The public tends to support Obama's child care and education aid promises, but many oppose the hike in capital gains tax needed to pay for it

In last week's State of the Union address President Obama focused on inequality in America and outlined an ambitious plan to provide more help to the middle class, funded by higher taxes on high earners. By raising the capital gains tax from 23.8% to 28%, and increasing other taxes on the wealthy and banks, the President hopes to fund increased aid for child care and education, as well as the plan for free community college introduced earlier in the month. While the plan is very unlikely to pass the Republican controlled Congress, it does lay out the stark differences between Democrats and Republicans before the 2016 Presidential election.

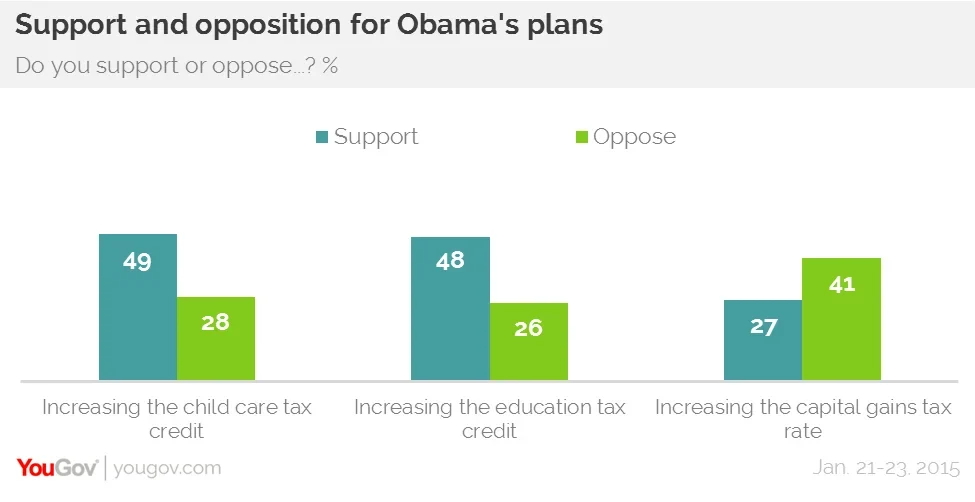

YouGov's latest research shows that many Americans support the President's plans to increase federal aid for child care and education, but tend to oppose increasing the capital gains tax. 49% support increased child care tax credits, while 48% support increased education tax credits. When it comes to the capital gains tax increase, however, 41% of Americans oppose it and 27% support it.

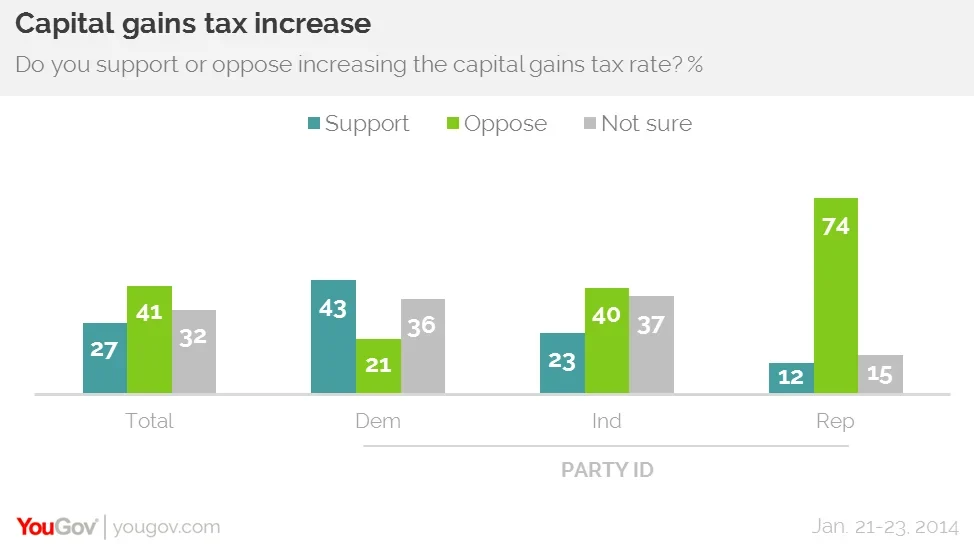

Most Democrats support increased federal aid, along with many independents while Republicans are evenly divided on both of the tax credit proposals. When it comes to the increase in capital gains tax that President Obama has proposed to pay for this extra spending, however, only Democrats tend to favor the move. 32% of Americans aren't sure either way, though Republicans are the least undecided with 74% against the increase and 12% in favor. Democrats support the move 43% to 21% against, while independents oppose it 40% to 23% in favor.

Full poll results can be found here.