In this piece, we’re rounding up the highlights of a year of leisure and entertainment insights and trends.

This year, we found consumers don’t think celebrity endorsements work all that well in the gambling sector. A survey across 17 markets revealed only about one in ten global consumers believe that a public figure can effectively endorse gambling products (9%).

Just as online gambling has seen enormous growth, so has esports. So, YouGov looked at the intersection between those two industries. Looking at six key global markets, esports betting is most popular in Australia, with 16% of gamblers reporting to have bet on esports online in the last 12 months. Aussies are marginally ahead of American gamblers, 15% of whom say they’ve placed a bet on an esports event in the last year, and Indian adults (14%).

Fueled by innovation in online gambling, de-regulation in key markets, and the pandemic, the popularity of online gambling globally is significantly increasing. YouGov’s International Gambling Report 2021 provides a snapshot of opinion towards the regulation of the sector and rising levels of acceptance - albeit with important caveats – and highlights lucrative opportunities for key players within the gambling industry.

Online gambling showed strong growth amid the lockdown and now, with the vaccine effort fully underway, gamblers are returning to physical casinos as well. To better understand outlooks on commercial gambling, YouGov launched Global Gambling Profiles, a tool that continually gathers data on gamblers. The dataset provides insights into where people typically gamble and the types of bets they tend to place, and uncovers how else they live their lives, from the sports and teams they follow to their core demographics their media consumption.

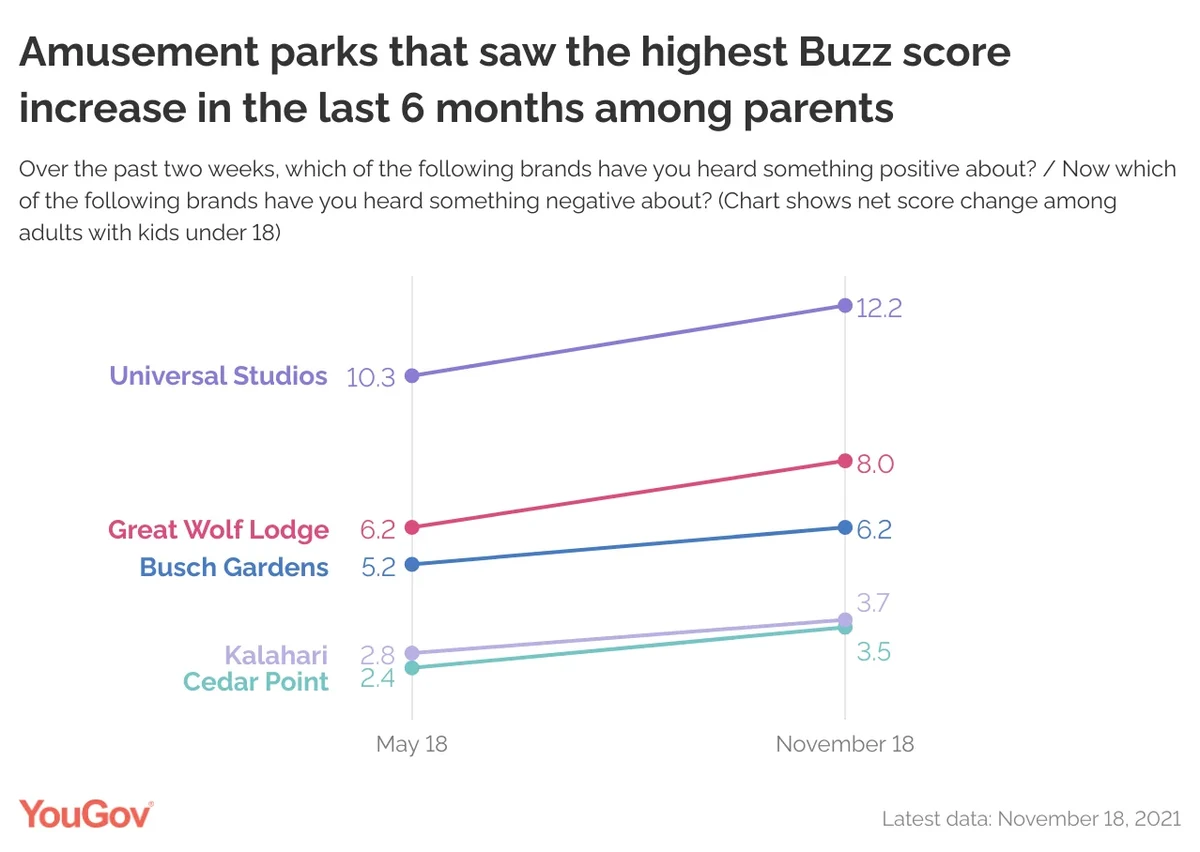

Meanwhile, in the more family-friendly side of leisure and entertainment, we turn our attention to amusement parks in the United States. Late in the year, we looked at which US parks saw the highest increase in brand health in the second half of 2021. Atop our list of parks with the highest Buzz score increase was Universal Studios in Orlando, posting a 16% hike over the last six months among the nation’s parents of kids under 18. Universal Orlando reported its most profitable quarter ending in October as domestic tourists blew off steam following pandemic-related restrictions.

Global YouGov research conducted midway through 2021 showed a plurality of global consumers — about three in ten (29%) — say they’d be comfortable attending a sporting event that’s between 25% and 50% capacity. Only 8% of global consumers say they’re comfortable with a near or totally filled stadium. However, there are significant differences among the 17 markets in which YouGov conducted its study.

Turning to online dating, YouGov research from this year showed adults in Indonesia, the United Arab Emirates and urban India are the most likely to have met their partner via an app. Our data also revealed western markets are less likely with 8% of Americans and 6% of adults in the United Kingdom currently with someone they met virtually on their phone. While these apps remain popular in these regions, it appears fewer users are finding longer-term relationships compared to other markets.

Our leisure and entertainment inishgts also include fitness and exercise. A 2021 framework analysis from YouGov found over half the adult British population did not work out at all in the last 30 days, according to a new YouGov Framework analysis based on data from YouGov Profiles. And while 42% of the nation say they did exercise in the past month, a majority of them are keen to do more.

Finally, in the broad sector that is leisure and entertainment, we turn our attention to music discovery, particularly among video gamers. The research found roughly a quarter of gamers discover new music through video games (24%). While that figure is behind other channels, such as music apps, recommendations from friends, and social media, it remains a substantial portion. A broader look at music discovery shows significant differences across age groups. Half of Americans aged 18-29 discover new music through apps such as Apple Music or Spotify (50% versus 37% of the general US public). Our data also shows a significant portion of this younger age group get their music from social media (45% versus 32% of the general population). While social media has been an important platform for the music industry for some years now, growing platform TikTok can be at least partially credited with creating a new generation of artists such as Lil Nas X.