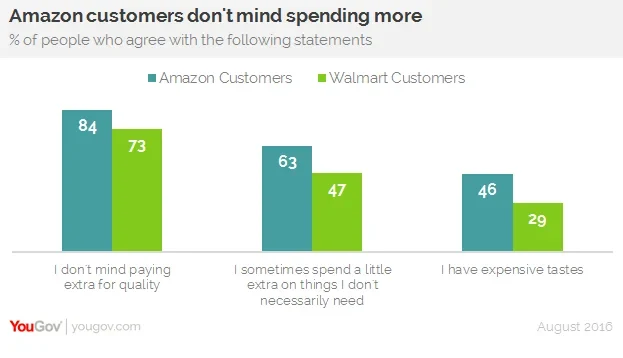

Data reveals that 46% of Amazon customers say they have expensive tastes, compared to just 29% of Walmart customers

Earlier this month, Walmart announced plans to buy the e-commerce startup Jet.com for $3.3 billion in cash and stock. As the Wall Street Journal rightly noted, the deal is a clear sign that Walmart, once the undisputed giant of retail, is growing more and more concerned about Amazon and the gradual shift toward online shopping.

Since Jet.com launched last summer, the company has quickly gained a reputation for its low prices on everything from men's watches to laundry detergent to a case of multi-colored Gatorade. Indeed, report after report suggests that Jet offers even cheaper rates than Amazon — a business founded on the idea of undercutting the competition. Although Walmart intends to run Jet.com and Walmart.com as separate entities for the foreseeable future, the new acquisition is likely to appeal to Walmart customers, who, even more than Amazon customers, tend to hunt for bargains.

While an analysis of customers who shop at both Walmart and Amazon might provide some valuable insights into the future of retail, data from YouGov Profiles is able to pinpoint Amazon customers who don't shop at Walmart, and Walmart customers who don't shop on Amazon. Using these two distinct groups of shoppers to better understand their key points of differentiation, the data shows that current Amazon-only customers are more likely to be younger, richer, and browse online for various homeware goods than current Walmart-only customers. Crucially, the Amazon crowd also shows less concern for price. Less than half of Walmart patrons, for example, admit they sometimes spend a little extra on something they don't necessarily need, while the same is true for over 60% of Amazon customers. Meanwhile, 46% of Amazon customers say they have expensive tastes, compared to just 29% of Walmart shoppers.

Examples of this different approach to price abound. 40% of Amazon shoppers, for instance, are willing to pay more for luxury brands, while only 28% of Walmart patrons feel the same. Amazon customers are also more likely to both buy some brands without even looking at the price and choose premium products and services over other options available. Walmart customers, on the other hand, are more likely to shop on a strict budget and look for the lowest prices.

The evidence suggests that Walmart is right to anticipate a future where more shoppers make purchases from home, while those still cruising store aisles for merchandise whip out their smartphone to see how much they'd save by buying the same item online. That makes the Jet acquisition a good move — remembering, of course, that the devil is in the execution. What makes it a potentially great move is that it's likely to help carve out a niche online space that appeals to Walmart's price-sensitive customer base, thus giving the retailer a differentiating edge in a crowded online marketplace.