The popularity of online streaming has the potential to be a boon for advertisers, but they also have to find ways of reaching consumers who use ad-blockers.

In this YouGov Profiles framework study, we segment Super Streamers into different sub-categories based on whether or not they use ad-blockers and profile the sub-groups. Super Streamers are defined as those who regularly watch two or more paid video streaming services and have at least one paid subscription to a music streaming service.

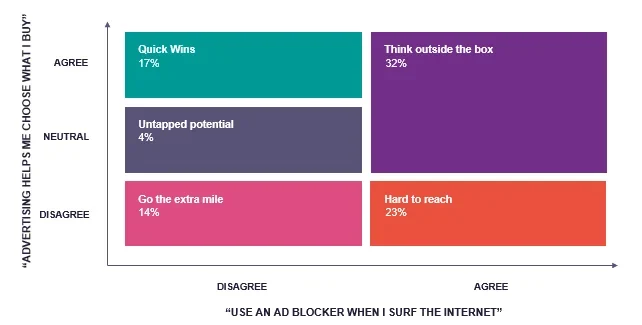

Before we get into the details, let’s define each consumer segment.

Think outside the box: People who use ad-blockers on the internet but either agree that advertising helps them choose products or are unsure about advertising’s effect on their purchase decisions.

Hard to reach: People who use ad-blockers and say advertising doesn’t influence their purchase decisions.

Quick wins: Consumers who say advertising helps them choose products and don’t use ad-blockers.

Go the extra mile: Those who don’t agree that advertising influences their purchase decisions but don’t use an ad-blocker.

Untapped potential: Those who are neutral to the statement “advertising helps me choose what I buy” and don’t use an ad-blocker.

Think outside the box: The reluctance to engage with online adverts, as indicated by their use of ad-blockers, might have something to do with the fact that these consumers tend to get their dose of advertising from print media. About six in ten (62%) say they often notice adverts in newspapers and magazines (vs 44% of all Super Streamers). Additionally, 63% say “Receiving emails directly from brands or companies can influence my purchasing decisions”.

Millennials form a majority in this group, making up 53% of the group (compared to constituting only 32% of all Americans). Five in nine (55%) consumers are male (vs 49% nationally) and 37% of them have children aged under 18 (vs 27% nationally).

Interestingly, four in ten (40%) consumers say, “A music artist’s social channels are the most important place for me to check in on”.

Hard to reach: This group might be the toughest one to crack for marketers, but they make up about a quarter of all Super Streamers (23%). Reinforcing the fact that this group generally tries to block out advertising, about seven in ten say they rarely notice who sponsors an event (71%).

About a third of consumers (33%) from this category are Reddit users compared to a quarter (24%) of all Super Streamers and about half of them get their news from a website not associated with a newspaper (48% vs 39% of Super Streamers).

Men make up about six in ten (58%) members compared to them forming only 49% of all Americans. Millennials are strongly represented too (45% vs 32% nationally).

Quick wins: One in six Super Streamers fall under this category (17%). Members of this group are far likelier than those of the broader Super Streamers category to enjoy watching ads with their favourite celebrities (55% vs 35%).

While the group are easy to reach, they appreciate a little care in an approach; two-thirds of them say “I’m more likely to engage with ads that are tailored to me” (65%).

There is a bigger share of women in this group compared to the national population (54% vs 51%) and almost half the group are millennials (46% vs 32%).

Go the extra mile: While this group denies being influenced by adverts when making purchase decisions, brands do have an opportunity to engage with them on social media. Four in ten (42%) say ‘social networks’ are the main advertising medium that grabs their attention (vs 28% of all Super Streamers).

About three in ten (29%) use Pinterest compared to a quarter of all Super Streamers (25%). They are also 16-percentage points likelier to use Firestick to watch a movie (42% vs 24%).

Women make up 56% of this group as compared to 51% of the national population. A third (33%) of them are Gen Xers (vs 28% nationally).

Untapped potential: This group makes up only 4% of the overall Super Streamers category but could still be an inviting one for marketers as they are sitting on the fence when it comes to whether or not advertising influences their purchase decisions.

37% of them describe themselves as heavy film watchers compared to just a quarter of all Super Streamers. Four in nine (44%) get their news from websites that aren’t linked to newspapers (vs 39% of Super Streamers). They are also slightly likelier than other Super Streamers to be Facebook users (76% vs 72%).