Results of a recent YouGov survey on Groupon indicate that nearly one fifth of non-users are looking to purchase a Groupon deal in the next six months. If all of these intend-to-buys were converted, Groupon would double its existing penetration.

These “purchase intenders” look less like Groupons existing customers however, only 21% of these “future customers” have Household Incomes at or over $80k, versus Groupon’s existing customer base of 35%.

There are other significant barriers to Groupon continuing its meteoric rise. Specifically:

- Share of wallet growth among existing Groupon customers may slow

- Future growth may have to come through more challenging segments

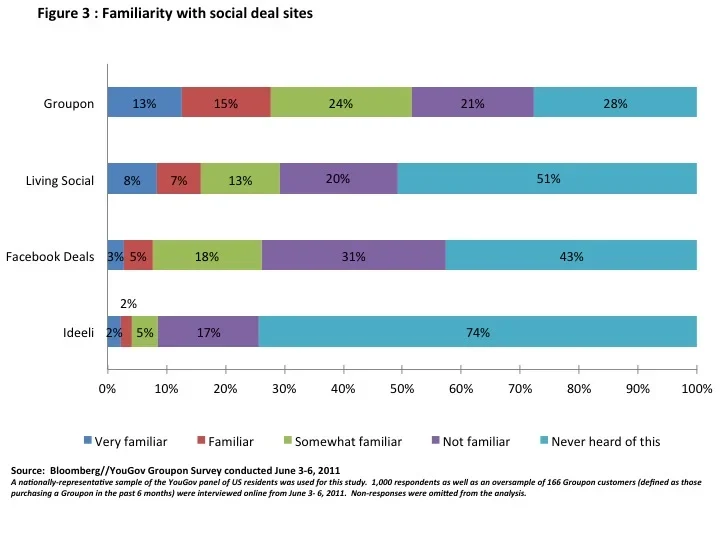

- Brand building expenses may be on the horizon: 33% of non-users have “never heard” of Groupon; only 16% say they are familiar or very familiar

Growing share of wallet among existing Groupon customers alone won’t deliver Groupon’s current explosive growth – existing customers are not currently planning to buy more Groupons. Penetrating new segments of customers and reinvigorating existing ones are keys to continued growth. Investors need to ask whether Groupon’s strategy and management team are aligned to overcome these obstacles to turbocharge its next level of growth.

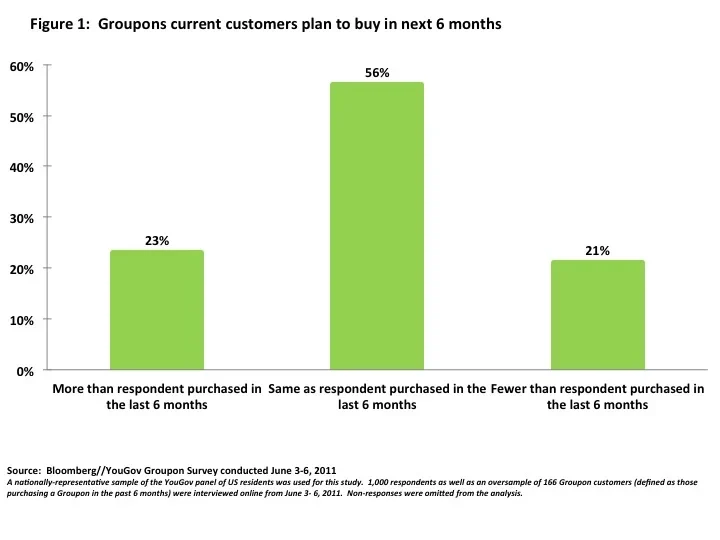

Expanding share of wallet with existing users

About 1 in 5 respondents reported buying a Groupon in the past 6 months (16%). Although Groupon is approaching its 50 millionth purchase, it may have difficulty driving increased spend per customer among its existing customers as nearly as many plan to buy fewer Groupons as do buying more Groupons.

While customer satisfaction is increasing, there is still significant opportunity for improvement.

Building position among non-users: Can Groupon convert its opportunity?

Groupon faces significant challenges to penetrate the market of non-users, as 33% of non-users have “never heard” of Groupon. At the other extreme, only 4% of non-users say they are “very familiar” with Groupon.

Competitive landscape

Groupon is well-positioned compared to other Social Deal sites. Across the population, 52% of people say they are “somewhat familiar,” “familiar,” or “very familiar” with Groupon. This compares to 29% for Living Social, 9% for Ideeli, and 26% for the newly launched Facebook Deals. Groupon’s position among existing deal sites is strong, though Facebook Deals and the very new Google Offers loom on the horizon. In order for Groupon to justify a $30 billion valuation, it will need to show the ability to reach new segments and further develop existing customers before smaller players like Living Social and category-killers like Google and Facebook steal them.

NOTE

A nationally-representative sample of the YouGov panel of US residents was used for this study. 1,000 respondents as well as an oversample of 166 Groupon customers (defined as those purchasing a Groupon in the past 6 months) were interviewed online from June 3- 6, 2011. Non-responses were omitted from the analysis.