The public puts the figure somewhere between $90,000 and $100,000

"Rich" and "poor" are universally understood concepts, but how much (or little) money do you actually have to be earning to fall under either category? Technical definitions of affluence or poverty often focus on relative income - i.e. whether or not someone is in, say, the top 5% of earners - rather than the specific amount being made, which doesn't really match the way regular people think about the subject.

Understanding where the public think that “rich” and “poor” lie on the income scale has an obvious importance for helping politicians formulate policies that they want to impact higher and lower earners differently: for instance, where to set income tax brackets, or at what point someone should no longer be eligible for certain welfare programs.

But it can also tell us a lot about society, which is why YouGov has explored the public’s views on where the lines for rich and poor lie.

How much money do you need to earn a year to be considered rich? And how little must someone earn to be considered poor?

YouGov put a range of income levels to the public and asked whether or not a person making that much money was rich, poor or neither.

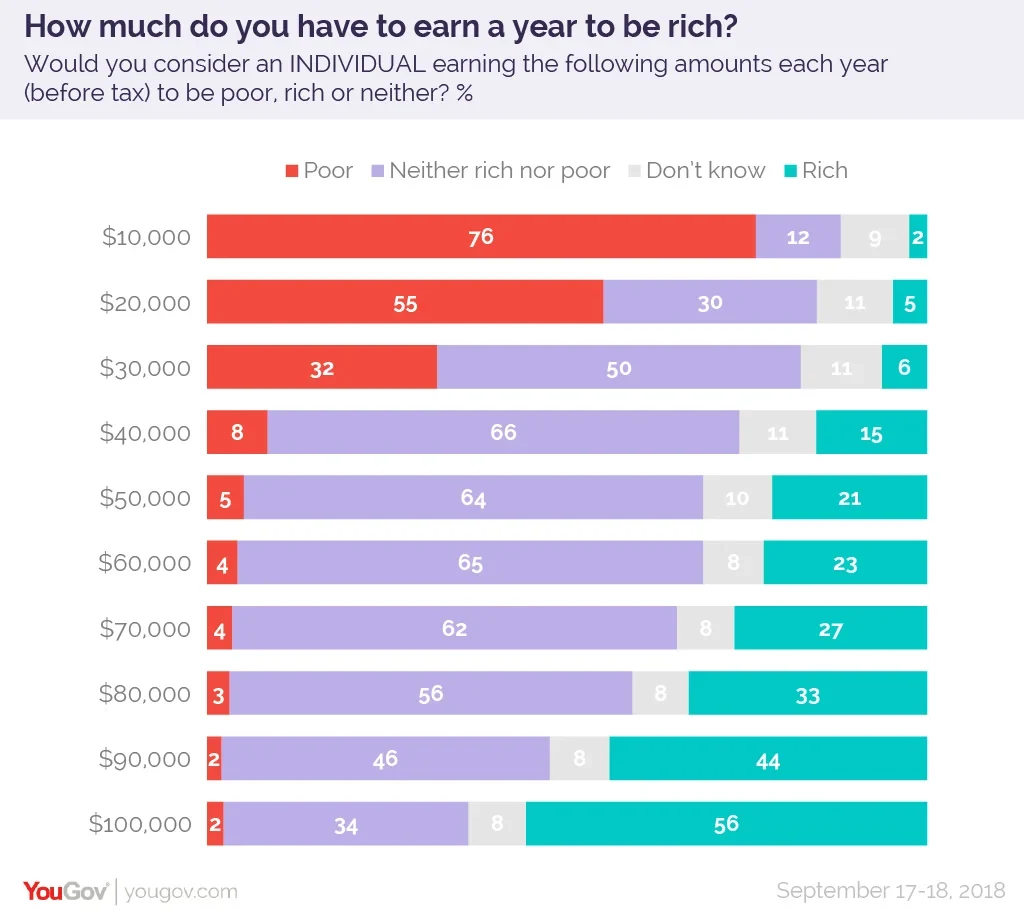

The point at which most Americans think you’ve escaped being poor comes at around $30,000. Half of the population (50%) believe someone on $30,000 a year is “neither rich nor poor”. One in three (32%) still consider them poor, however, and only 6% think that they are rich.

The level of income at which most Americans begin to consider someone rich clearly rests between $90,000-$100,000 dollars. People are divided on whether a person on $90,000 a year is “neither rich nor poor” (46%) or “rich” (44%). At $100,000 opinion has tipped much more strongly towards “rich” at 56%, with only one in three (34%) believing someone with an income this high to be “neither rich nor poor”.

Income milestones and tax thresholds

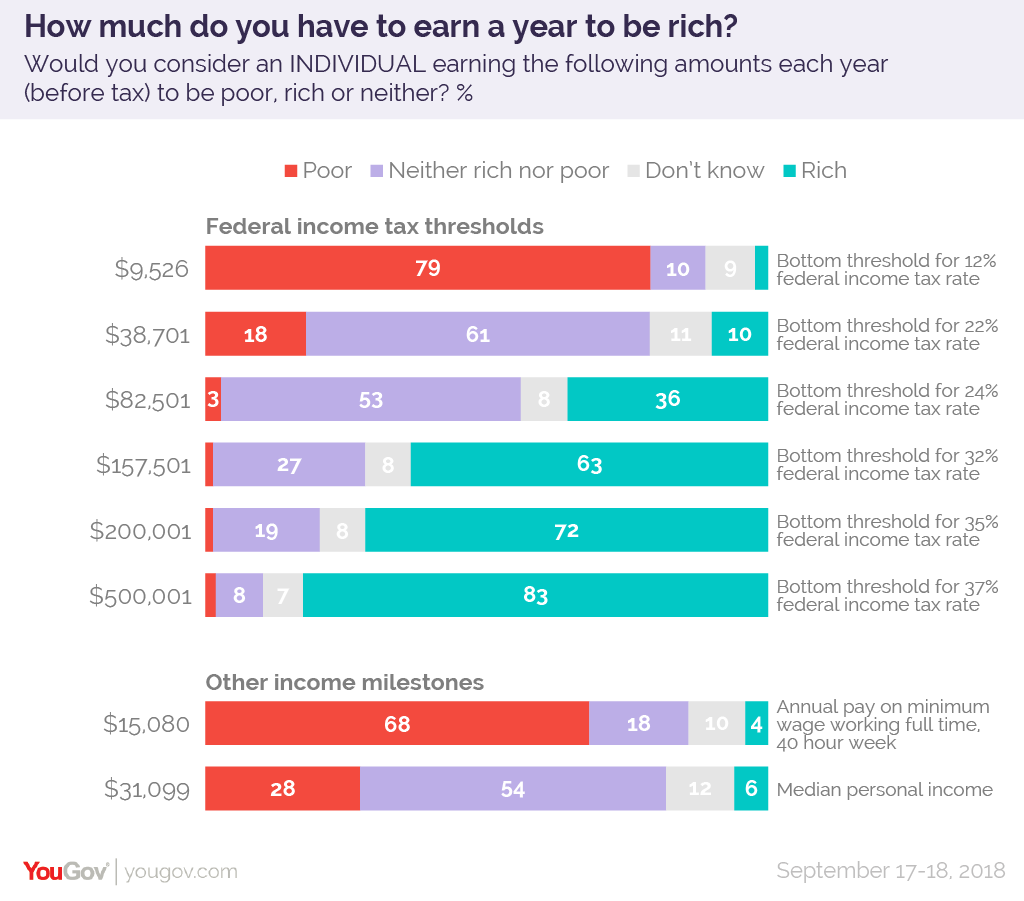

As perceptions of rich and poor could be so important in informing tax policy, we also tested attitudes to incomes at the entry point of each federal income tax bracket. Similarly, given that the aim of minimum wage legislation is to guarantee a minimum acceptable living standard, we have also examined how Americans see both the minimum wage rate and the average income.

12% tax rate ($9,526) Once someone earns $9,526 a year they become eligible for the 12% rate of income tax. Someone earning this much is considered poor by close to eight in ten Americans (79%).

Minimum wage ($15,080): Assuming that they worked a 40 hour week, a person working full time on the minimum wage would make $15,080 a year and be considered poor by two thirds (68%) of Americans, and neither rich nor poor by a further 18%.

Average income ($31,099): According to the US Census Bureau, the median annual personal income in the US in 2016 was $31,099. The majority of Americans (54%) consider someone earning this much each year to be “neither rich nor poor”. Three in ten (28%) would still believe them to be poor.

22% tax rate ($38,701) The 22% tax bracket doesn’t kick into until someone is earning at least $38,701 a year. Most Americans (61%) consider earning this amount makes them neither rich nor poor. One in five (18%) still believe them to be poor, while 10% now consider them rich.

24% tax rate ($82,501) At $82,501 a person qualifies for the 24% tax rate. A majority of people still think someone earning this much is neither rich nor poor, but the proportion who consider them poor has dropped off to just 3%, while the number who believe them rich has risen to 36%.

32% tax rate ($157,501) Now the majority of Americans (63%) consider someone earning this much to be rich, with only one in four (27%) still believing them to be neither rich nor poor.

35% tax rate ($200,001) The next tax bracket up takes effect once someone starts earning $200,001. By this point, almost three-quarters of Americans (72%) believe a person has moved into the rich category, but one in five (19%) still think they are neither rich nor poor.

37% tax rate ($500,001) The highest rate of income tax kicks in once someone is earning $500,001. Earning just over half a million dollars a year makes you rich to 83% of Americans, while only 8% think they are still categorized as neither rich nor poor.

How rich or poor do Americans consider themselves to be?

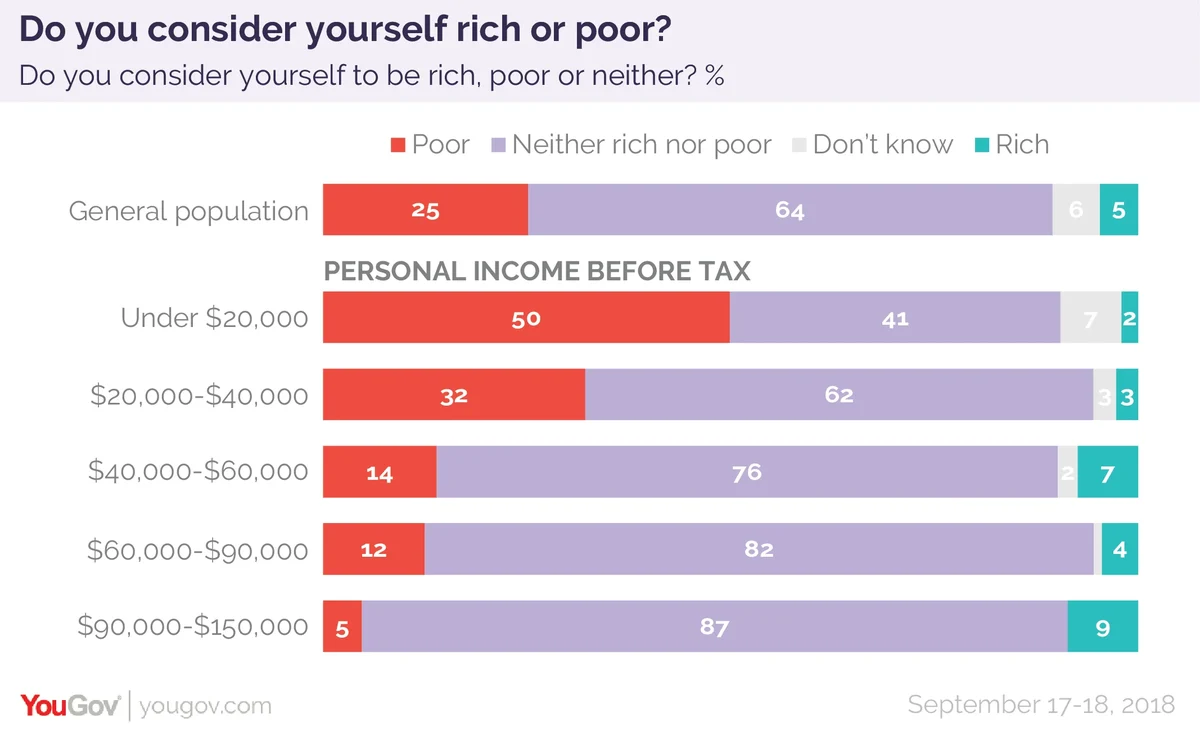

We also asked whether Americans considered themselves to be rich or poor. Overall, the majority (64%) think they are neither. One in four Americans (25%) believe themselves to be poor, whilst just 5% think themselves rich. (A final 6% don’t know).

These are not objective measures of course – it may well be the case that many people who are technically poor do not consider themselves so because of the negative connotations associated with the term.

What is perhaps more interesting here is that, although people become less likely to consider themselves poor the more money they make, they don’t really become much more likely to consider themselves rich. For instance, the proportion of people considering themselves rich rises from 2% of those earning under $20,000 a year to only 9% of those on $90,000-$150,000 a year.

This effect has been observed previously. In America, Richard Reeves, of the Brookings Institute, has described the “Me? I’m not rich!” problem whereby most people – even if they are making a lot of money – tend to think that they are not rich and that the point where someone becomes “rich” is always at a higher earning level than they themselves are on.

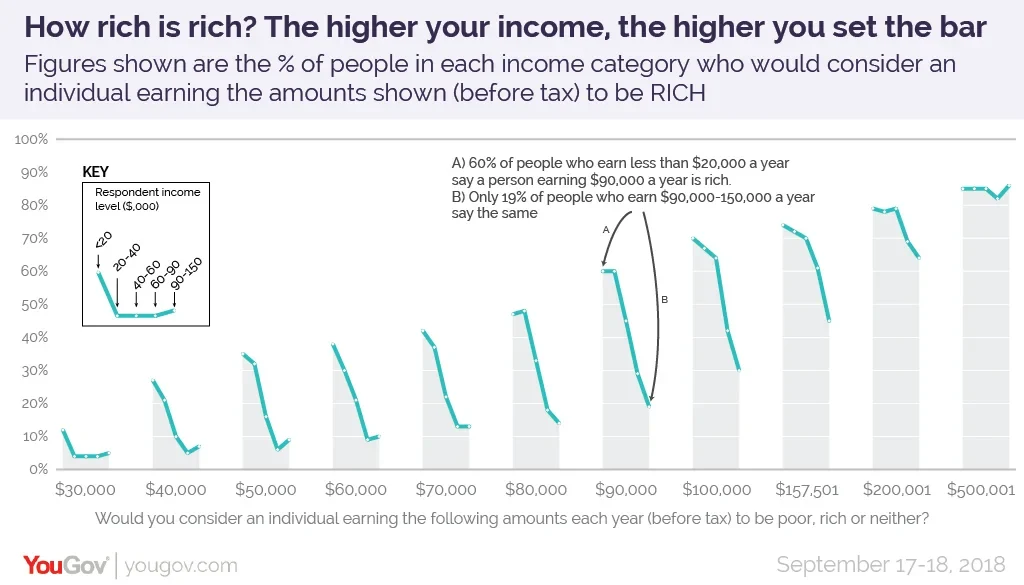

The results of the survey bear this out. The higher an income someone is on, the less likely they are to say that earning a certain amount makes a person rich. For instance, while 60% of people with an income of below $20,000 a year would consider someone on $90,000 a year to be rich, this figure falls to 45% of those whose annual income is $40,000-$60,000 and just 19% of those earning $90,000-$150,000 a year.