People are unwilling to see tax deductions go even if they don’t benefit from them

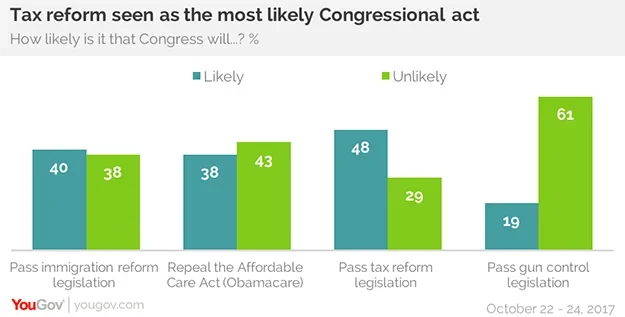

Half of the public expects that Congress will pass tax reform legislation this year – more than think Congress will be able to pass immigration reform, repeal the Affordable Care Act, or take action on gun control. But the latest Economist/YouGov Poll indicates that while Americans would like a tax cut, many aren’t willing to give up two popular tax deductions – for state and local taxes or home mortgage interest – even in order to increase the standard deduction.

Republicans are especially likely to think there will be tax reform – nearly three in four Republicans believe tax reform is at least somewhat likely. They are more hopeful than the public at large that Congress will take action of all sorts, despite their current dissatisfaction with Congress itself and what they see as inaction in the legislative branch.

Americans are also more likely to believe the President has a plan for tax reform than to say he has a plans for health care reform or job creation. He did, after all, present one in a speech last month. Just 35% think Donald Trump has a plan for health care and 42% that he has a plan to create jobs, but 48% say he has a plan for tax reform. But even after his speech, one in three don’t think there is a presidential plan for tax reform.

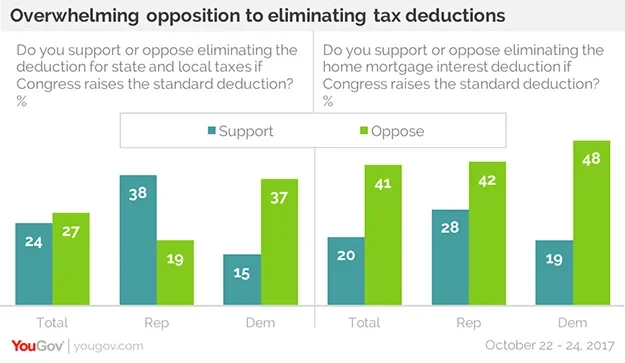

For the last few weeks, since the President’s speech, Economist/YouGov Polls have shown popular support for tax cuts for all – though many of those supporters change their position if tax cuts would increase the federal budget deficit. But there is less support for two changes that have been suggested as part of the tax reform plan – trading deductions for some people in return for an increase in the standard deduction. Nearly half the public doesn’t know whether or not the deductions for state and local taxes should be eliminated as part of the trade off. Those with an opinion are split. There is broad opposition to eliminating the home mortgage interest deduction. Republicans with an opinion are willing to eliminate the deduction for state and local taxes, but they agree that the home mortgage deductions should stay.

There is certainly self-interest in how people view these deductions. Many Americans don’t itemize on their tax returns, choosing instead to take the standard deduction. So they can’t take advantage of these tax breaks. Those with higher incomes are much more likely to itemize.

Those who itemize are not willing to lose those tax advantages. The difference between those who itemize and those who don’t is clear when it comes to state a local taxes. Those who take the standard deduction are divided on whether state and local taxes should be deductible (as is the public overall); those who itemize oppose eliminating that deduction by 44% to 29%.

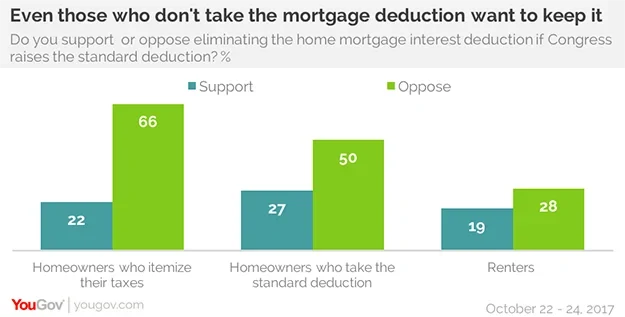

Not all states have state income taxes; many of those who do are Democratic states. But homeowners live everywhere. And home ownership may be a goal even of those who now rent. Opposition to eliminating the mortgage deduction comes from every political group and from both those who have mortgages and those who do not.

Homeowners who itemize oppose eliminating the mortgage deduction three to one. So do homeowners who take the standard deduction, who could see their standard deduction increase if the mortgage interest deduction were eliminated. Those homeowners oppose that change by about two to one. Even renters, who do not and cannot benefit from this deduction, oppose its elimination, though half have no opinion.