Another week of contentious debate has raised the level of skepticism among the American public about whether an agreement on raising the debt ceiling will be reached by the August 2 deadline. And in the latest Economist/YouGov Poll, there are indications that fewer Americans — especially Republicans — are worried about economic consequences should the deadline pass, although there is general concern about the state of the country.

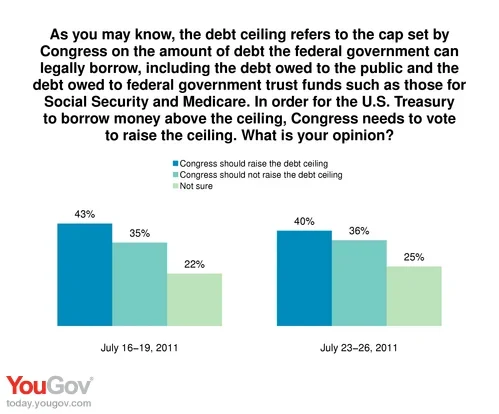

Americans remain divided about whether or not to raise the debt limit: 40% are in favor, 36% opposed. This is the second week that a small plurality has supported increasing the ceiling.

Democrats continue to support increasing the debt limit, while Republicans oppose it. Last week, a majority of independents also favored an increase; this week, a plurality of 43% favors an increase, while 35% oppose.

Last week, too, more Americans than now believed the consequences of not raising the debt ceiling would be dire. The percentage expecting panic in the financial market if the ceiling were not raised dropped 9 points in the last week. There have been declines as well in the percentage expecting delays in Social Security payments, cancellation of government services and the loss of the U.S. dollar’s position as the world’s reserve currency.

Are the following things likely to happen if Congress does not raise the debt ceiling? Table displays respondents who responded that consequence is likely

| July 16-19, 2011 | July 23-26, 2011 | |

|---|---|---|

Some government services will be canceled | 79% | 74% |

Interest rates will go up | 72% | 70% |

There will be a panic in financial markets | 70% | 61% |

The government will start selling off its gold reserves | 27% | 22% |

The government will default on its current debt payments | 57% | 52% |

Social Security payments will be delayed | 60% | 53% |

The U.S. dollar will lose its position as the world’s reserve currency | 61% | 55% |

The biggest drops in concern have come from Republicans. Last week, two-thirds of Republicans expected panic in the markets and a majority thought Social Security payments would be delayed. This week, half expect a financial panic and only a third of Republicans think Social Security payments will be delayed.

Are the following things likely to happen if Congress does not raise the debt ceiling? Table displays Republican respondents who responded that consequence is likely

| July 16-19, 2011 | July 23-26, 2011 | |

|---|---|---|

Some government services will be canceled | 83% | 78% |

Interest rates will go up | 74% | 67% |

There will be a panic in financial markets | 68% | 50% |

The government will start selling off its gold reserves | 27% | 17% |

The government will default on its current debt payments | 52% | 40% |

Social Security payments will be delayed | 51% | 34% |

The U.S. dollar will lose its position as the world’s reserve currency | 59% | 47% |

The budget deficit ranks as the country’s third most important issue this week: the economy is first, followed by Social Security. 11% name the deficit as their most important issue.

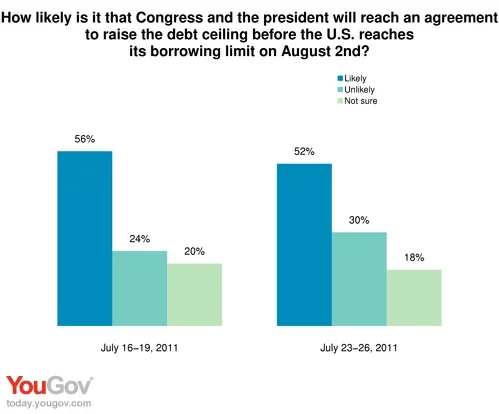

Just over half the country expects the President and Congress to reach an agreement in time, a drop of four points from last week. Last week there was more hope than worry. This week, Americans are almost evenly divided on whether or not there will be an agreement before August 2nd.

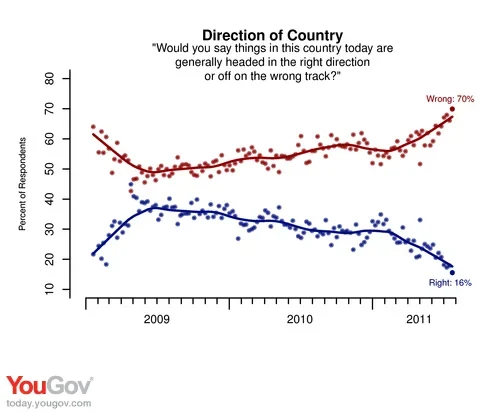

And while the fears about a debt ceiling disaster may have lessened, Americans are still worried about the state of the country. In this week’s poll, 70% say things in the country are headed in the wrong direction, the highest reading in an Economist/YouGov Polls since President Obama took office. Only 16% think things are on the right track.