In the four months since the November 2015 terror attack in Paris, acts of terrorism have targeted travelers in Ivory Coast, Istanbul and most recently, Brussels.

According to a YouGov poll of high-income travelers, the majority (62%) have not made any changes to their international travel plans and very few have canceled a booked trip as a result of terrorist activity. Instead they are taking steps to increase their peace of mind. According to the poll, 12% of all respondents stated they have canceled their plans all together, an estimated 342,000 households. The economic impact of these cancelations totals an estimated $1.05 billion.

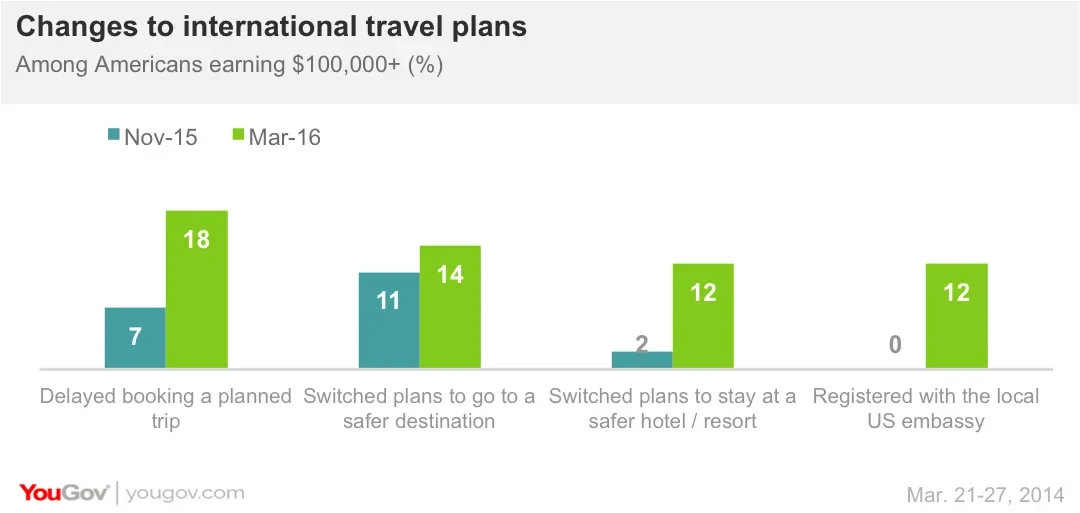

While a minority of high income travelers have admitted to cancelling trips due to international unrest, a rising number of high-income travelers - defined as U.S adults with $100,000 or more in annual household income - have made changes to their existing plans, increasing from 25% in a similar poll conducted by YouGov in November to 38% in the most recent poll.

Resisting Terror, but Realistic about the World Today

While well aware of the risks and threats the world faces - 67% of those with international travel plans continue to believe that ISIS is the biggest threat to U.S. national security and 54% don’t feel safe traveling overseas right now - high-income travelers remain resilient in the face of terrorism. 69% of travelers say “placing self-restrictions on my plans is the equivalent of letting terrorists dictate how I live my life,” a number unchanged from observations in November.

According to Cara David, Managing Partner at YouGov, “the desire to travel is strong, particularly as the person’s level of affluence grows. The fact is, people are standing up for what they want, and that is reflective of their independent spirit.”

That said, with this resilience has come an increase in precaution. Respondents indicated that their willingness to purchase travel insurance has surged, increasing significantly from 2% in November to 15%. Said David, “One way high earning travelers are responding to the potential for a terrorist attack while they are traveling is to have a plan in place if something tragic happens. For some, purchasing travel insurance is one way to avoid the financial risk of skipping a trip. For others, it’s about making different choices where they spend their time.” High-earning travelers confirmed this notion, with 94% saying they prefer travel options that offer trip cancellation without a fee.

News Media Affecting Travel Interest

High-earning travelers are taking steps to educate themselves on the areas they visit, and do admit that what they see in the news increasingly affects their interest in traveling to certain areas (71% in November to 81%). Additionally, 89% of high-income travelers claim that they familiarize themselves about a destination to feel more secure as it relates to international travel and the risk of terrorism. However, 62% also envision a point in the future where they wouldn’t want to travel to another country.

According to David “high earners tend to be savvy travelers, and they know—or are willing to find out—which areas are safe to visit, which hotels or resorts are likely to be safer or more secure, and are increasingly likely to prepare for the worst by registering with the local U.S. embassy.”

All figures, unless otherwise stated, are from YouGov Plc. Fieldwork was undertaken between November 23-24, 2015 and March 25-28, 2016. The survey was carried out online. Total sample has been weighted and are representative of all US adults (aged 18+). Interviews totaled 1,064 in November and 1,153 in March, with 136 in November and 149 in March who earn $100,000 or more per year. The margin of error among $100,000+ consumers is 4-8%. Changes referred to as “increasing” or “decreasing” are statistically significant at the 95% confidence level. The original article posted in December 2015 can be found here.

About YouGov Affluent Perspective

YouGov Affluent Perspective conducts an annual study of high-income and high-net-worth consumers in 12 countries around the world. The study in the United States includes more than 2,500 interviews and represents the top 10% of consumers, those who earn a minimum of $150,000 per year. The study offers readable samples among three distinct consumer groups, the Base Affluent, Middle Affluent, Upper Affluent and “The Wealthy.” To find out more about this study follow this link.

For inquiries regarding YouGov Affluent Perspective please contact Cara David (cara.david@yougov.com)