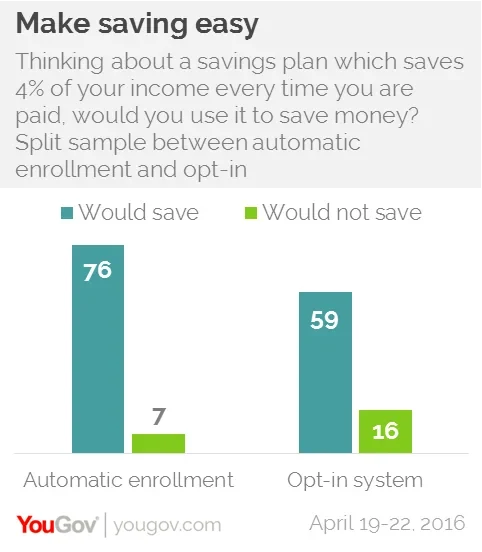

Americans are nearly a fifth more likely to say that they would use a regular savings plan if they were automatically enrolled

The personal savings rate of Americans has been slowly increasing recently, hitting 5.5% at the end of 2015. Historically, however, even this savings rate is relatively low. Forty years ago the average American saved nearly 12% of their disposable income. Much of this change in savings behavior has affected lower income Americans, who once put a little aside each month but now instead largely rely on credit to cover unexpected expenses.

Research from YouGov shows that Americans are more likely to put a little money aside each month if they are automatically enrolled in a savings plan instead of having to opt into one. All respondents were asked about a hypothetical system in which 4% of their income would be put into savings every paycheck. Half of respondents were asked about a plan in which they were automatically enrolled and would have to opt out of regularly saving money, while the other half were asked about a plan they would have to choose to enroll in. 76% of Americans say that they would regularly save 4% of their paychecks if they were automatically enrolled, while 59% say that they would choose to opt into this plan - a difference of 17%.

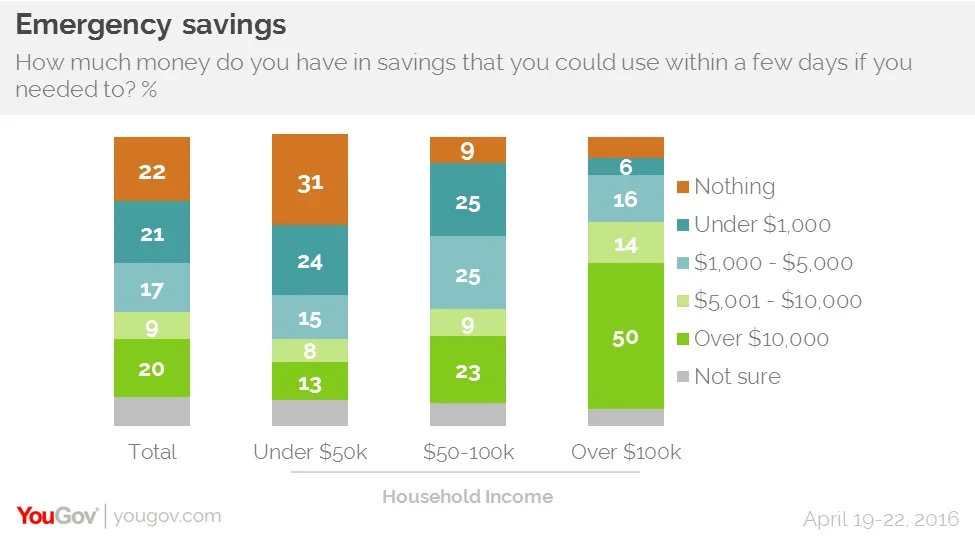

Even a small level of saving would make a significant difference for many Americans. 22% of Americans say that they do not have any savings that they can quickly access if they needed the money, while 21% say that their emergency savings are less than $1,000. 26% say that they have savings of between $1,000 and $10,000 and 20% have savings of over $10,000.

Unsurprisingly those Americans with the highest incomes are also the most likely to have large savings at their disposal. 50% of people with incomes of over $100,000 a year say that they have over $10,000 at hand, while 31% of people in households earning less than $50,000 a year have no savings at all.