This is the latest installment in a series that delves into insights from the YouGov Affluent Perspective 2018 Global Study. Each year, we study the lives, values, and shopping habits of the world’s most successful households. This piece spotlights the “Wealthy” – an estimated 500,000 U.S. households who count themselves among the most affluent – the top 0.1%.

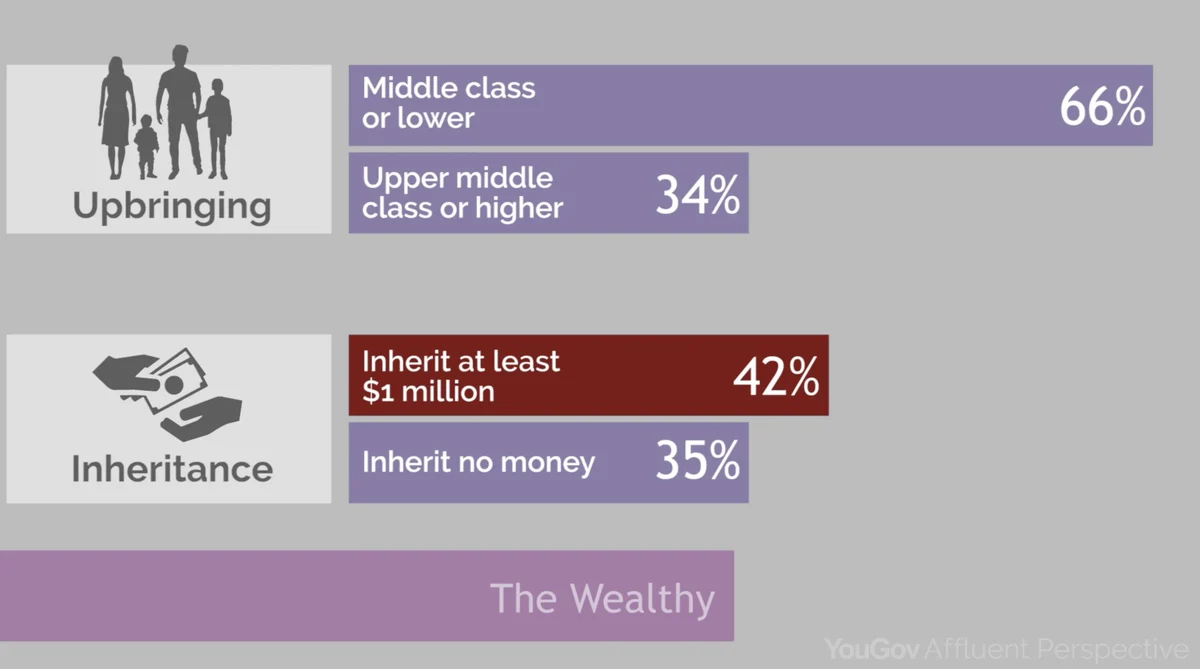

On average, the Wealthy earn annual household incomes of $1.4 million. On top of this, they’ve accumulated personal assets of $19 million, with a majority of the Wealthy building these fortunes on their own. Sixty-six percent of the Wealthy grew up in middle-class or lower households and 35% expect to receive little or no inheritance.

These newly moneyed elites describe themselves as intelligent (72%) and practical (61%), which is evident in how carefully they manage their personal finances – 84% agree “my family has never been more economically healthy than we are right now”. Nearly all (93%) agree that they’re on top of their finances. Yet despite their great wealth and upscale lifestyles, they continue to save, on average, 44% of their income.

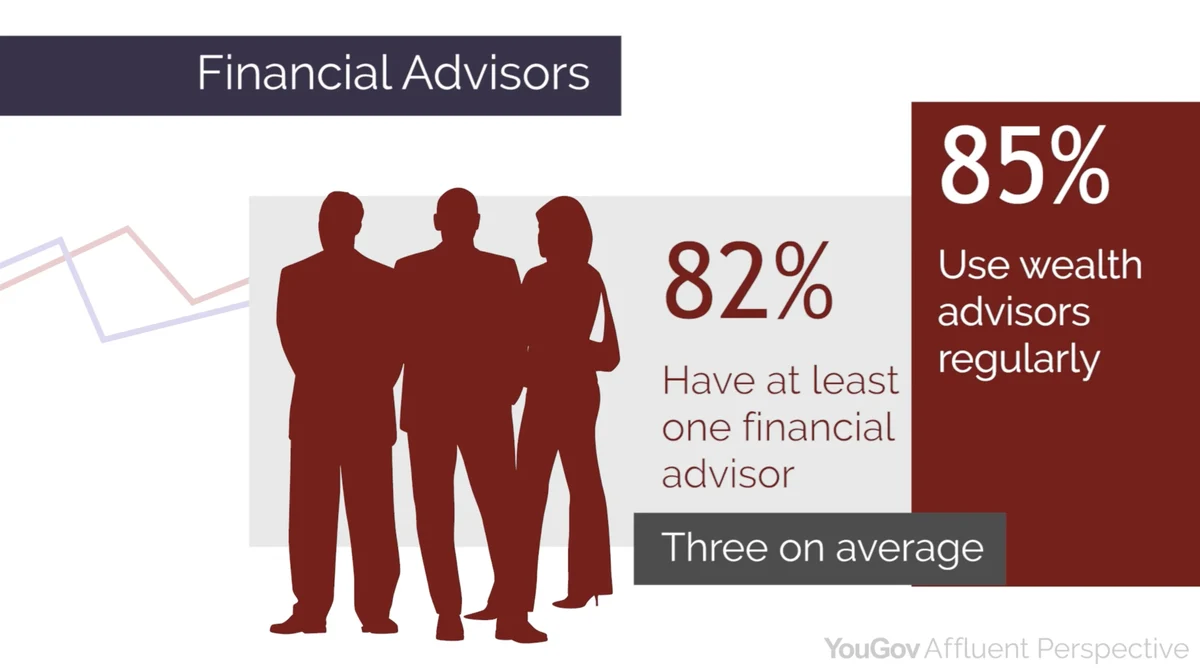

Both self-made and self-reliant – 85% percent of the Wealthy agree that it’s important to be self-sufficient in their finances. Yet the vast majority also work with a financial advisor (82%), and do so on regular basis (85%). In fact, the average number of advisors they work with is three.

What are the qualities the Wealthy look for in their financial advisors? These are the top three: an engaged listener, a forthright communicator, and a proven record of success.

Seventy-seven percent of the Wealthy agree that “professional advisors often give me better results than when I pick investments on my own”. It should be no surprise then, that 91% agree that financial advisors will always have a role in the management of their wealth.

Learn more about Affluent Perspective.

Image: Getty