Data suggests that the struggling mid-market retailer might be better off aiming for either high- or low-income consumers

The past holiday season wasn't merry for Macy's. Earlier this month, the retail giant announced a decline in sales for November and December. On the same day, it also reported plans to close 68 locations across the country, from Florida to Washington to Oklahoma. Shares dropped by 14%.

By now, it's hardly news that America's brick-and-mortar retailers are struggling to attract shoppers, who increasingly spend their time and money online. But there are exceptions. Various reports show that the off-price retail chain TJ Maxx, which offers brand names and designer fashions at discount rates, is doing well. Indeed, TJ Maxx's parent company, TJX Companies, Inc., which also owns the off-price retailer Marshalls, among other brands, has seen its stock rise quite steadily since the financial crisis.

New data from YouGov Profiles illustrates the extent to which Macy's is wedged between off-price retailers such as TJ Maxx and higher-end shops such as Bloomingdale's (also owned by Macy's, Inc.), and why that might not be such a good thing given the current economic climate.

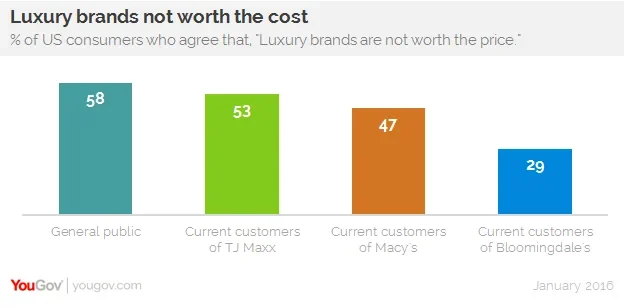

When asked if they agree or disagree with the statement, "Luxury brands are not worth the price," 47% of Macy's current customers (i.e. customers who've purchased items from the department store in the past three months) agreed. Meanwhile, more than half of TJ Maxx customers agreed (53%), compared to just 29% of Bloomingdale's customers.

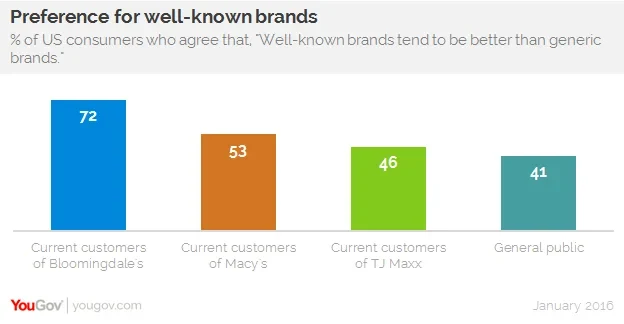

When asked if well-known brands tend to be better than generic brands, the order of agreement flips. Now the vast majority of current Bloomingdale's customers agree (72%), while the same is true for only a minority of TJ Maxx customers (46%). Just like the previous question, Macy's customers once again place themselves neatly between the two other retailers (53%). It's also worth noting that the average American's opinion, as denoted by "General public," always ends up closest to TJ Maxx customers and farthest from Bloomingdale's customers.

With the shrinking of America's middle class, market forces are shunting consumers into either higher or lower income brackets. As Fortune put it back in 2015, "Middle of the road isn’t such a great place to be if you’re a retailer. Just ask Macy’s."

Macy's is heeding the advice and currently investing in both ends of the market. On one hand, the retailer plans to open approximately 50 locations of its own off-price brand, Macy’s Backstage, over the next two years. On the other hand, the Wall Street Journal reports that Macy's intends to push its best-performing stores upscale by introducing higher-end merchandise and removing clearance goods.