A large majority want the DoJ and IRS to examine the Panama Papers, while a slim majority say tax avoidance is unacceptable

One week ago the German newspaper Süddeutsche Zeitung revelead that it had obtained 11 million leaked documents from the Panamanian law firm Mossack Fonseca. The firm has helped thousands of wealthy people from around the world structure their finances to avoid, or even evade, taxation. The revelations have already forced the Prime Minister of Iceland to resign and has prompted awkward questions for the British Prime Minister David Cameron, whose father ran an offshore investment firm to avoid British taxation.

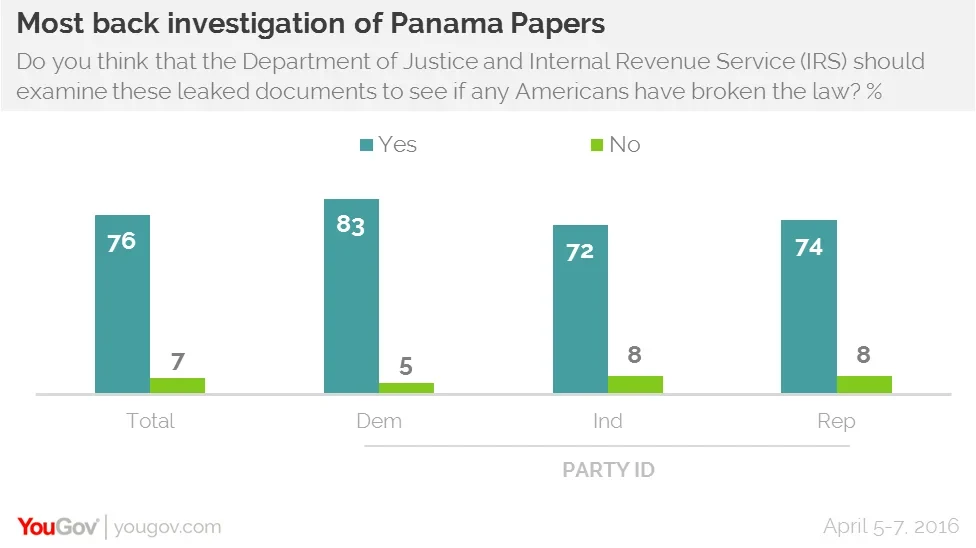

Research from YouGov shows that a large majority of Americans (76%) want the Department of Justice and the Internal Revenue Service (IRS) to be able to examine the leaked documents to discover if any Americans have broken the law by evading taxes. Only 7% of the country opposes the federal authorities getting access to the currently secret papers to see if Americans have broken the law.

The reason the papers have not been widely released is because many of the arrangements exposed in the documents concern the legal financial arrangements of private individuals, many of whom were not even seeking to avoid tax let alone evade tax. Many arrangements handled by the firm did, however, seek to help people avoid tax. Tax avoidance is when someone uses legal but artificial methods to avoid paying as much tax as they otherwise would, as opposed to evasion which is when people break the law to not pay tax.

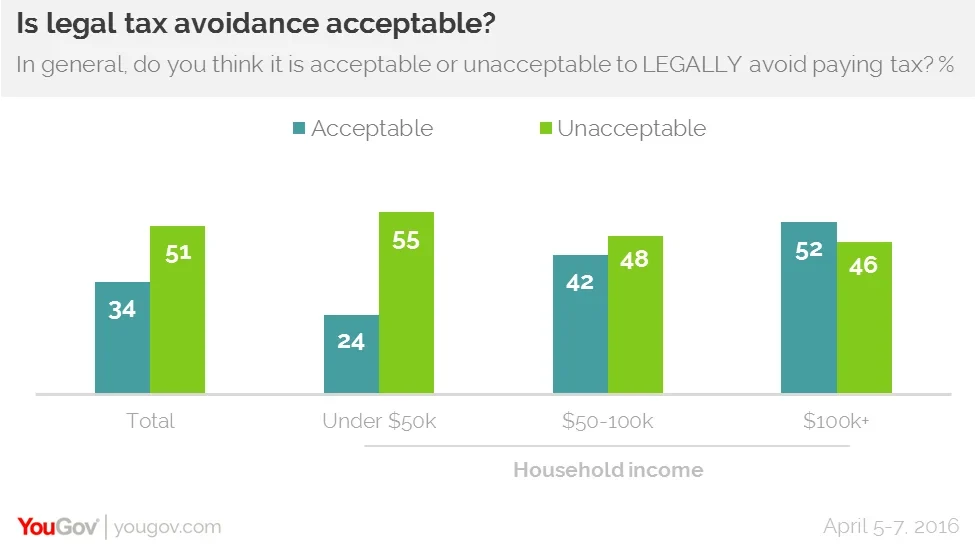

A slim majority of Americans (51%) say that it is unacceptable to engage in tax avoidance. However, 34% of Americans say that it is acceptable, and this includes a majority of people (52%) in households with incomes over $100,000 a year.