45% of Americans think that Donald Trump will pay less under the new tax plan

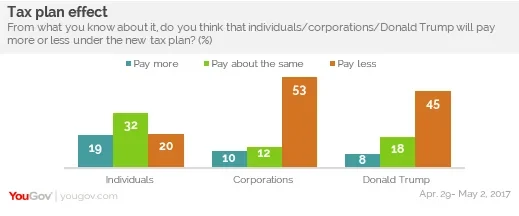

The one-page tax plan announced by Treasury Secretary Steve Mnuchin last week isn’t really understood by most Americans: just 19% in the latest Economist/YouGov Poll say they have heard “a lot” about it. But the instinctive public reactions are that President Trump – and corporations – will get tax breaks from it. As for what will happen to their own personal taxes, Americans are divided on whether their own tax rates will go up or go down under the plan.

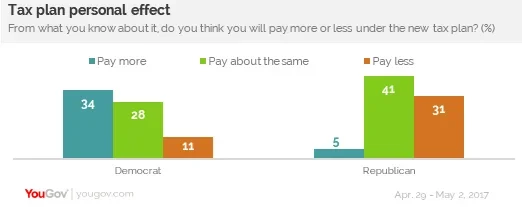

Of course, not knowing a lot about the details means that answers on many of these questions are based more on opinions about the President than on opinions about the plan. There is little partisan difference in self-reported attentiveness to the plan. Democrats and Republicans are equally likely to say they have heard a lot about it. But a third of Democrats say they will pay more under the plan; a third of Republicans think they will pay less.

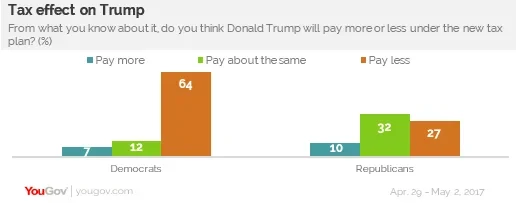

Two-thirds of Democrats believe Mr. Trump’s own taxes will go down, something only one in four Republicans think. Republicans are more likely than Democrats to say the President’s own taxes won’t change or to say they aren’t sure what he will pay under his plan.

On the other hand, Republicans and Democrats agree that taxes will drop for corporations.

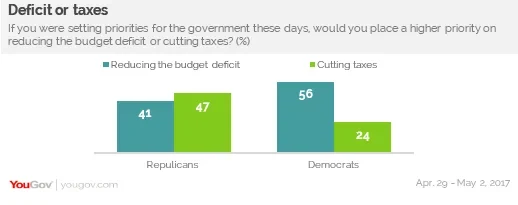

The tax plan has another perception problem, and that is what will happen to the budget deficit. Most Republicans, as well as most Democrats, say they are concerned about the size of the deficit. Historically, reducing the deficit has taken priority over cutting taxes for many, and this poll is no exception. 47% say it’s more important to reduce the budget deficit; 31% believe it’s more important to cut taxes.

In this poll, traditional party differences on this question have changed somewhat. Rank and file Republicans, many of whose representatives characterize themselves as “deficit hawks,” lean more in favor of tax cuts today: 47% prioritize cutting taxes, 41% favor reducing the deficit. Democrats choose deficit reduction over tax cuts by more than two to one.

Democrats believe this Administration’s tax plan will increase the deficit; Republicans aren’t so sure. But Republicans remain more supportive than Democrats of a balanced budget amendment. Two-thirds of Republicans favor passing that change to the Constitution, along with requiring a three-fifths Congressional majority to raise the debt limit. Just over a third of Democrats agree.

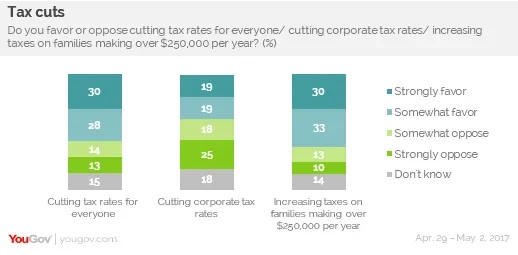

In principle, majorities of the public (including 57% of Republicans) would increase taxes on families making more than $250,000 a year, a group that would include the President himself. The public isn’t sure about cutting corporate taxes (Republicans are in favor of that), but they do favor reducing tax rates for everyone (though on this Democrats are divided).

How is President Trump doing on taxes? The public is split on his plan, and on his performance on taxes: 38% approve, 42% disapprove. But there is a Trump tax issue that gets wide support: by nearly two to one, the public still wants the President to release his tax returns. One in three Republicans agree.