There’s been a lot of movement in the podcast space, with several big players making hefty investments. SiriusXM adds Stitcher, a longtime pioneer in podcasting, to its leading audio entertainment platform, alongside Pandora, Simplecast and AdsWizz. Spotify spent the past two years acquiring podcast networks and exclusive rights to popular podcasts, such as The Joe Rogan Experience. In the past two weeks, Amazon announced the acquisition of podcast network Wondery and Twitter is acquiring podcasting platform Breaker.

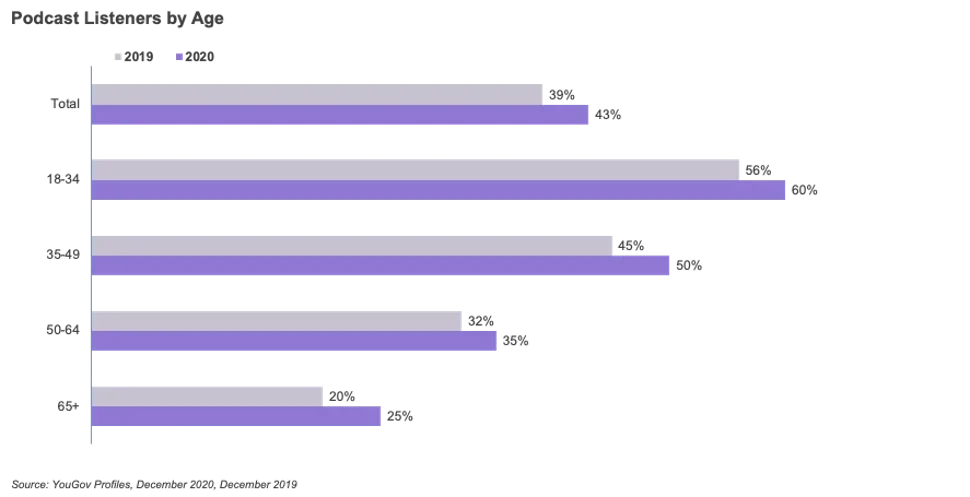

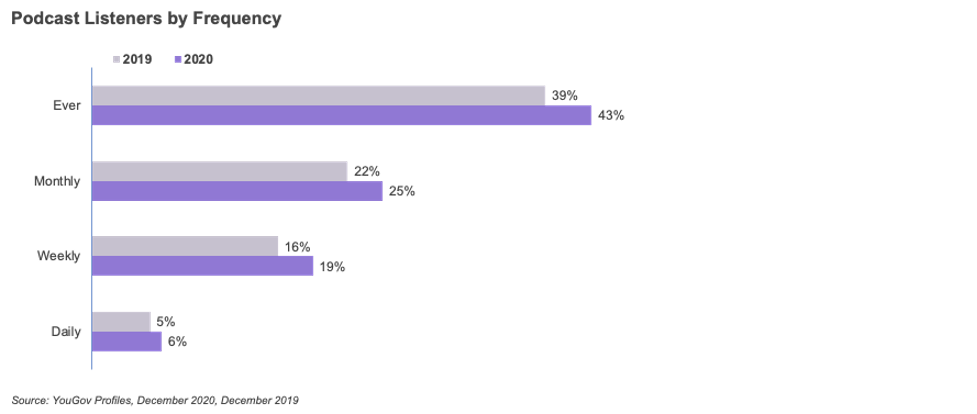

These moves put to question what the opportunities are for advertisers and publishers, and where their audiences now lie. Data from YouGov shows that between 2019 and 2020, the share of podcast listeners — and frequency of listening— increased across all ages. These big changes in listening habits signal good news for both ad businesses and content creators and it will be critical to understand which audiences are driving the demand for audio content.

More than half of US adults under 50 are listening to podcasts

While reduced commuting due to COVID-19 cut into radio listening – traditional and streaming – podcast listening continued to grow in 2020. Listening grew across all age groups between 2019 and 2020, although the audience remains greater among younger adults. We’ve now reached the point where 50% or more of adults under 50 and more than two in five of all US adults (43%) are listening to podcasts.

Frequency of listening also grew, with increases of about 15% among monthly, weekly, and daily podcast listeners.

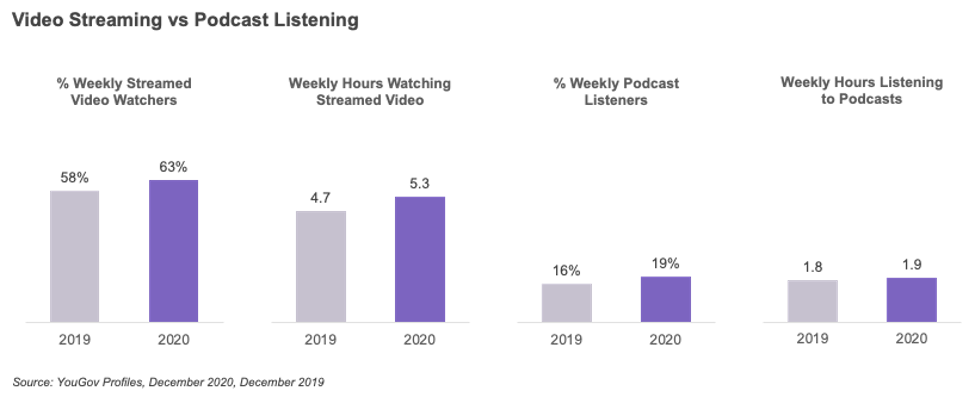

Whereas video streaming has seen growth in both audience size and time spent watching streamed video (8% and 12.7% respectively), the same can’t be said of podcasting. The number of podcast listeners grew by 18% but the average time spent listening to podcasts remained consistent with last year – that's overall and across age groups.

If your audience is under 50, podcasts should definitely be in consideration for your media mix for advertising or content distribution. Listeners are tuning in – and with greater frequency – which opens the doors for marketers to not just tell a story but create a relationship when listeners are actively listening.

Why people listened to podcasts in 2020

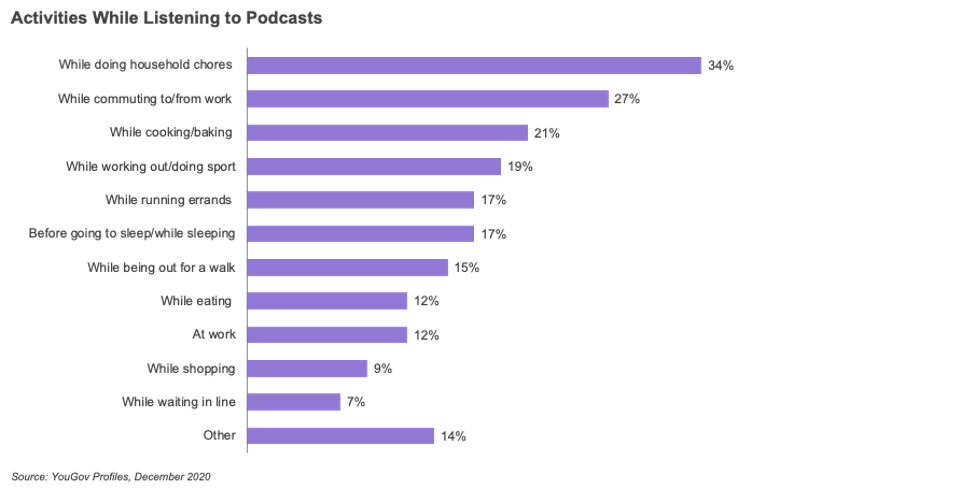

Unlike traditional radio, which is predominantly listened to in the car, podcasts are listened to as much at home as when out and about. In fact, ‘doing household chores’ and ‘cooking/baking’ are the first and third most popular occasions for listening to podcasts.

Different from other media, where we saw shifts due to COVID-19 (e.g. the decline in listening to radio in the car or the increase in daytime TV viewing), there were no dramatic shifts in when people listen to podcasts as a result of COVID-19 -- just a slight decline in listening while commuting (29% to 27%) and slight increase during cooking/baking (17% to 21%).

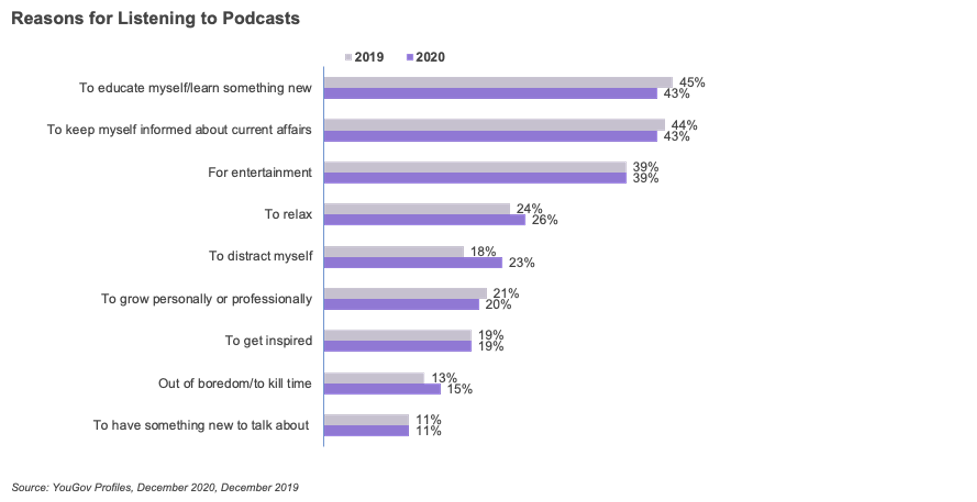

During a year where pandemic and politics created stress and many of our normal activities were off-limits, it makes sense that listening to podcasts “to relax” and “to distract myself” increased in 2020.

As marketers consider the role of podcasts in their marketing plans and the role of their brand in podcasts, understanding why consumers are listening to a podcast helps refine those roles. Whether it be for entertainment or informative reasons, marketers need to ask themselves what messaging will resonate best in each context?