Welcome to the second installment in a series that delves into the latest insights from the YouGov Affluent Perspective 2017 Global Study. Each year, we study the attitudes, lifestyles, values, and shopping behaviors of the world’s most successful households.

U.S. Affluent spending expected to hold steady in 2017

Looking at data across several categories, which include apparel, handbags, accessories, jewelry, watches, dining, leisure travel, and items for the home, we forecast that affluent U.S. households will spend 1% more this year than last, for a total of $335 billion. While experience categories, such as dining and leisure travel, account for 50% of the overall total, there is a marked increase in spending on products thanks to the growing population of affluent Millennials.

Rapidly changing spending habits among the young and old

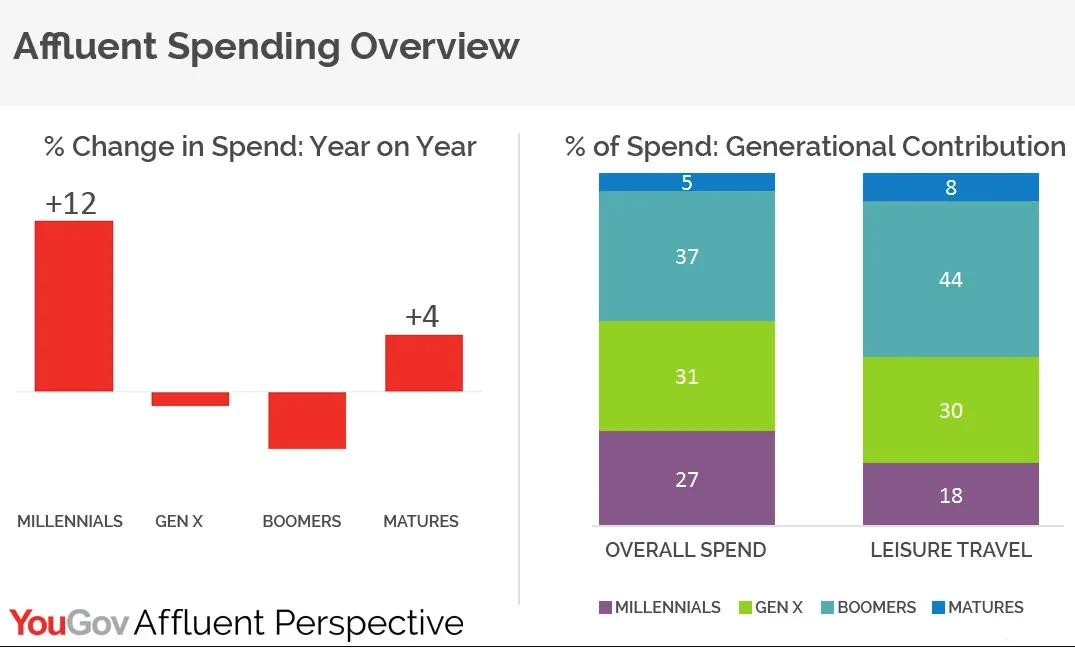

Affluent Baby Boomers and Gen Xers make up the bulk of affluent U.S. households (11.4MM) and do the majority of the spending. At the same time, however, affluent Millennial households, which now number 3.1MM, plan to increase their spending by 12%, while Boomers and Gen Xers anticipate a decline of 4% and 1%, respectively.

Affluent Boomers report having everything they need to be happy, and that their focus now is on experiences and bolstering their retirement nest egg.

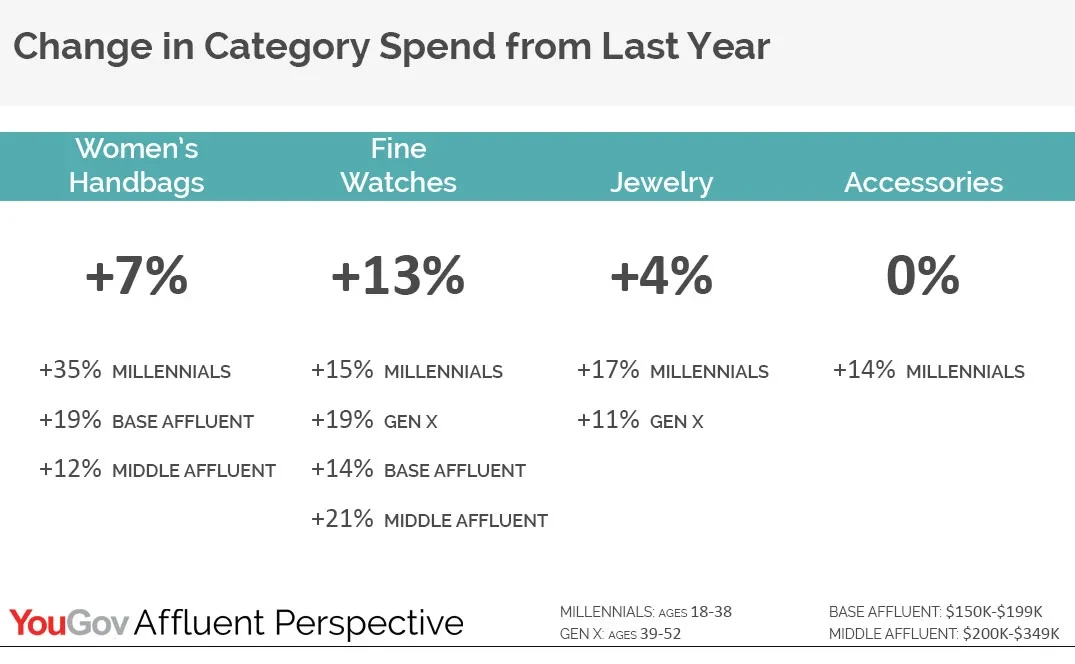

Gen Xers, on the other hand, aim to achieve a balance of saving for retirement and spending on their children. But it’s not all work with no play. Gen Xers will also put aside some money for discretionary spending, with much of their annual spend focusing on experiential categories, such as dining and leisure travel. In 2017, they’re expected to increase their spending in product categories, too, as they accessorize themselves with the latest watches and handbags.

Today’s affluent Millennials are the first generation to grow up primarily in affluent households. These wealthy youths have more experience with, and passion for, luxury brands than any previous age group — and this novel combination is causing rapid changes in their spending habits. Their purchase decisions, for instance, are largely based on their need to build a career, connect with the right network, and continue along an upwardly mobile path.

Accessories, accessories, accessories

Driven by a need to express their individuality and success, affluent Millennials are propelling the overall spending increase on accessories, handbags, and fine jewelry.

The need to nest

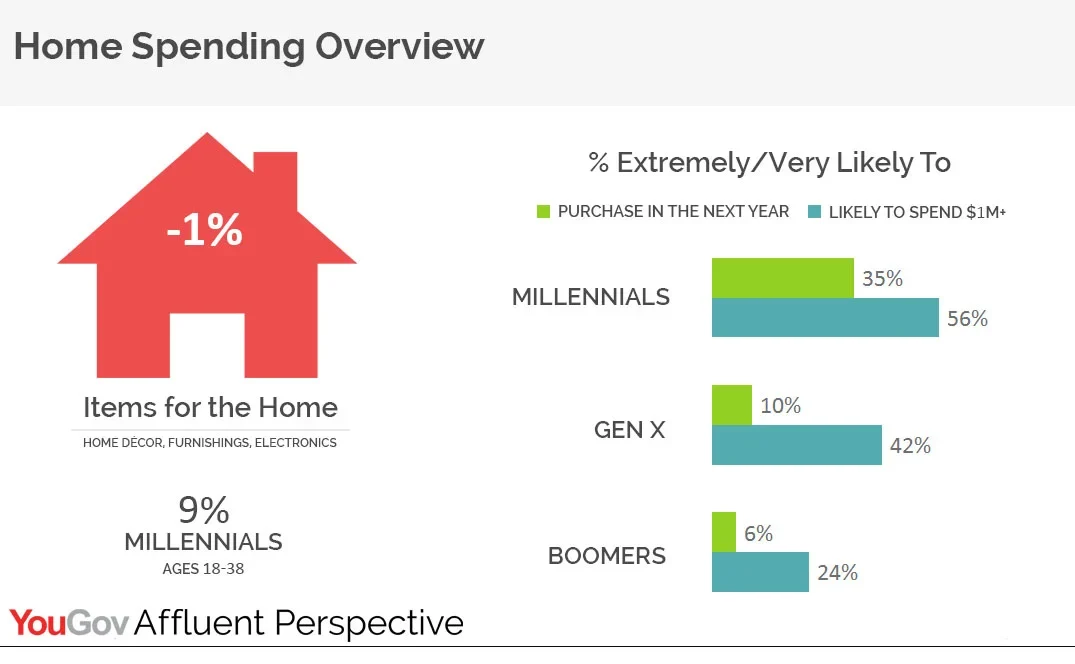

Affluent Millennials are also chasing the American dream of owning their own home, with 33% looking to buy a new house sometime this year. Items to fill that house comes next. While home furnishings and electronics as a whole are down, affluent Millennials plan to increase their spending by 9%.

Although Gen Xers and Boomers together account for 67% of our spending forecast, affluent Millennials have the momentum in every way. They’re ambitious, determined, and, despite the fact that the majority grew up in a wealthy household, they’re not sitting on their laurels. Ultimately, they’re driven by a strong desire for an even more luxurious lifestyle in the years ahead. Get ready.

In our next installment, we examine how the presidency of Donald Trump has affected affluent U.S. households and their outlook on future spending.

For more information, visit AffluentPerspective.com