[This analysis is a part of a larger YouGov report on property and casualty insurance providers. Download the full report here]

Travel insurance provides travelers with the peace of mind for things like being reimbursed for trip cancellations or protection from extensive medical expenses while out of the country. Purchasing a travel insurance policy can decrease the risks that come with traveling for business or leisure.

Who has a travel insurance policy?

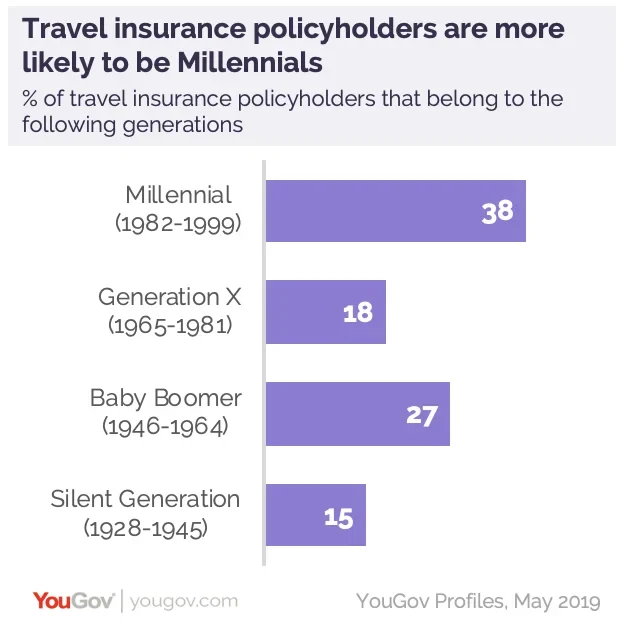

Today, 3 percent of Americans say they are covered by a travel insurance policy. Those with travel insurance are more likely to be Millennials: 38 percent of these policy holders fall between the ages of 23 and 38. Baby Boomers make up the next largest share, with 27 percent, followed by Generation X (18%), and the Silent Generation (15%).

Travel insurance policy holders are also more likely to come from households that make over $60,000 a year (57% vs. 34% of Nat Rep) and 33 percent say they are a parent of children under the age of 18 (vs. 27% of Nat Rep).

This type of insurance may only target a certain type of consumer, but YouGov data reveals that 64 percent of Americans say they intend to go on a vacation in 2019. Prospective leisure travelers represent a market of 160 million individuals that potentially need travel insurance.

Why travelers choose to take out–or not take out–travel insurance

Among leisure travelers who took out a travel insurance policy on their last trip, 52 percent opted for a policy that covers trip cancellations. At least three in ten in this same group say they took out travel health insurance (35%) or accident insurance (30%) policy. An additional one in five (22%) say they took out a curtailment policy, which reimburses travelers that have to cut their trips short to return home, and 16 percent took a third-party policy that covers liability.

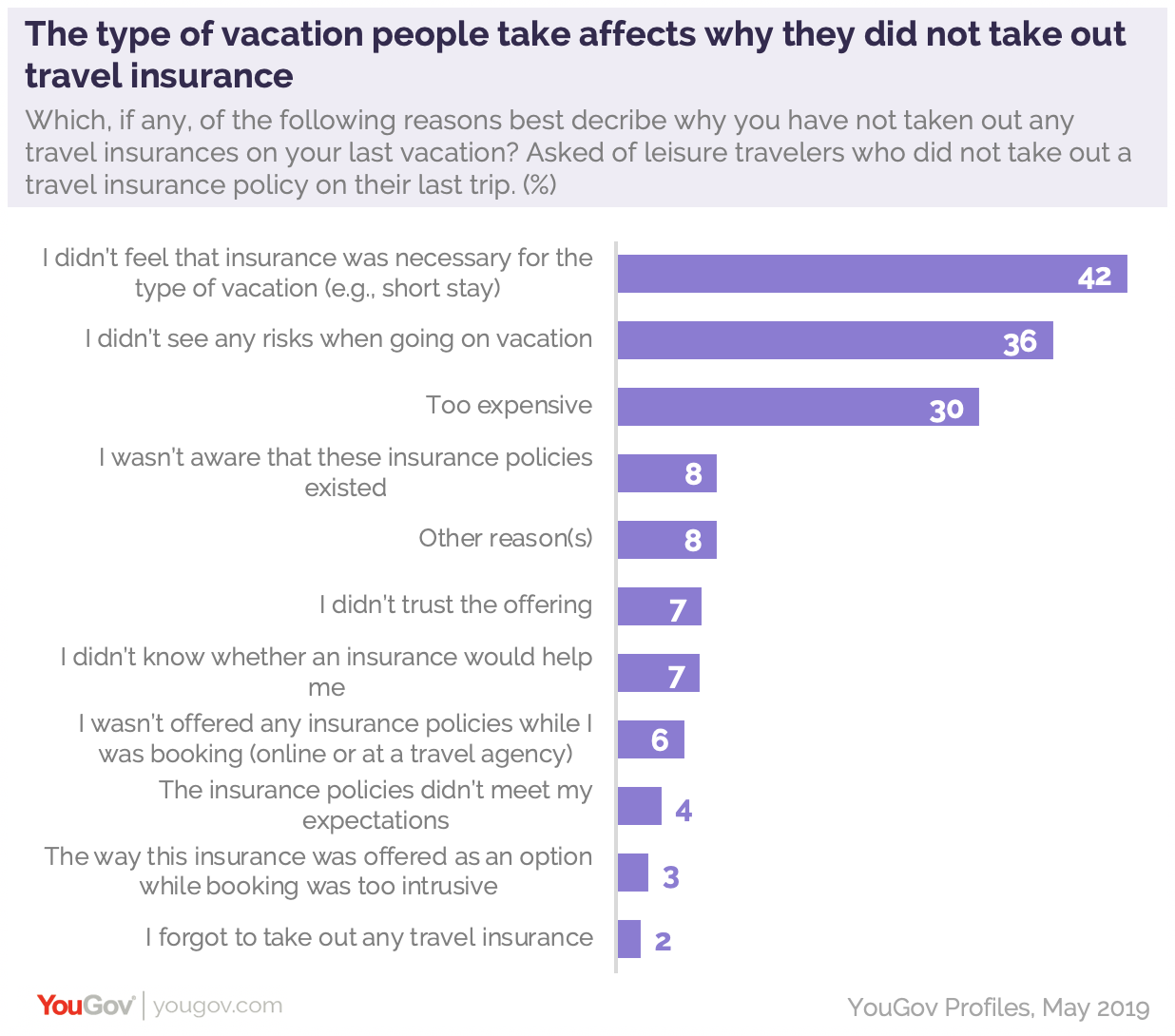

Among leisure travelers who did not take out travel insurance on their last trip, 42 percent say it was because they didn’t consider it necessary for the type of vacation they were taking. Similarly, over a third (36%) in this same group say they didn’t see any risks when going on vacation. Increasing demand for travel insurance, then, comes down to helping prospective travelers identify the things that have or can go wrong while traveling. Customer testimonials, as an example, can be a powerful way to shape the narrative as to why people shouldn’t travel without travel insurance.

Identifying marketing opportunities

Insurance providers that understand how and when to reach these travelers may have the most success at winning them over.

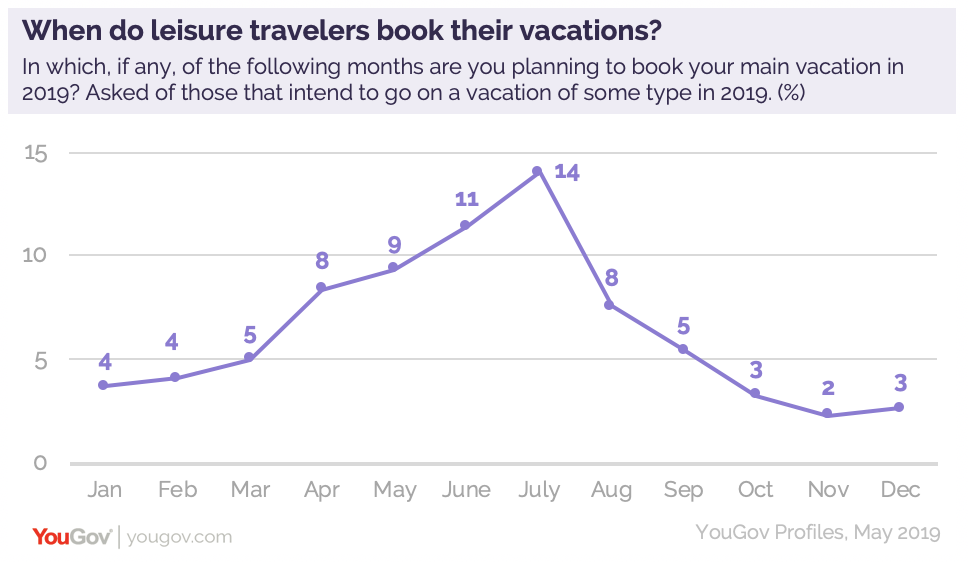

A look at when leisure travelers book their vacations reveals that at least eight percent plan to book their main vacation between April and August. Travel insurance providers that run campaigns in those months, particularly in July, when 14 percent of leisure travelers say they will book their vacation, may have the highest degree of advertising exposure amongst this group.

Additionally, understanding just how these leisure travelers shop for insurance reveals potential advertising partnerships. Compared with the general population, leisure travelers are more likely to find insurance information by asking for recommendations from friends and family (36% vs. 33% of Nat Rep), visiting the websites of insurers they know (32% vs. 28%), or going to the websites of financial advisors (9% vs. 7%).

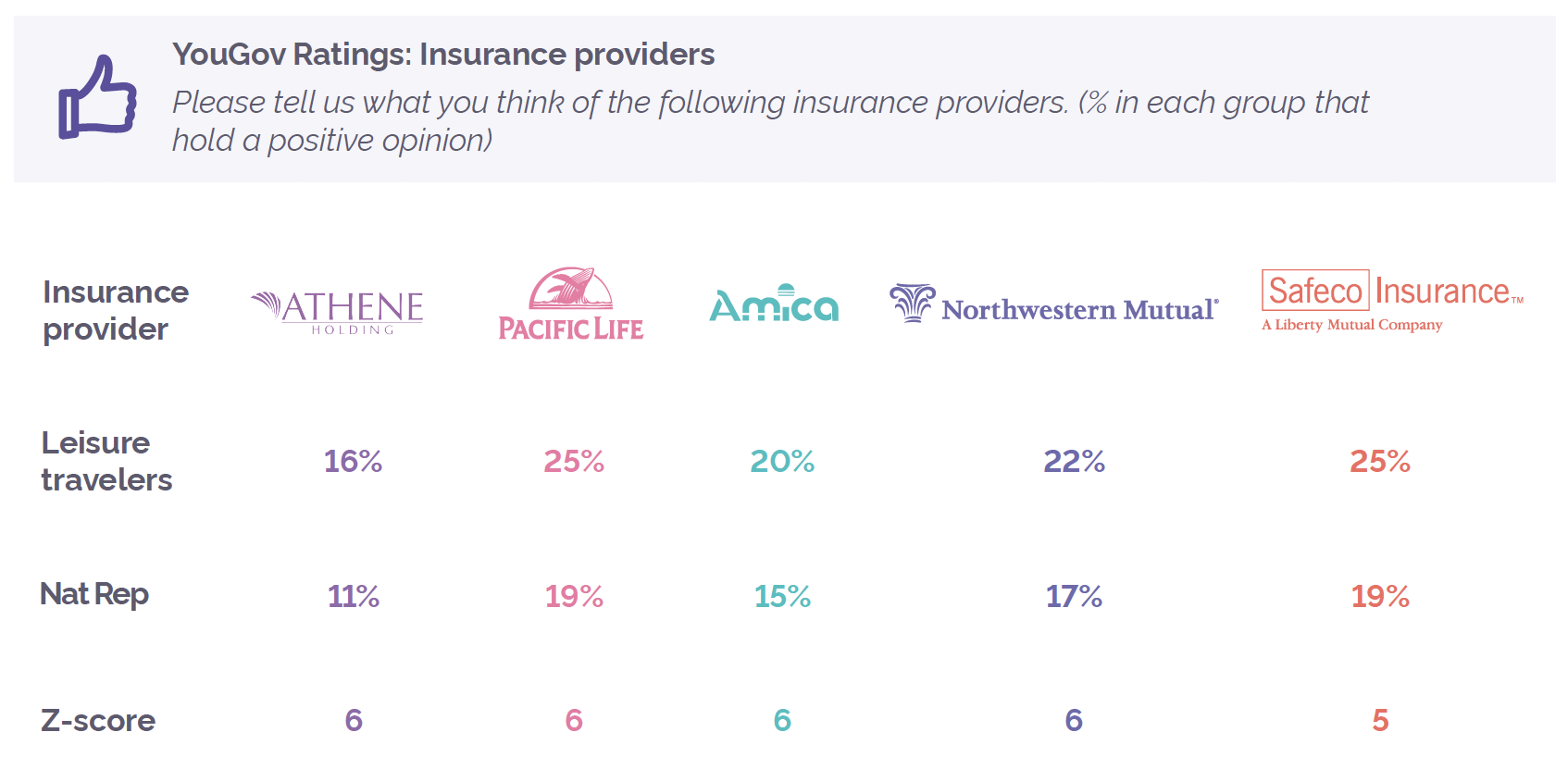

Travel insurance providers, then, can look to advertise or partner with the sources that these travelers trust. According to YouGov Ratings, which measures consumer opinion around brands, celebrities, sports teams, and more, leisure travelers are more likely to hold a positive opinion of brands such as Athene, Pacific Life, Amica, Northwestern Mutual, and Safeco (a subsidiary of Liberty Mutual).

Download YouGov's latest Insurance whitepaper for free here

Learn more about YouGov Plan and Track

Photo: Getty