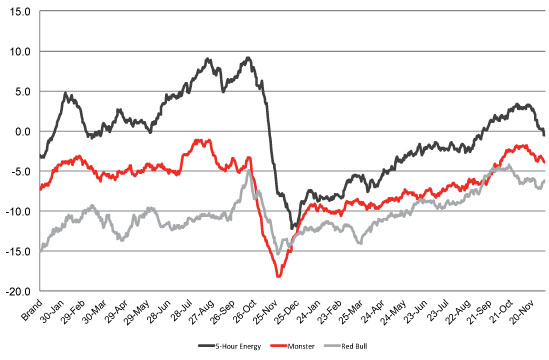

After consumer perception for the entire sector took a big hit in the fall of 2012 over reports linking 5-Hour Energy drinks to 13 deaths, not only has the sector rebounded but purchase consideration – one indicator of future sales – has gradually risen with it.

A change in marketing direction for two of the brands, along with a quiet year so far with lawsuits and negative reports, may have helped facilitate the comeback. While consumer perception has swung back this year, it has still not recovered to levels seen in the first half 2012.

5-Hour Energy was the best perceived brand in the category when the FDA broke their report in November 2012, and has experienced a faster rebound than its rivals, Monster and Red Bull. This year, 5-Hour Energy swapped its TV cowboy sheriff spokesperson for charitable themes: the company posted more than 20 “5-Hour Energy Helps Amazing People” videos, and a recent spot announcing a portion of the proceeds from its new raspberry-flavored energy drink will go to Living Beyond Breast Cancer pulled in four million views in a week.

Monster recently declared itself a “category innovator” to Beverage Digest, citing its introduction of Muscle Monster energy shakes and Monster Ultra Blue, and even proposing voluntary guidelines for the marketing of energy beverages.

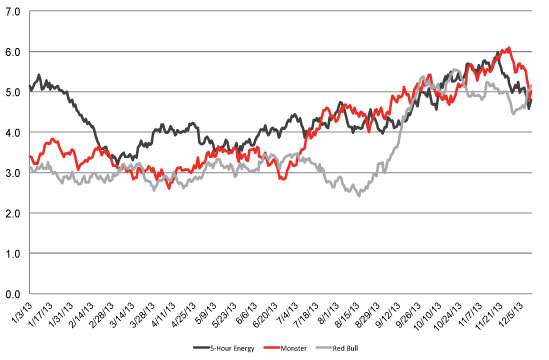

From mid-September through early November, energy drink purchase consideration for 5-Hour Energy, Monster and Red Bull rose closely together, indicating potential sales increases across the board. Monster Beverage Corporation CEO Rodney Sacks told a conference call that recent Nielsen data showed that his company’s sales were up more than 9%.

5-Hour Energy, Monster and Red Bull were measured using two YouGov BrandIndex scores: Buzz, which asks respondents "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?"; and Purchase Consideration, which asks "When you are in the market next to purchase items in this particular category, from which of the following brands would you consider purchasing?”

YouGov BrandIndex’s Buzz scores range from 100 to -100 and are compiled by subtracting negative feedback from positive. A zero score means equal positive and negative feedback.

Purchase Consideration is measured as a range from 0 to 100%.

Buzz: 5-Hour Energy, Monster, Red Bull

Purchase Consideration: 5-Hour Energy, Monster, Red Bull