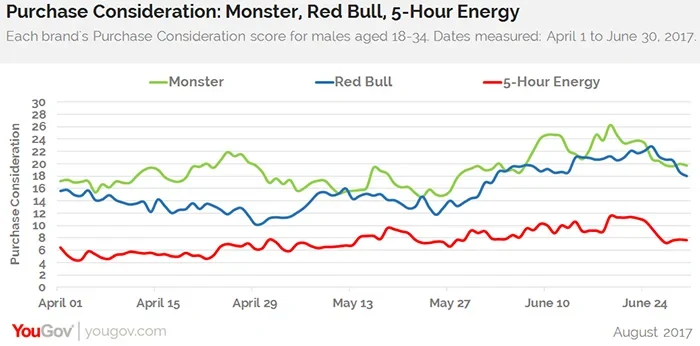

Between April and June, Monster has also maintained a higher consideration score than rivals Red Bull and 5-Hour Energy

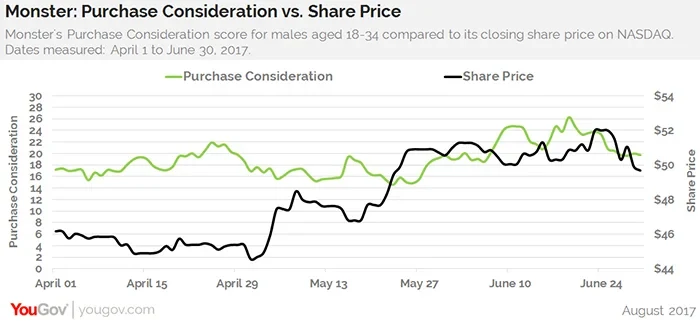

As the Monster Beverage Corporation prepares to release its Q2 earnings, data from YouGov for Traders shows a slight correlation between the company's share price and purchase consideration score for the Monster energy drink among American males aged 18-34, the brand's primary demographic.

Between April 1 and June 30, the share price rose 7.6%, from $46.17 to $49.68, while purchase consideration for the Monster brand grew 14.5% among young men.

In early May, share prices began to climb after the Monster Beverage Corporation released Q1 results, highlighting a 9% increase in net sales to $742 million from $680 million during the same period last year. But both share price and purchase consideration dipped in May after news broke that a South Carolina teen died from consuming an excessive amount of caffeine. The event led to opinion pieces condemning the caffeine-fueled beverages, such as one published in the Washington Post entitled "Energy drinks are killing young people. It’s time to stop that."

At the same time, purchase consideration for Monster has largely remained higher than rivals Red Bull and 5-Hour Energy among males aged 18-34 throughout April, May, and June. Warmer summer weather might have also played a role in the slight bump for all three brands in the latter half of the quarter.