: 56% of those under 30 who had a student loan have (or had) debts of more than $25,000. Three in four of those 65 and older with student debt had debts under $25,000. For half of senior citizens, their debt was less than $10,000. Only 15% of those under 30 can say that.

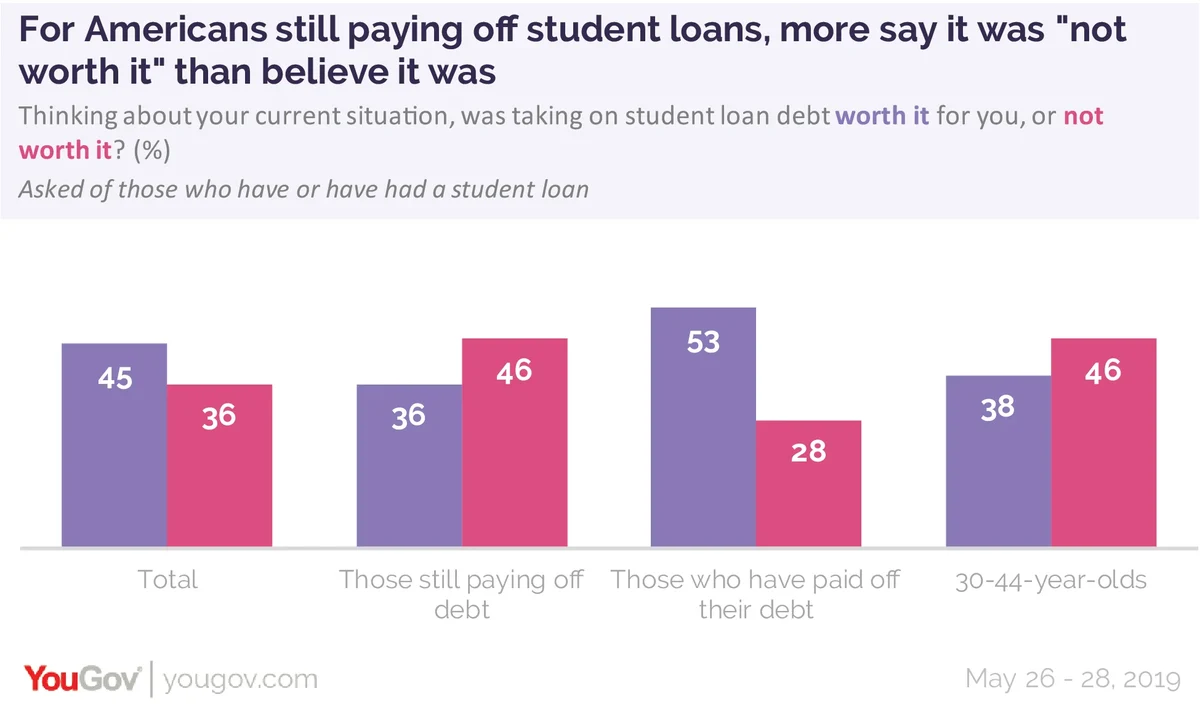

A major question is whether that debt was worth it. For older Americans who experienced student debt, the response is clearly “yes.” Younger adults aren’t so sure. Those between 30 and 44, who have been paying on student debts even longer than those under 30, are especially like to question the value of their student loans.

For the 18% of the population still paying off their student loans, more say it wasn’t worth it than believe it was.

Those 45 and under are far more likely to report that they have suffered financially because of their student loan debt. Three in ten have delayed buying a home, and the same number have delayed buying a car. More than a quarter admit they have moved back in with their parents at least for a time. 15% have delayed having children, 12% say they delayed getting married. Just 27% in this group say they have not had to do any of these things. Among those 45 and older, most who took out student loans have not had to take these actions.

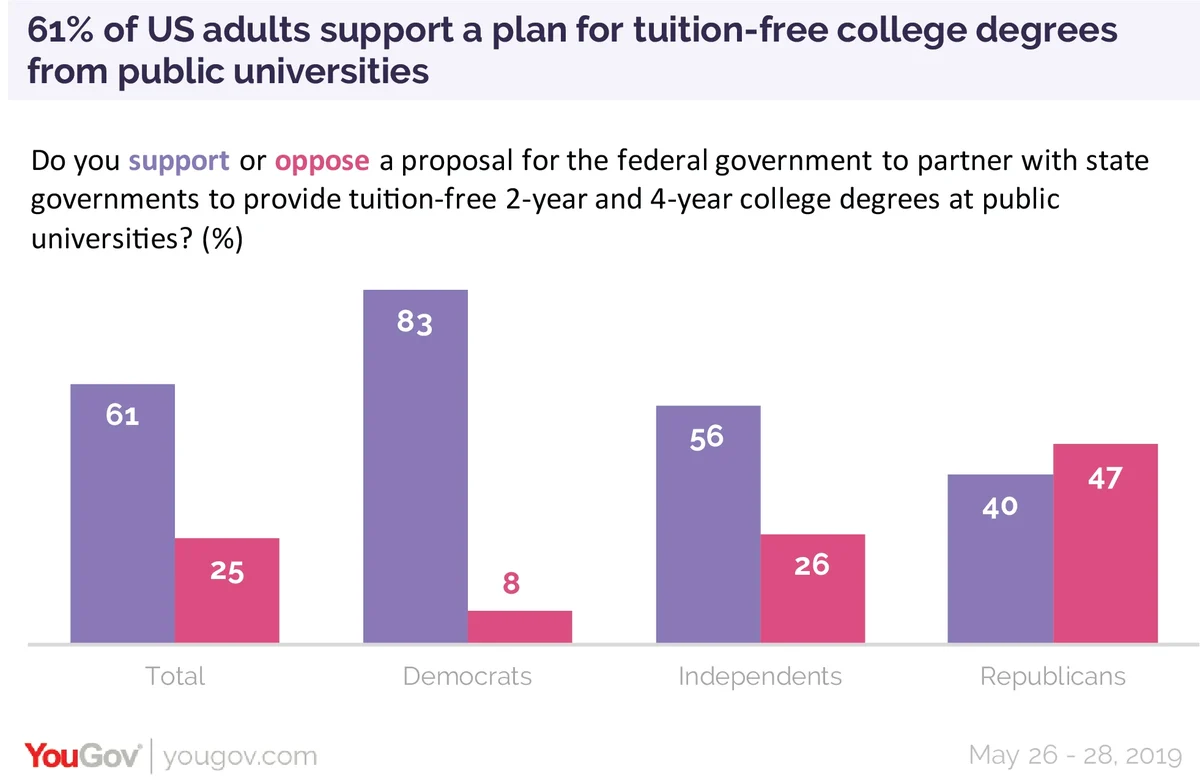

There is a willingness to have the government take responsibility on the student loan debt problem, but there is a party difference in willingness. Republicans are a little less likely than Democrats still to be paying off student loans. 18% of Republicans compared with 23% of Democrats still have debt. Some of that reflects the age differences in the composition of the two parties.

Republicans are far less likely to view student debt as a serious national problem. 47% of Republicans call it “very serious,” compared with 67% of Democrats. The pattern continues even among those who are still paying off student debt: 50% of Republicans in that position call student loan debt a very serious national problem; 84% of Democrats say the same.

Majorities in both parties would cancel student loan debt for disabled veterans, but there is a party split on the question of federal and state governments partnering to make public universities tuition-free. [New York State now provides an income-based version of this: free tuition scholarships to those with family incomes below $125,000 in two- and four-year SUNY and CUNY institutions]

See the full toplines and tables results here

Related: These are the 2020 student debt policies Americans support

Photo: Getty