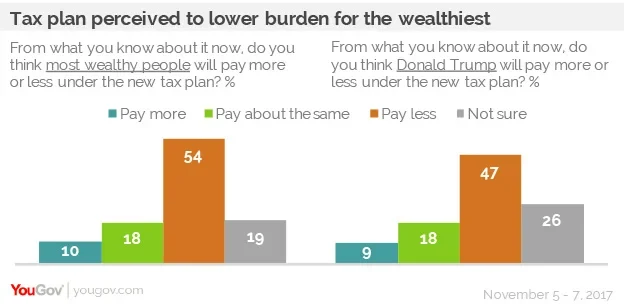

But 47% think President Trump will see a tax cut

Americans say tax cuts for all are desirable, but don’t believe that’s what the Republican tax plan would actually provide, according to the latest Economist/YouGov Poll. So far, many don’t see themselves gaining any benefits from the GOP plan.

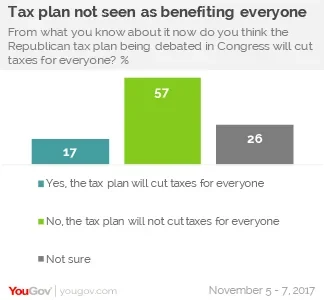

Democrats and liberals reject a tax cut for all by wide margins, but most groups favor such a move, sometimes even if tax cuts would increase the federal budget deficit. But pretty much all groups of Americans don’t think that the GOP tax plan will, in fact, cut taxes for everyone. Even Republicans aren’t sure. A third of Republicans say it will cut taxes for all, while 42% say it won’t.

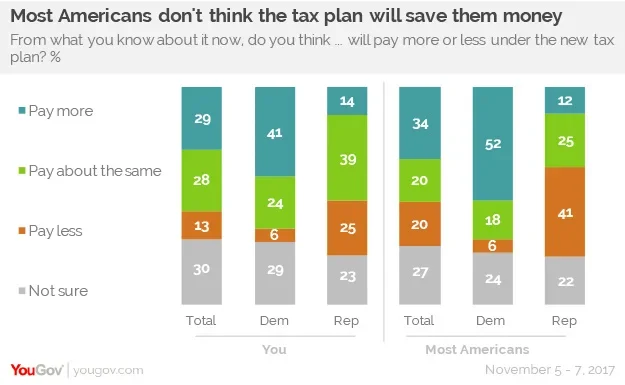

But what happens to everyone else may not matter, if people see an advantage to themselves in the tax plan. The problem for supporters of the Congressional Republican tax plan? Most people don’t see an advantage for themselves. Just 13% say they will pay less in taxes if the plan passes; only one in five believes most Americans will pay less.

One in four Republican think they personally will pay less; but even more Republicans say their tax burden will not change. 41% of Republicans believe most Americans will pay less. Democrats and independents are convinced Americans – and themselves personally – are more likely to be paying more in taxes than they are today.

The winners, in the eyes of many, will be the wealthy – and that includes Donald Trump. More than half the public believes the wealthy will pay less under the GOP tax plan; almost as many say the President will pay less.

The other “winner,” according to the public, is deficit spending. 41% say the tax plan will increase the deficit, more than the combined total of those who think it will reduce the deficit or leave it unchanged. Only 30% say the bill is revenue neutral or will reduce the deficit.

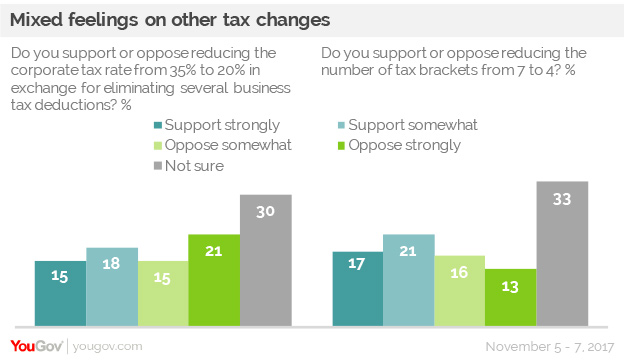

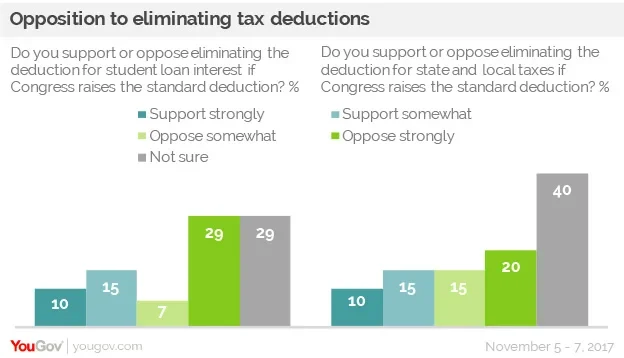

There isn’t a lot of support for some of the specifics of the proposal. Americans oppose losing the deduction for student loan interest. They also oppose eliminating the deduction for state and local tax payments. They are divided on whether or not to eliminate the estate tax. They are also divided on whether or not to cut the corporate tax rates in exchange for losing some business tax deductions. One positive response: Americans would like to see the number of tax brackets cut.

Those following the tax proposal very closely are not very different from the public overall in how they feel about each of these items. On the tax plan overall, those paying a lot of attention are closely divided.

It should be noted that, as a national issue, both taxes and deficit pale in comparison with issues like terrorism, the economy, and especially health care. Just 3% cite taxes as the country’s most important issue, and even fewer, 2%, cite the deficit.

In principle, Americans favor reducing the federal budget deficit. More than two-thirds are concerned about the size of the federal budget deficit, with nearly a third very concerned. Those with an opinion would favor a balanced budget amendment by three to one.

For more results, visit the full tab report or toplines.

Image: Getty