In this piece, we’re rounding up the highlights of a year of gaming insights and trends.

This era of gaming has been defined by an incredible increase in popularity coupled with a shortage of available consoles. For so many consumers, next-generation consoles remain elusive, thanks to the confluence of chip shortages and supply-chain disruptions.

If shoppers can’t get the next-gen console they want, what will they do? In the United States, roughly half of consumers who indicated it has been harder for them to purchase their first choice of gaming console say they will seek out an alternative product (52%). In Great Britain, that number is higher at 63%.

But it’s not just console gaming that’s rising in popularity. Virtual reality has long been seen as the next major leap in video games, dating back to Nintendo’s ambitious and ill-received Virtual Boy in 1995. While manufacturers continue to nurture this slow-growing niche of the gaming industry, YouGov data shows what activities consumers around the world are interested in doing using a VR headset, apart from just gaming.

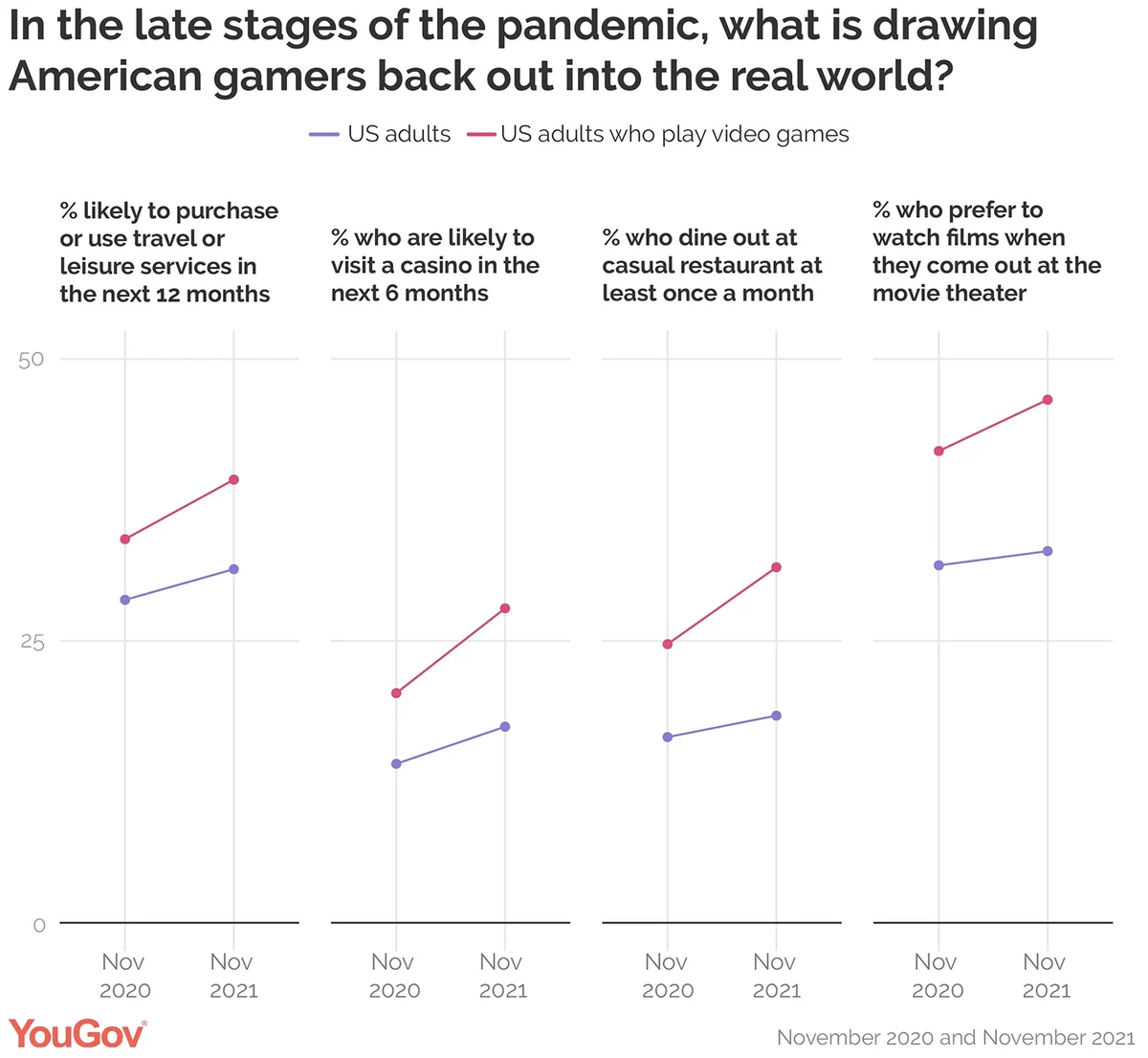

But while gaming is generally on the up and may have reached a high during the pandemic, video gaming in America has declined in the last year and YouGov has insight into what are players doing instead as restrictions have eased and leisure choices have returned. Looking at a few key metrics tracked by YouGov Profiles, we see Americans who play video games have once again sought out familiar pastimes – like travel and cinema - in greater numbers. By knowing these activities, marketers may be able to strike partnerships and campaigns to keep their brand top of mind among gamers.

That isn’t to say video gaming has lost any relevance. The Olympics hosted an esports event and YouGov data shows who tuned in. Our analysis shows 13% of consumers across 17 global markets tuned into at least a portion of the Olympic Virtual Series Competition, which featured Gran Turismo car racing, Zwift cycling, eBaseball Powerful Pro Baseball 2020, and Virtual Regatta.

The global reach of gaming influencers is increasing exponentially, providing lucrative partnership opportunities for brands to reach new audiences and connect with current audiences in different ways. YouGov’s three-part global report series is an in-depth exploration of the gaming influencer landscape, the profile and behaviors of gaming influencer audiences, and the value of trust within the influencer sector.

Teenage consumers remain a powerful demographic in the gaming space and their behavior can help hypothesize where the industry is going. If there is any doubt about the power of esports, consider this: One in five American boys aged 13-17 support FaZe Clan, the biggest esports team in the world. No traditional sports team enjoys that level of support among this demographic. In fact, three out of the top five teams with the most support are esports teams.

If brands want to market to male youth, they should look to video games, not social media. Ads in video games are a powerful tool for marketers to reach America’s youth, according to YouGov Teen Profiles, a new YouGov data tool that takes a closer look at the consumer habits of young Americans aged 13 – 17.

Finally, we’ll end with a stat that demonstrates the dominance of video games in society today: more than two in five consumers aged 18-24 from around the world say video games are as culturally important — if not more important — than music.

As a new strain of COVID-19 hits shores, the return of old restrictions is possible. And if people are once again confined to their homes, video games are likely to enjoy another year of popularity.