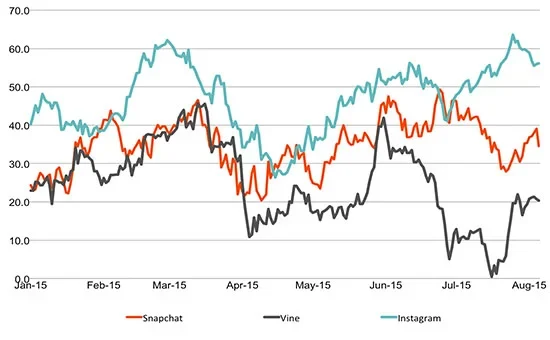

The hot perceived brand for millennials is photo/video sharing app Instagram, which has been breaking out of the pack over the past two months, while Snapchat has held steady and Vine has had a rocky road.

In mid-July, Instagram hit its highs for the year in both buzz and satisfaction metrics for adults 18 to 34, after spending the late spring pulling ahead of its rivals Snapchat and Vine.

To understand just how well Instagram has done with millennials lately, let’s compare scores among millennials who are aware of each brand.

Buzz and Satisfaction are both measured on a range from 100 to -100 with a zero score equaling a neutral position. For Buzz score, respondents are asked "If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?"

On July 19, Instagram reach its new Buzz score high for the year with millennials at 33, meaning 33% more millennials had a favorable view of Instagram than non-favorable. On that same date, Snapchat’s score was one third of that (11) – while Vine trailed with a 7 score.

However, Snapchat and Vine have switched places since that date – Vine is currently at 12, Snapchat at 7, while Instagram maintains its lead with a score of 30.

To measure Satisfaction, millennials were asked "Are you a satisfied customer?" Instagram’s Satisfaction score peaked on July 25th at 64, while Snapchat was half that at 31, and Vine further behind at 20.

Snapchat jumped up to 38 recently, perhaps reflecting new Snapchat Discover design tweaks and the addition of new content partners Buzzfeed and iHeartRadio.

Instagram has been significantly ahead of both Snapchat and Vine all year long in terms of millennials who report having visited these services over the past 30 days, also known as YouGov BrandIndex’s “Current Customer” metric. However, Instagram has been cooling down a bit on this metric after coming off a June – July elevated run, and Snapchat has been on the upswing since mid-June.

Currently, 37% of millennials have logged on to Instagram over the past 30 days versus 29% for Snapchat and 15% for Vine. Snapchat and Vine spent the first quarter of this year in a neck and neck tie at around 19% until Vine subsided in April.

Satisfaction: Snapchat, Vine, Instagram

Buzz: Snapchat, Vine, Instagram

.jpg)