Data reveals which energy drink brands attract high-frequency customers with a strong sense of brand loyalty

According to one report, global sales of energy drinks are expected to grow from an estimated $41 billion in 2015 to $57.3 billion in 2020 — an increase of 40%. A large pie, however, doesn't guarantee that everyone sitting at the table gets an equal slice.

Like all brands competing for market share in a given industry, different energy drinks attract different types of customers with their own unique set of habits and behaviors.

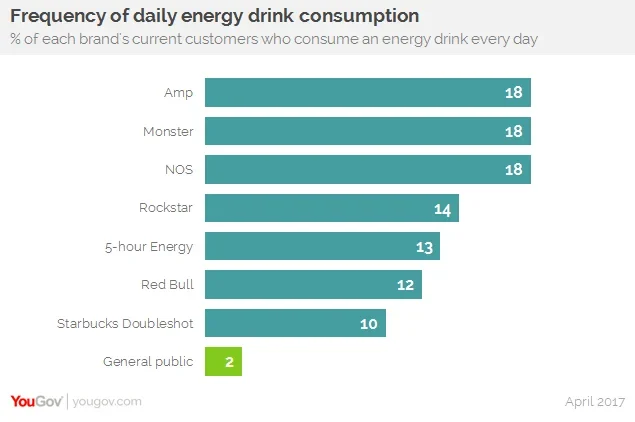

Data from YouGov Profiles, for example, shows that 18% of current Amp, Monster, and NOS customers (i.e. customers who've purchased a product from one of the three energy drink brands in the past 30 days) report consuming an energy drink each day. The same goes for 12% of Red Bull customers, and 10% of those who've recently purchased an espresso-fueled Starbucks Doubleshot. Overall, only 2% of US adults say they consume an energy drink each day.

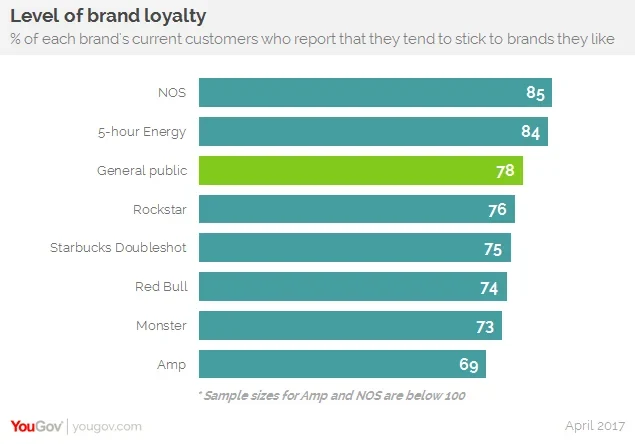

When it comes to brand loyalty, NOS customers are the most likely to say they tend to stick to brands they like, followed by customers of 5-hour Energy shots. It's interesting to note that, at 78%, the average American adult appears to possess slightly more brand loyalty than customers of industry leaders Red Bull and Monster.

Additional data shows that Monster has the largest percentage of customers aged 18-34, Starbucks Doubleshot attracts the most females, and Amp does well with consumers who reside in towns and rural areas.