Despite the best of intentions, a quarter of Americans left it until April to file their tax returns

April 15th marks the last day every year in which Americans can file their taxes without facing penalties from the IRS for late filing. Each year the IRS pays out vast sums in refunds to Americans, with $125 billion in refunds having been paid out by the federal government by the end of March alone. The average American household is set to receive a federal tax refund of just under $3,000 in 2015.

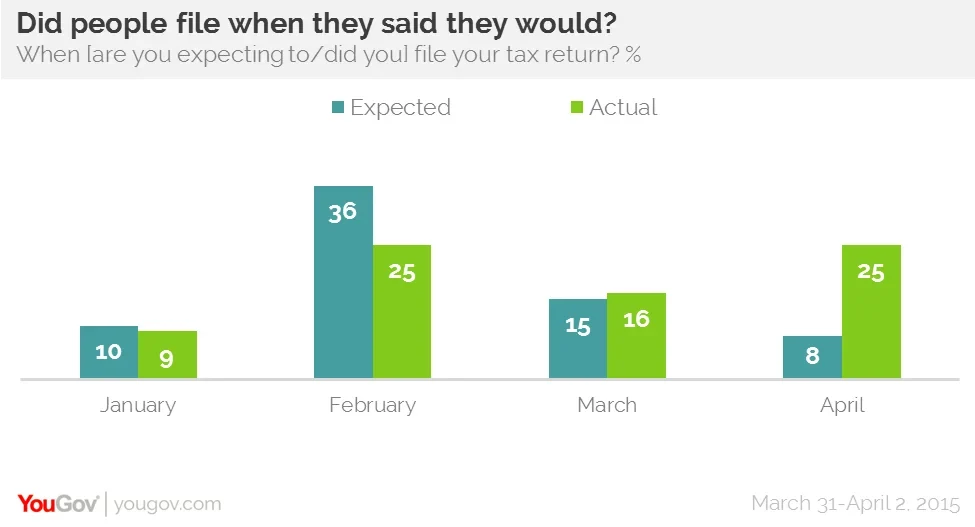

Research from YouGov conducted at the beginning of the year and again at the beginning of April shows that while nearly half of Americans (46%) said that they intended to be done with their taxes before the end of February, only 34% actually followed through. More dramatically only 8% of the public said that they'd wait until April to file their tax return, but when the same question was asked at the beginning of April a quarter of the country said that they would be filing with only two weeks left to sort out their affairs.

Older Americans were the most likely to say that they had waited until April to file. While only 24% of people aged 30 to 44 had waited that long, 37% of over-65s said that they are filing in the weeks before the April 15th deadline. Looking at all demographic groups, people with househole incomes of between $40,000 and $80,000 a year were the most likely (64%) to have filed their tax return in March or earlier.

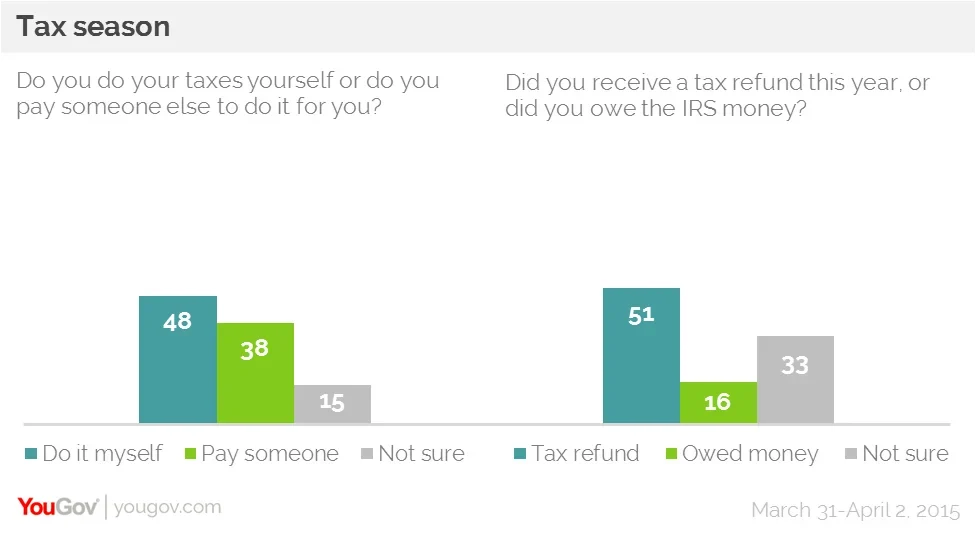

Looking at the finances of tax season, just under half of the country (48%) say that they pay someone else to do their taxes for them while 38% do their taxes themselves without paying an account or tax preparer like H&R Block. Just over half (51%) of the country say that they're receiving a tax refund this year, but an unlucky 16% are having to pay extra to the IRS to meet their tax obligations.