And more than two-thirds of Americans are very confident that they file their taxes correctly each year

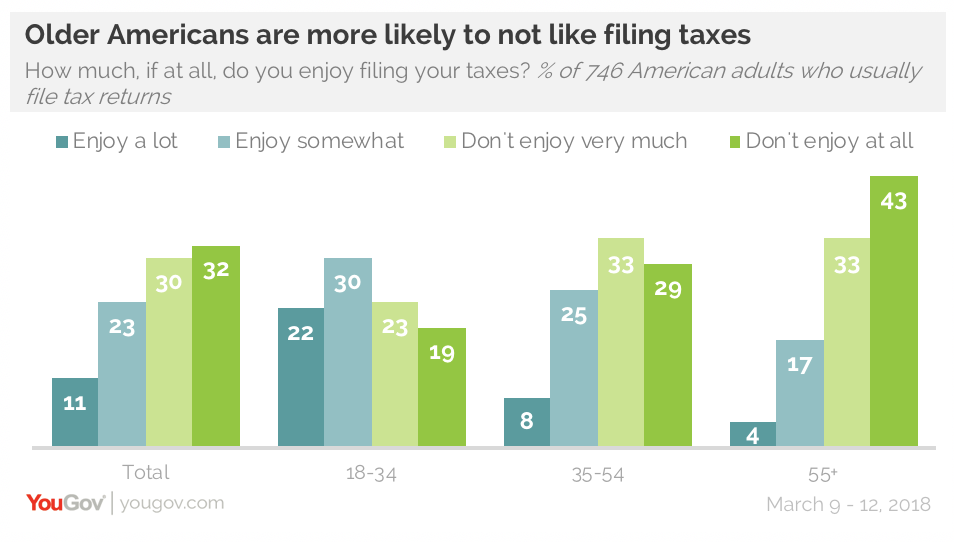

Taxes may be as inevitable as death, but for younger American taxpayers, that’s not necessarily a bad thing. According to new data from YouGov Omnibus, most millennials enjoy filing their taxes.

While only 34% of the American public say they enjoy filing their taxes, either “somewhat” or “a lot,” that number rises to 52% for those between the ages of 18 and 34. And these millennials likely didn’t learn this from their elders, as only 21% of Americans over the age of 55 feel the same. In contrast, 43% of the 55-and-over crowd say they don’t enjoy filing taxes at all, while another 33% say they don’t enjoy it very much.

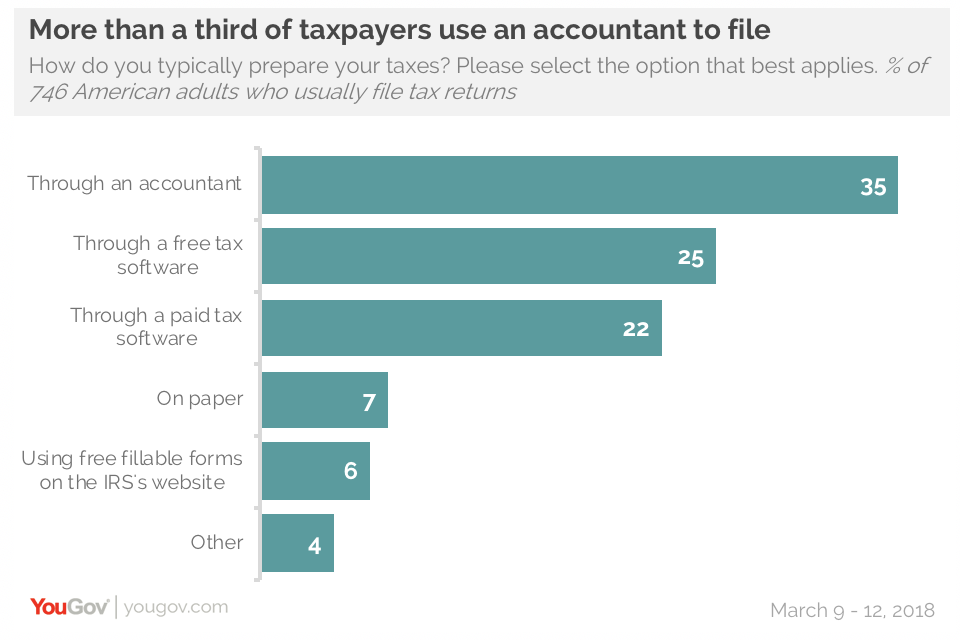

Even in the digital age, 7% of American taxpayers say they file their taxes on paper and mail them in. Americans over the age of 55 are most likely to say they do their taxes through an accountant, while 18- to 34-year-olds are the group most likely to use free tax software and free fillable forms on the IRS’s website.

Even in the digital age, 7% of American taxpayers say they file their taxes on paper and mail them in. Americans over the age of 55 are most likely to say they do their taxes through an accountant, while 18- to 34-year-olds are the group most likely to use free tax software and free fillable forms on the IRS’s website.

While taxes aren’t due until mid-April, the most common time to file tax returns is February, with 41% of Americans filing then. Millennials are more likely than older Americans to file in January, while those 55 and over are more likely to file in March or April.

While taxes aren’t due until mid-April, the most common time to file tax returns is February, with 41% of Americans filing then. Millennials are more likely than older Americans to file in January, while those 55 and over are more likely to file in March or April.

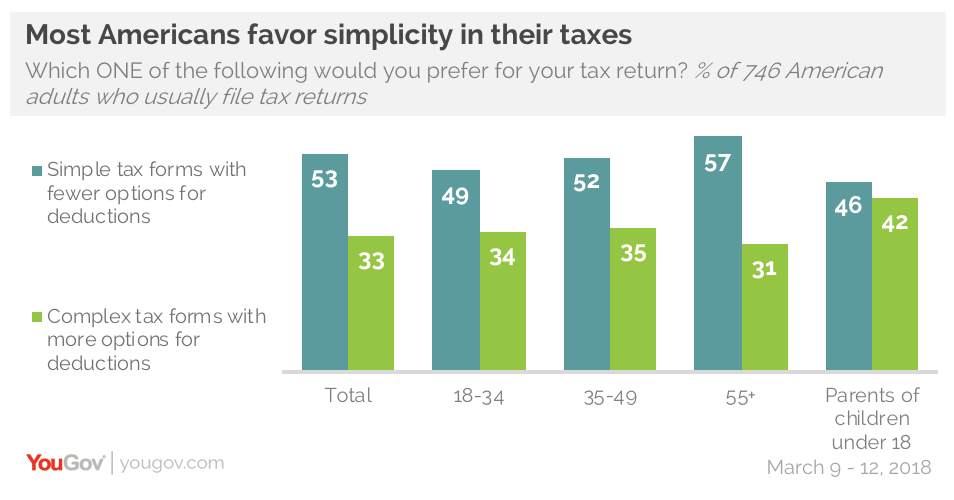

If given the choice between the two, most Americans would prefer simple tax forms with fewer options for deductions over complex tax forms with more options for deductions. One group more equally split on the issue is parents of children under the age of 18: 46% favor simple forms, while 42% prefer more deductions.

Even though they may want simpler tax filing, more than two-thirds of Americans (68%) say they’re “very confident” that they file their taxes correctly every year. Four-fifths (80%) of those over 55 say this, compared to only 52% of 18- to 34-year-olds.

Even though they may want simpler tax filing, more than two-thirds of Americans (68%) say they’re “very confident” that they file their taxes correctly every year. Four-fifths (80%) of those over 55 say this, compared to only 52% of 18- to 34-year-olds.

Learn more about YouGov Omnibus.

Image: Getty