Americans tend to oppose a tax break for married couples and think the government has no business encouraging people to marry or have kids

Across most of the developed world married individuals file their taxes individually, each paying taxes and making deductions on the basis of their personal situation. In the United States, however, married couples are able to file jointly, combining their deductions and incomes in a way that can result in married couples either paying more or less in taxes than they would if they filed separately. Middle-incomes couples where one person earns most or all of the income benefit the most, while couples with nearly even incomes tend to lose out by filing jointly.

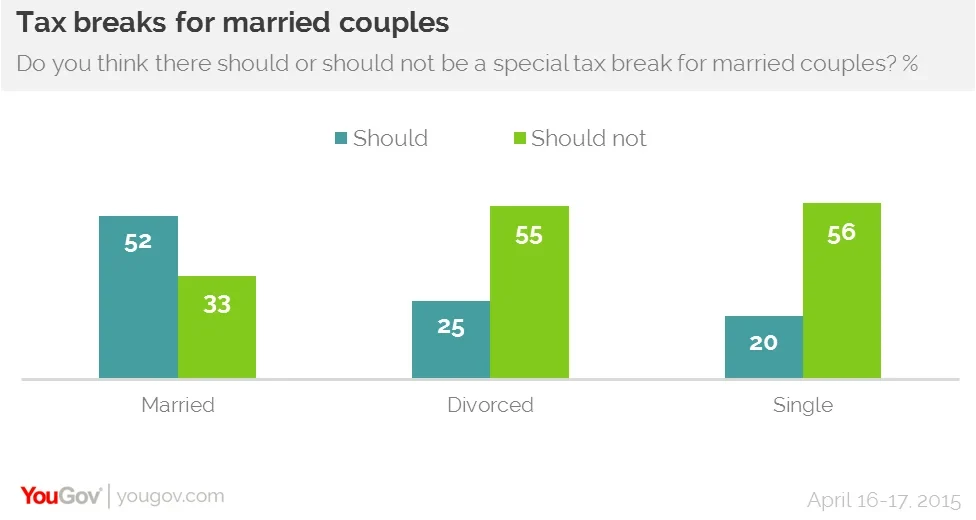

YouGov's latest research shows that Americans narrowly tend to oppose a special tax break for married couples. Overall, 44% of Americans oppose a special tax break for the married while 36% support it. While most married people (52%) support a special tax break for themselves, most divorced people (55%) and single people (56%) oppose the special tax break.

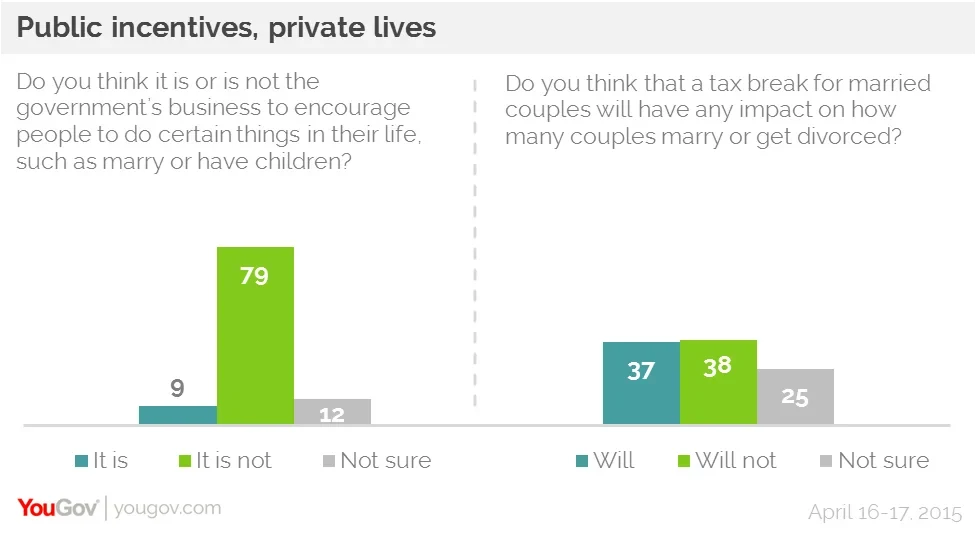

Despite the narrow split on whether or not married couples should get a tax break, the vast majority of Americans (79%) believe that it isn't any business of the government to encourage people to do certain things, such as marry or have children.

Only 9% of Americans believe that it is the government's business to encourage certain behaviors. When asked whether a special tax break for married people would have any impact on the rates of marriage and divorce, opinion once again is divided. 37% of Americans believe that giving a special tax break to the married would have an impact, while 38% think that it would not.